- Home

- Views On News

- May 3, 2021 - Why Did AU Small Finance Bank Shares Fall Today?

Why Did AU Small Finance Bank Shares Fall Today?

Shares of AU Small Finance Bank slipped 8% on the BSE in intra-day trade today as the bank's asset quality worsened during the March quarter (Q4FY21).

Asset Quality Deteriorates Sequentially

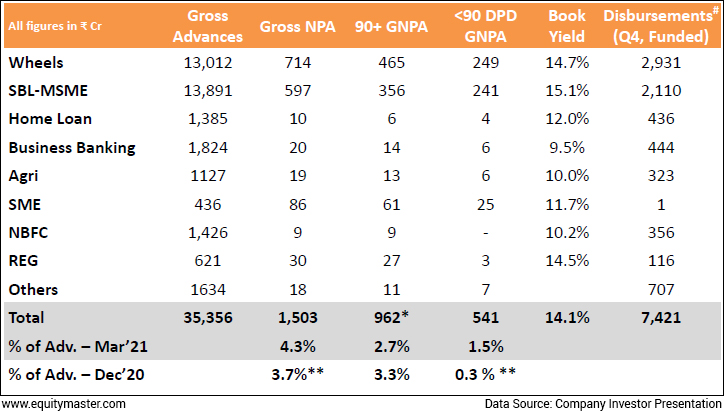

The bank's gross non-performing assets (NPA) ratio increased to 4.25% in the March quarter (Q4FY21), against a pro forma gross NPA ratio of 3.3% in the December quarter (Q3FY21).

The increase in gross NPAs was due to a particularly affected stressed pool that was less than 90 days past due (dpd) and paying but were 'once NPA' and have been tagged as NPAs now.

This resulted in an increase in non-performing loans by Rs 5.4 bn (1.6% of loans).

AU Small Finance Bank Asset Quality Overview (Q4)

Net NPA ratio also soared to 2.18% from 0.81% during the same period a year ago, and 0.24% in Q3FY21.

Meanwhile, provisions for bad loans and contingencies, increased to Rs 1.8 bn during the quarter from Rs 1.5 bn in the previous quarter.

Total restructured loans of the bank increased to 1.8% vs 1.5% guided for in Q3FY21. The bank carries a provision of Rs 1.2 bn on this.

Bank's Business Resiliency Comes to the Rescue

AU Small Finance Bank's core operating metrics for the quarter trended better than expected.

The bank's assets under management (AUM) grew by 22% year-on-year (YoY) primarily driven by retail products, strong traction in deposits and a steady reduction in the cost of funds.

Total deposits grew 38% YoY to Rs 360 bn with the share of retail deposits increasing to 55% of the total mix. The bank's CASA ratio increased to 23% during the quarter vs 22% in the previous quarter.

Net interest income (NII) of the bank also grew 18% YoY to Rs 6.6 bn. However, the NII was impacted due to interest reversals of Rs 660 m on account of NPA tagging of borrower accounts in compliance with the Reserve Bank of India (RBI) circular of 7 April 2021.

The bank had made Rs 380 m of provisions against these reversals which were utilised during the quarter.

Collection efficiency and customer activation rate of the bank also moved higher than pre-Covid-19 levels.

Chief Audit Officer of the Bank Resigns

Meanwhile, AU Small Finance Bank made a notable announcement of the resignation of the Chief Audit Officer (CAO) in its exchange filings, post numbers for Q4FY21 were declared.

Mr Nitin Gupta, CAO of the bank submitted his resignation request on 3 March 2021 to pursue career opportunities outside the bank.

The Audit Committee has accepted his resignation with effect from 13 May 2021 and will appoint a new Chief Audit Officer (Internal Audit) to take charge from 14 May 2021.

Mr Gupta will remain in employment with the bank until the completion of his notice period.

How the Stock Markets Reacted to AU Small Finance Bank's Results

Shares of AU Small Finance Bank opened at Rs 958 on the BSE and slipped over 8% to Rs 927.1 in intra-day trade today.

The stock was trading lower for the third straight day, falling 19% during the period. It corrected 32% from its 52-week high level of Rs 1,356, touched on 30 March 2021.

At its current price, it is trading at a P/E of 26.8.

About AU Small Finance Bank

AU Small Finance Bank is an Indian scheduled commercial bank that was founded as vehicle finance company AU Financiers (India) in 1996 and converted to a small finance bank on 19 April 2017.

The bank has a long-standing track record of over two decades of being a retail-focused and customer-centric institution; serving low and middle income individuals and small businesses that have limited or no access to formal banking and finance channels.

The bank offers a comprehensive suite of loan, deposit & payment products and services.

For more details about the banking sector, you can check out the banking sector report on our website.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

Equitymaster requests your view! Post a comment on "Why Did AU Small Finance Bank Shares Fall Today?". Click here!

1 Responses to "Why Did AU Small Finance Bank Shares Fall Today?"

Tejinderpal Singh

May 4, 2021Report on AU Small Bank is comprehensive but writer's comments in view of all developments are not there. Loved to see that.