- Home

- Views On News

- Apr 6, 2024 - Best AMC Stock: HDFC AMC vs Nippon Life AMC vs Aditya Birla Sun Life AMC

Best AMC Stock: HDFC AMC vs Nippon Life AMC vs Aditya Birla Sun Life AMC

Mutual funds are one of the most sought-after investments in India.

The Systematic Investment Plans (SIP) investments are touching new highs every year, and so are the SIP folios.

Despite such high growth, less than 3% of India's population invest in mutual funds. Moreover, the mutual fund penetration is just at 14% against an average of 60% of the world.

This leaves a massive opportunity for growth for Asset Management Companies (AMC).

In this article, we compare the top three listed AMCs in India and how they stack up against one another. Read on to find out more.

Business Overview

# HDFC Asset Management Company

Incorporated in 1999, HDFC Asset Management Company (HDFC AMC) offers fund management services.

It is the investment manager of HDFC Mutual Fund and is India's third-largest mutual fund company.

It has product suite to provide unique solutions to different kinds of investors. The company's products range from diversified equity, to solution oriented, theme based, index, and hybrid funds.

# Nippon Life India Asset Management

Nippon Life Asset Management is one of the leading private life insurance companies in Japan, Nippon Insurance.

It is the fourth largest mutual fund company in India and offers a wide range of products and solutions to its customers.

Some of its products and services include equity mutual funds, exchange-traded funds (ETFs), management accounts, portfolio management services, alternative investment funds, and pension funds.

# Aditya Birla Sun Life AMC

Aditya Birla Sun Life AMC (ABSL AMC) is one of the largest non-bank asset management companies (AMC) and the fifth-largest mutual fund in India.

The company is a joint venture between Aditya Birla Capital and Sun Life AMC and offers mutual fund solutions, portfolio management services, and offshore services.

It offers over 100 schemes comprising 37 equity-oriented schemes, 52 fixed-income schemes, six funds of funds, and 5 ETFs.

| Particulars | HDFC AMC | Nippon Life AMC | Aditya Birla Sun Life AMC |

|---|---|---|---|

| Market Cap (in Rs billion)* | 790 | 328.5 | 138 |

| Market share (%)** | 11.10% | 7.30% | 7.00% |

Of the three companies, HDFC AMC has the highest market cap, followed by Nippon Life AMC and ABSL AMC.

HDFC AMC has a market cap of Rs 790 billion (bn), whereas Nippon Life AMC and ABSL AMC have a market cap of Rs 328.5 bn and Rs 138 bn, respectively.

In terms of market share, HDFC AMC is again leading with a market share of 11.1%, followed by Nippon Life (7.3%) and ABSL AMC (7%).

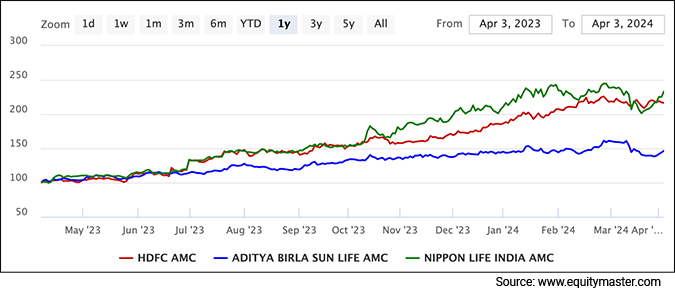

If we compare the three companies based on their performance on the stock market, then Nippon Life AMC is leading with a 138.7% return, followed by HDFC AMC (112.2%) and ABSL AMC (42%).

All the three companies have outperformed Nifty 50 which gave a return of 28% in the last one year, however, only Nippon Life AMC and HDFC AMC managed to give multibagger returns.

#Assets Under Management (AUM)

When analysing mutual fund companies, one of the first parameters to look at is the AUM.

AUM is the cumulative sum of the market value of all securities held by a mutual fund. It fluctuates to reflect the flow of money in and out of the schemes and the performance of the underlying securities.

Investors often consider high AUM as a sign of positive indicators of quality and management experience.

