- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

5 Upcoming Renewable Energy IPOs to Watch Out

5 Upcoming Renewable Energy IPOs to Watch Out

May 1, 2024

To capitalise on India's transition to a low carbon economy, these five PSU companies are set to launch the IPOs of their subsidiaries soon.

Can IREDA Get to Zero Net NPAs Post Navratna Status?

Can IREDA Get to Zero Net NPAs Post Navratna Status?

May 1, 2024

Getting a 'Navratna' status gives the company's board and management much more autonomy and control on quick decision making.

After Tata can This Business Group Create Wealth?

After Tata can This Business Group Create Wealth?

May 1, 2024

Aditya Birla Group announces multiple strategic decisions. How can you profit?

Recycling Stocks are Booming. Here are 10 Stocks to Track Now

Recycling Stocks are Booming. Here are 10 Stocks to Track Now

May 1, 2024

Keep an eye on these 10 top-performing recycling stocks leading the sustainability revolution.

Indegene IPO: 5 Things to Know

Indegene IPO: 5 Things to Know

Apr 30, 2024

From grey market premium to price band, here's everything you need to know about the upcoming IPO of this upcoming life science IPO.

Top 5 Debt Free Penny Stocks with Solid Growth

Top 5 Debt Free Penny Stocks with Solid Growth

Apr 30, 2024

Debt-free companies are less susceptible to economic downturns. Here are five that should be on your radar.

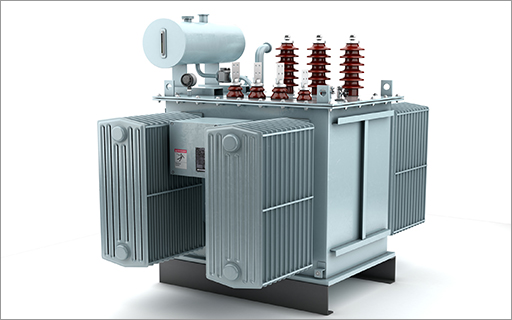

Best Transformer Stocks for Your Watchlist

Best Transformer Stocks for Your Watchlist

Apr 30, 2024

How to profit from the transformer gold rush.

Stocks Watchlist for the Rising 'Luxury' Theme

Stocks Watchlist for the Rising 'Luxury' Theme

Apr 29, 2024

Stocks that could enjoy the halo effect from the rise of luxury class in India.

Are Good Days Ahead for Telecom Stocks?

Are Good Days Ahead for Telecom Stocks?

Apr 29, 2024

Interested in investing in telecom stocks? Read on...

Why BSE Share Price is Falling

Why BSE Share Price is Falling

Apr 29, 2024

BSE suffers steepest single-day decline, tanks 19% in a day. Will the slide continue?

Is this Famous Tata Stock a Hidden Trap for Investors?

Is this Famous Tata Stock a Hidden Trap for Investors?

Apr 29, 2024

A case study on why this Tata Stock might be overheated.

This Solar Stock is Up 500% in 2024. Here's What Comes Next

This Solar Stock is Up 500% in 2024. Here's What Comes Next

Apr 29, 2024

What to do with this smallcap stock that turned Rs 1 lakh to Rs 1 crore in less than a year?

Earnings Visual: Next Week is Make or Break for ICICI Bank Share

Earnings Visual: Next Week is Make or Break for ICICI Bank Share

Apr 28, 2024

The private lender declared a dividend of Rs 10 per share for the year ended March 2024.

Multibagger Stocks for the Next 10 Years

Multibagger Stocks for the Next 10 Years

Apr 28, 2024

What are the potentially top 10 multibagger stocks for the long term? Find out...

Better Railway Stock: RVNL vs IRFC

Better Railway Stock: RVNL vs IRFC

Apr 28, 2024

The government's massive Rs 1 trillion investment to improve railway infrastructure could help this Indian company rise to the top.

Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Apr 27, 2024

As India's solar race heats up, these companies are well-poised to capitalise on the major investment megatrend of this decade.

Special Dividend Alert! 2 Stocks Primed for Big Payouts

Special Dividend Alert! 2 Stocks Primed for Big Payouts

Apr 27, 2024

Craving Extra Cash? Here are three stocks for your watchlist.

3 Factors that Could Trigger a Rally in Maruti's Stock Price

3 Factors that Could Trigger a Rally in Maruti's Stock Price

Apr 27, 2024

The carmaker posted its highest ever unit sales, net sales, and net profit for both - the fourth quarter of FY24 as well as for the full financial year.

This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money?

This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money?

Apr 27, 2024

To scale up renewable energy generation in India, this company is looking to open more centres in India.

5 Stocks to Watch Out for Bonus Shares and Stock Splits in May 2024

5 Stocks to Watch Out for Bonus Shares and Stock Splits in May 2024

Apr 26, 2024

These five companies are set to issue bonus shares and stock splits in May 2024. Do you own any?