- Home

- Views On News

- Jul 7, 2022 - 10 Things to Know About the Vauld Debacle

10 Things to Know About the Vauld Debacle

Unless you're living under a rock, you know that crypto prices are falling sharply. Crypto punters are getting jittery, with many exiting the markets.

Crypto volumes are on the decline (a sign of falling prices and therefore interest perhaps).

This has led to carnage in the crypto world which is getting further exacerbated by trust issues.

One firm which has been impacted is Singapore-based Vauld.

As per its website, Vauld aims to provide "holistic banking system for your crypto and FIAT currencies".

Vauld suspended all withdrawals, trading and deposits on its platform on 4 July.

Why did this happen? And what next?

Here are 10 things you need to know about the Vauld debacle...

- Vauld is backed by PayPal founder Peter Thiel's Valar Ventures. Other big names which have backed the startup and participated in its funding include Coinbase and Pantera Capital.

- What's the USP of Vauld? Unlike other exchanges, Vauld is not just used to buy and sell cryptos. On Vauld you can also lend your crypto holdings or borrow from other people at a fixed rate of interest.

Vauld, with its zero to no brokerage scheme receives no income from the transactions but makes money through interest by lending cryptos to other enterprises.

Many crypto platforms are doing this by the way. Binance launched this program back in August 2019.

Here, you can earn money just by storing your crypto in the wallet and creating a FD. Once you do that, you will receive regular interest payments!

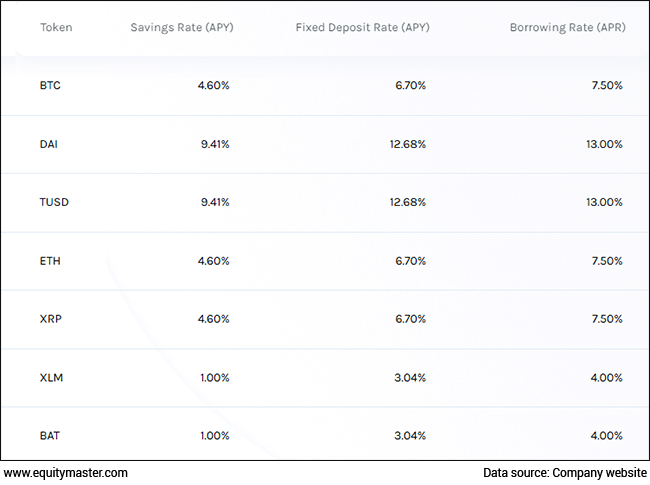

In case of Vauld, the interest payment was weekly. At as high as 12% pa. Exciting, right?

Interest Rates

This is what lured most of the investors to opt for Vauld.

- Majority of Vauld's users are Indians who contribute about 20% of the assets under management (AUM) with as much as US$10-15 m per day to the platform's volume.

- In the latest series of events, Vauld became the latest casualty and suspended all operations over 'financial crisis' concerns.

It suspended all withdrawals, trading and deposits on its platform on 4 July. - In a statement, the company's CEO Darshan Bathija said that the management is facing financial challenges due to volatility in the market. This had led to significant customer withdrawals in excess of US$ 197.7 m since 12 June 2022.

- This significant amount of withdrawal was the after-effect when the decline of the cryptocurrency market was triggered by the collapse of Terraform Lab's UST stablecoin, Celsius network pausing withdrawals, and decade-old crypto hedge fund Three Arrows Capital defaulting on their loans

- At present, Vauld is considering restructuring options and is in talks with potential investors. It has hired financial and legal advisors.

- Vauld will apply to the Singaporean courts for a moratorium.

- Was the collapse inevitable? Yes, in some sense.

Last month, Vauld announced that it laid off 30% of its workforce. The firm then said it needed to cut marketing expenses, suspend hiring, and even slash salaries by 50%.

So you see, the pressure was already mounting. - In the past couple of weeks, we've already seen big names in the crypto industry raising trust issues and rapidly falling. These firms include Celsius, Three Arrows Capital, Vauld, Babel Finance and Voyager Digital.

Will all the chaos come to an end with the Vauld-debacle uncovering? Seems highly unlikely...

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "10 Things to Know About the Vauld Debacle". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!