Assets Under Management (AUM)

| AUM (in Rs bn) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 3-Year CAGR |

|---|---|---|---|---|---|---|

| HDFC AMC | 3,439.40 | 3,190.90 | 3,954.70 | 4,075.50 | 4,367.00 | 3.40% |

| Nippon Life AMC | 2,277.60 | 1,635.50 | 2,218.30 | 2,773.70 | 2,868.70 | 8.90% |

| Aditya Birla Sun Life AMC | N/A | N/A | 2,450.40 | 2,932.80 | 2,812.50 | 4.70% |

HDFC AMC is managing assets worth Rs 4.3 trillion (tn) as of March 31, 2023, whereas Nippon Life AMC and ABSL AMC are managing assets worth Rs 2.8 tn each.

Hence, HDFC AMC is leading in terms of AUM. However, in terms of AUM growth, Nippon Life is leading with a compound annual growth rate (CAGR) of 8.9%, followed by ABSL AMC with 4.7% and HDFC AMC with 3.4%.

Despite having a low growth rate, HDFC AMC has an AUM that is almost 1.5x higher than that of its peers, Nippon Life AMC and ABSL AMC.

As of December 2023, the AUM of HDFC AMC, Nippon Life AMC, and ABSL AMC is Rs 5.7 tn, Rs 3.9 tn, and Rs 3.1 tn, respectively.

The primary reason behind growth of AUM across all the AMCs is the high growth in investor base, and high inflows in equity, fixed income, and hybrid schemes.

#Investor base

Another parameter unique to asset management companies is the investor base. A rising investor base indicates high customer trust, which is very important for asset management companies.

Investor Base

| Unique Investors (in Rs m) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 3-Year CAGR |

|---|---|---|---|---|---|---|

| HDFC AMC | 5.3 | 5.6 | 5.3 | 5.8 | 6.6 | 7.60% |

| Nippon Life AMC | NA | NA | 9 | 12 | 13.5 | 14.50% |

| Aditya Birla Sun Life AMC | NA | NA | NA | NA | NA | NA |

In terms of the number of unique investors, Nippon Life AMC is leading with a customer base of 13.5 million (m), followed by HDFC AMC at 6.6 m.

In terms of investor base, Nippon Life AMC has a market share of 39%, one of the highest among mutual fund companies. In the last three years, the company's customer base grew by a CAGR of 14.5%, followed by HDFC AMC (7.6% CAGR).

The information regarding ABSL AMC's investor base is not available. However, at the end of March 2023, the company had 8 m folio or customer accounts, whereas HDFC AMC had 144.9 m folios, and Nippon AMC had 64 m folios.

#Distribution network

There are multiple distribution channels for a mutual fund company, such as distributors, distribution companies, banks, e-commerce platforms, and direct sales offices.

Having a wide distribution network across the country is very important as it will directly impact the total number of retail investors for an AMC.

HDFC AMC has a network of over 253 branches and 80 thousand distributors, and it services approximately 99% of the pin codes across India.

Nippon Life AMC has a network of 260 offices and 98 thousand distributors across India.

ABSL AMC, on the other hand, has a network of 290 offices, 300 national distributors, 78 thousand mutual fund distributors, 120 digital partners, and over 85 emerging market locations across India.

All three AMCs have a well-established distribution network.

#Revenue

In terms of revenue, HDFC AMC has the highest revenue of Rs 21.6 bn, followed by Nippon Life AMC and ABSL AMC at Rs 13.4 bn and Rs 12.26 bn, respectively.

In terms of revenue growth, HDFC AMC is again leading with a 2.5% CAGR growth. However, both Nippon Life AMC and ABSL AMC witnessed a degrowth in the last five years.

The primary reason for growth in revenue of HDFC AMC is high growth in investor base, and SIP inflows for a tenure longer than five years.

For ABSL and Nippon, the pandemic caused a decline in revenue. However, since the financial year 2022, the companies witnessed their revenues bounce back.

