- Home

- Views On News

- May 13, 2024 - Up 275% in a Year, This Defence Stock's Growth Is Just Getting Started

Up 275% in a Year, This Defence Stock's Growth Is Just Getting Started

To investors...

The Russia-Ukraine war exposed numerous weaknesses in the defence sector.

For India, the most notable one was the lack of domestic manufacturing and the wide-spread reliance on international supply chains.

We have spent decades importing defence equipment from various countries around the world.

India's vulnerability was on display.

Shortly after this crisis, the narrative changed. The Modi-led government gave a boost to defence industry by announced various import bans and other ambitious plans.

Today, India's defence sector is roaring with the engines of self-reliance.

India has achieved significant success in bolstering its domestic production of defence equipment.

The government's spending on defence has increased so much that India is now the third biggest spender on defence.

The increased spending along with many necessary rule changes and a focus on indigenous procurement, has given a massive boost to the entire sector. Companies across the defence ecosystem have done benefited.

The prospect of exponential growth offers investors a great opportunity to ride the defence megatrend with the help of this little-known defence company.

Nibe Ltd: Dipping Toes in Every Defence Opportunity

Incorporated in 2005, Nibe is in the business of manufacturing critical components for defence, electric vehicles (EVs) and software development.

The company manufactures structures, sub-assemblies, and assemblies of mobile weapon launchers for programs such as BrahMos Missile, MRSAM, and Pinaka rocket launcher.

It also makes structural and engineering systems for naval applications. The company's electronic division focuses on sensors & wiring, control systems and military software.

In the CEO's own words, Nibe is leaving no stones unturned and taking up each and every project from the defence segment. The company's CEO said that if you take any ministry of defence project, Nibe is up there getting more and more orders.

Adding to this, Balakrishnan Swami added that they have the right resources, qualified welders, and a competitive team, which gives them an edge.

Nibe's clients include all three Indian defence forces, and L&T Defence.

Apart from defence, the company also has some exposure to the high growth EV segment via its subsidiary.

Through its subsidiary Nibe E-Motor, Nibe deals in e-bicycle, e-rickshaw, batteries and motors, hybrid PCU, solar induction cooker, and water treatment unit as well.

Some Recent Developments that Need a Mention...

In the year gone by, share price of Nibe has almost multiplied investors' wealth by 3x. The stock has rallied 275% in the past 1 year.

Now, most of these gains have come on the back of multiple order wins.

Recently, Nibe signed a 10-year exclusive manufacturing agreement to manufacture and supply hardware to Munition India (MIL) for export of ammunitions in product range of MIL.

MIL's product range includes ammunition, explosives, rockets and bombs for the use of the Indian Armed Forces, foreign militaries and domestic civilian use.

It also received an order from Ordefence Systems for assemblies, sub-assemblies and supply of 12 kits of small arms for a total consideration of Rs 3.1 billion.

Nibe also has a purchase order from L&T for machining of modular bridge structure and assembly amounting to Rs 1.3 billion (bn).

Apart from that, the aircraft manufacturing division of Hindustan Aeronautics (HAL) has registered Nibe for outsourcing of:

- CNC turning of small and medium Aerospace components

- CNC milling of big parts

- GHE and GSEs

Earlier this year in February, the company also inaugurated its new production facility at Pune to produce a wide array of equipment covering diverse metallurgy.

Meanwhile, there are two more major developments for Nibe (not related to defence).

It has entered a collaboration with Hewlett Packard (HP) Enterprise India Pvt Ltd for green lag cloud services.

Nibe also has a licensing agreement with DIPAS, a constituent laboratory under DRDO for transfer of technology of solar heated shelters.

A Close Look at Nibe's Financials

Owing to progressive order book, the company's financials have received a big boost in most recent quarters.

In December 2023, the company posted sales of Rs 627 million (m) compared to Rs 412 m in September 2023 and Rs 152 m in December 2022.

Net profit shot up almost 6 times from Rs 7.2 m in December 2022 to Rs 44.2 m in December 2023.

