- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

If You'd Invested 100,000 in Bajaj Finance Stock 10 Years Ago, Here's How Much You'd Have Today

If You'd Invested 100,000 in Bajaj Finance Stock 10 Years Ago, Here's How Much You'd Have Today

May 14, 2024

Given Bajaj Finance's multibagger gains over the past 10 years, has its valuation outpaced the broader market's growth?

Shankar Sharma Acquires 3,500,000 Shares in a Surging Penny Stock

Shankar Sharma Acquires 3,500,000 Shares in a Surging Penny Stock

May 14, 2024

The NSE-only listed stock has rallied around 40% in 2024 so far.

Make Better Returns than Big Investors in the Market

Make Better Returns than Big Investors in the Market

May 14, 2024

Can you beat the big boys of the stock market at their own game? Read this...

This Indian Tech Player is Partnering with Nvidia to Lead the AI Revolution

This Indian Tech Player is Partnering with Nvidia to Lead the AI Revolution

May 14, 2024

This Indian high-performance computing (HPC) leader is riding the AI wave with cutting-edge solutions and strategic partnerships.

Why Bank of India Share Price is Falling

Why Bank of India Share Price is Falling

May 13, 2024

This PSU stock is down more than 10% today. Here's why.

Sign of a Market Top? Warren Buffett Sells his Biggest Holding

Sign of a Market Top? Warren Buffett Sells his Biggest Holding

May 13, 2024

Buffett has trimmed his Apple stake. Is it a warning for the market?

Why Tata Motors Share Price is Falling

Why Tata Motors Share Price is Falling

May 13, 2024

Tata Motors shares tank over 9% after Q4 results. More pain down the road?

Jio Financial: Moon Shot or Crash Landing?

Jio Financial: Moon Shot or Crash Landing?

May 13, 2024

Is the recent surge in Jio Financial justified?

Up 275% in a Year, This Defence Stock's Growth Is Just Getting Started

Up 275% in a Year, This Defence Stock's Growth Is Just Getting Started

May 13, 2024

Foreign investors (FIIs) have increased their holding in the defence stock from 1.4% to 11.4% in less than a year.

Pharma Stocks Watchlist to Profit from Patent Cliff

Pharma Stocks Watchlist to Profit from Patent Cliff

May 12, 2024

The last time such a cliff occurred during 2011-15 and offered substantial upside in pharma stocks.

5 High Dividend Stocks Up More Than 80% in 2024

5 High Dividend Stocks Up More Than 80% in 2024

May 12, 2024

Dividend stocks are making sense now. Here are 5 which have also performed well on the bourses in 2024 so far.

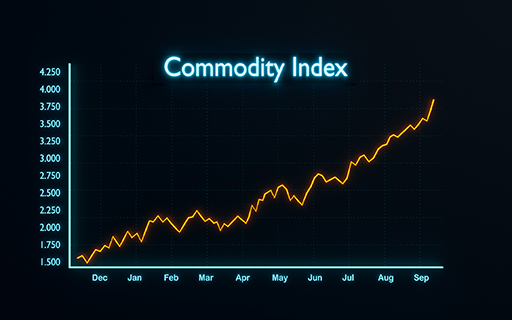

5 Stocks that Could Deliver Superb Gains During a Copper Supercycle

5 Stocks that Could Deliver Superb Gains During a Copper Supercycle

May 12, 2024

Several factors indicate that copper demand is likely to exceed supply, which could potentially have a positive impact on these 5 companies.

Which Companies are Involved in the Bullet Train Project in India?

Which Companies are Involved in the Bullet Train Project in India?

May 11, 2024

Here are the major companies making the bullet train project a reality in India.

Top EV Shares in India 2024: EV Companies to Add to Your Watchlist

Top EV Shares in India 2024: EV Companies to Add to Your Watchlist

May 11, 2024

These companies are prime candidates to benefit from this decade's EV investment boom.

Union Bank vs Canara Bank: Which PSU Bank is Better?

Union Bank vs Canara Bank: Which PSU Bank is Better?

May 11, 2024

These banks have over 8,000 branches across the country and that will be key to garnering low-cost savings and current account deposits to keep NIMs steady.

Top 5 Dividend Stocks That Have Been Making Recurring Payments for 20+ Years

Top 5 Dividend Stocks That Have Been Making Recurring Payments for 20+ Years

May 10, 2024

Dividend stocks make sense now. Here are 5 with the biggest payout ratios over the past 2 decades.

This is How The US Fed Affects Your Stocks

This is How The US Fed Affects Your Stocks

May 10, 2024

Understanding the US Fed's impact on the markets.

FIIs & DIIs are Bullish on These 5 Indian Stocks. Do You Own?

FIIs & DIIs are Bullish on These 5 Indian Stocks. Do You Own?

May 10, 2024

Amid the FIIs outflow, these 5 stocks have caught the attention of foreign as well as domestic institutional investors.

Jio Financial: Is the Hype Real?

Jio Financial: Is the Hype Real?

May 9, 2024

We look into the recent price rise of Jio Financial.

Dixon Technologies: Leading the Charge in India's Electronics Revolution

Dixon Technologies: Leading the Charge in India's Electronics Revolution

May 9, 2024

A consumer electronic company worth keeping on your radar.