Going forward, due to strong growth in investor base, and wide distribution reach, the revenue of all the AMCs is expected to go up.

Revenue

| Net Sales (in Rs m) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| HDFC AMC | 19,152 | 20,033 | 18,525 | 21,154 | 21,668 | 2.50% |

| Nippon Life AMC | 14,786 | 12,030 | 10,621 | 13,066 | 13,498 | -1.80% |

| Aditya Birla Sun Life AMC | 14,075 | 12,368 | 10,679 | 12,930 | 12,266 | -2.70% |

#Profitability

In terms of profitability, Nippon Life AMC is leading, followed by HDFC AMC and ABSL AMC.

The earnings before interest tax depreciation and amortisation (EBITDA) of Nippon AMC has grown by a CAGR of 8.1% in the last five years primarily due to high growth in AUM and market share.

HDFC AMC's EBITDA grew by a CAGR of 6%, on account of high investor base, and strong order book through long-term Systematic Investment Plans (SIP).

ABSL AMC, on the other hand, witnessed a marginal growth of 0.6% (CAGR) in EBITDA.

In terms of net profit growth, HDFC AMC is leading with 8.9% growth, followed by Nippon Life AMC, and ABSL AMC with 8.2% and 5.9% CAGR respectively in the last five years.

All the three companies have managed to expand their gross and net profit margins on account of growing investor base, and digital transactions.

Profitability

| EBITDA (in Rs m) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| HDFC AMC | 12,058 | 15,722 | 14,639 | 15,999 | 16,172 | 6.00% |

| Nippon Life AMC | 5,381 | 5,126 | 5,575 | 7,902 | 7,938 | 8.10% |

| Aditya Birla Sun Life AMC | 6,829 | 7,019 | 6,011 | 8,198 | 7,052 | 0.60% |

| PAT (in Rs m) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 5-Year CAGR |

| HDFC AMC | 9,306 | 12,624 | 13,258 | 13,931 | 14,234 | 8.90% |

| Nippon Life AMC | 4,871 | 4,158 | 6,794 | 7,434 | 7,229 | 8.20% |

| Aditya Birla Sun Life AMC | 4,468 | 4,944 | 5,263 | 6,728 | 5,964 | 5.90% |

| Gross Profit Margin (%) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| HDFC AMC | 63.00% | 78.50% | 79.00% | 75.60% | 74.60% | |

| Nippon Life AMC | 36.40% | 42.60% | 52.50% | 60.50% | 58.80% | |

| Aditya Birla Sun Life AMC | 48.50% | 56.80% | 56.30% | 63.40% | 57.50% | |

| Net Profit Margin | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| HDFC AMC | 48.60% | 63.00% | 71.60% | 65.90% | 65.70% | |

| Nippon Life AMC | 32.90% | 34.60% | 64.00% | 56.90% | 53.60% | |

| Aditya Birla Sun Life AMC | 31.70% | 40.00% | 49.30% | 52.00% | 48.60% |

#Dividend

A company shares its profits in terms of dividends. To analyse the dividends of a company, we must look at the dividend per share, dividend payout ratio, and dividend yield.

The dividend per share is the highest for HDFC AMC at Rs 48 per share, followed by Nippon Life AMC and ABSL AMC at Rs 11 and Rs 10, respectively.

Despite a high variation, the dividend per share has grown at a CAGR of 15%.

In terms of dividend yield, Nippon Life AMC is leading with a five-year average dividend yield of 2.9%, followed by HDFC AMC and ABSL AMC at 1.6% and 0.9%, respectively.

Nippon Life AMC is also leading in terms of dividend payout ratio with a five-year average of 82.6%, followed by HDFC AMC (58.6%) and ABSL AMC (35.9%).