In FY23, the company turned around and reported a net profit compared to a loss reported in FY22.

Nibe Financial Snapshot

| Rs m, standalone | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Net Sales | 19 | 14 | 25 | 212 | 1,050 |

| Growth (%) | -59% | -25% | 74% | 745% | 394% |

| Operating Profit | 1 | -4 | 2 | 36 | 130 |

| OPM (%) | 4% | -31% | 7% | 17% | 12% |

| Net Profit | 0 | -5 | 1 | -4 | 46 |

| Net Margin (%) | 0% | -33% | 5% | -2% | 4% |

| ROE (%) | 0.0 | -4.6 | 1.2 | -4.4 | 11.9 |

| ROCE (%) | 0.3 | -4.3 | 1.7 | 6.9 | 17.5 |

| Dividend (Rs) | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 |

| Debt to Equity (x) | 0.0 | 0.0 | 0.1 | 0.0 | 0.3 |

This year's profit could be the highest ever as Nibe's order wins for the past 15 months come to fruition.

What Next?

At present, this under the radar defence company is ticking all the right boxes. It has a heavy order book which provides future revenue visibility.

On top of that, its massive long-term deal with Munition India makes sure that the company is progressing well on the defence front and contributing to the sector's overall growth.

Although the stock has run-up a lot in the past one year, industry experts are of the view that Nibe is still under-the-radar and not known to many investors... at least they don't know it's a big and critical defence player.

Nibe currently trades at sky-high price to earnings multiple which its price to book value (P/BV) also stands at around 20x, way above its median P/BV of 8x.

Comparative Analysis

| Company | NIBE | CFF Fluid | Krishna Defence | Paras Defence | Rossell India |

|---|---|---|---|---|---|

| ROE (%) | 11.9 | 50.9 | 18.5 | 10.2 | 10.3 |

| ROCE (%) | 17.5 | 34.3 | 15.1 | 14.6 | 10.9 |

| Latest EPS (Rs) | 9.3 | 5.2 | 3.9 | 8.4 | 3.5 |

| TTM PE (x) | 149.1 | 80.9 | 104.3 | 83.5 | 131.6 |

| TTM Price to book (x) | 11.9 | 7.4 | 6.1 | 6.9 | 5.5 |

| Dividend yield (%) | 0.1 | 0.0 | 0.0 | 0.0 | 0.1 |

| Industry PE | 46.6 | ||||

| Industry PB | 9.7 | ||||

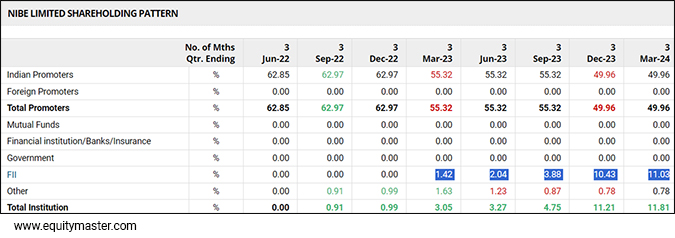

Interestingly, foreign investors have found quite a liking to this defence player as they've taken up their holding to 11% at present from 1.4% last year.

FIIs Buying this Defence Stock

Going by its current revenue and profit numbers, there's a big opportunity for the company as the current numbers are too small. Once Nibe gets going and executes the pending order book, the revenues are expected to shoot up.

As India aims to become a defence superpower in the future, Nibe has a critical role to play in this journey.

How Nibe Share Price has Performed Recently

In the past 5 days, Nibe share price is down 7%.

In 2024 so far, the stock has already churned out multibagger returns for shareholders by rising as much as 119%.

Nibe has a 52-week high of Rs 1,770 touched on 4 March 2024 and a 52-week low of Rs 317 touched on 20 June 2023.

In the past 1 year, Nibe share price has rallied over 275%.

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Up 275% in a Year, This Defence Stock's Growth Is Just Getting Started". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!