Dividend

| Dividend Per Share (Rs) | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | 5-Year CAGR |

|---|---|---|---|---|---|---|

| HDFC AMC | 23.9 | 27.9 | 33.9 | 42 | 48 | 15.00% |

| Nippon Life AMC | 5.8 | 4.9 | 7.8 | 10.9 | 11.4 | 14.30% |

| Aditya Birla Sun Life AMC | 5.2 | 5.7 | 2.6 | 11.5 | 10.3 | 14.50% |

| Dividend Yield | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| HDFC AMC | 1.50% | 1.00% | 1.30% | 1.60% | 2.40% | |

| Nippon Life AMC | 3% | 1.60% | 2.70% | 2.90% | 4.10% | |

| Aditya Birla Sun Life AMC | 0.00% | 0.00% | 0.00% | 1.90% | 2.40% | |

| Dividend Payout Ratio | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| HDFC AMC | 54.80% | 47.20% | 54.60% | 64.30% | 72.00% | |

| Nippon Life AMC | 75.40% | 73.60% | 72.60% | 92.20% | 99.10% | |

| Aditya Birla Sun Life AMC | 33.60% | 33.40% | 14.10% | 49.00% | 49.50% |

#Valuation

Valuation ratios tell us the actual worth of a company by helping us evaluate whether a company is undervalued or overvalued.

A company is undervalued if its valuation ratios are lower than its peers and overvalued if the valuation ratios are higher than its peers.

The two important valuation ratios are price to earnings ratio (P/E) and price to book value (P/B).

In terms of valuation, HDFC AMC is highly overvalued, followed by Nippon AMC and ABSL AMC.

The P/E ratio of HDFC AMC is 44.9x, whereas Nippon AMC and ABSL AMC's P/E stand at 33x and 19.5x, respectively, and the industry P/E ratio currently stands at 20.3x.

Even in terms of P/B ratio, HDFC AMC is overvalued at 12.3x, followed by Nippon Life AMC at 7.9x, and ABSL AMC at 1.7x. The industry average P/B is 1.7x.

| Valuations | HDFC AMC | Nippon Life AMC | Aditya Birla Sun Life AMC | Industry Average |

|---|---|---|---|---|

| P/E (x) | 44.9 | 33 | 19.5 | 20.3 |

| P/B (x) | 12.3 | 7.9 | 4.6 | 1.7 |

Which AMC is Better: HDFC AMC, Nippon Life AMC or ABSL AMC?

In terms of growth in AUM, investor base, profit growth, and dividend yield, Nippon Life AMC outpaced its peers.

This is primarily because the company's schemes have performed exceptionally well against those of its peers in certain categories.

Hence, investors automatically switched to Nippon Life AMC's schemes, leading to a high growth in AUM.

Apart from mutual funds, the company also witnessed higher inflows to Alternative Investment Funds (AIF) and Portfolio Management Services (PMS).

It is also focussing on expanding its distribution network to capture the growth in Tier 2 and Tier 3 cities.

After Nippon Life, HDFC AMC saw the highest growth in its unique investor base. It is also the largest listed company in terms of AUM, and its net sales grew at a higher rate than Nippon Life AMC and ABSL AMC.

HDFC AMC also pays a higher dividend per share, has the highest profitability margins, and a higher market share in terms of AUM among the three companies.

It offers the highest number of schemes to cater to different investor categories. Moreover, being a part of a well-reputed banking player, HDFC AMC can leverage the distribution network of the bank to expand its investor base.

It has a strong retail investor base, indicating a high customer trust when compared to other AMCs.

With HDFC and HDFC Bank merger, the sales of HDFC AMC are expected to go up in the medium term.

AMSL AMC is the fifth largest player among all the AMCs, and one of the largest non-bank AMCs in India.

Although considered small against HDFC AMC and Nippon Life, the company's AUM and investor base are continuously growing.

ABSL AMC is focussing on geographical expansion in B-30 cities and rural regions that are underserved and have less competition.

Given the under penetration of mutual funds in India when compared to other countries, and growing preference of investing in financial assets over physical assets, there is a massive growth opportunity for all the three AMCs.

HDFC AMC, Nippon Life, and ABSL AMC are all well-equipped to capture this growth and are working towards expanding their distribution network to increase their customer base.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Best AMC Stock: HDFC AMC vs Nippon Life AMC vs Aditya Birla Sun Life AMC". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!