- Home

- Views On News

- Aug 29, 2022 - This Multibagger Smallcap Stock Zooms 10% ahead of Bonus Issue

This Multibagger Smallcap Stock Zooms 10% ahead of Bonus Issue

What equals the feeling of buying good quality healthy vegetables at reasonable prices? The feeling of getting coriander and curry leaves for free!

And what equals the feeling of getting a good quality small-cap stock at a reasonable price? The feeling of getting bonus shares.

Shareholders of Pondy Oxides and Chemicals must have felt this when the company declared a bonus.

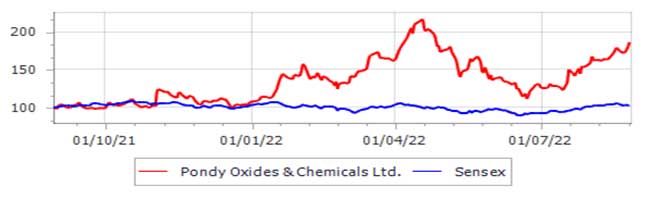

Pondy Oxides and Chemical's share price has performed very well on the bourses even when the benchmark Sensex was beaten down.

Take a look at the comparison chart below.

Rs 100 Invested in Pondy Oxides Vs Sensex

Hence, when the board of Pondy Oxides declared a bonus after a long time, the shareholders were overjoyed.

Today, shares of the company soared over 10%. Gains of 10% at a time when the entire market plunged and benchmark indices fell over 2%.

Let's talk about the bonus issue in detail.

- Pondy Oxides and Chemicals announced a bonus on 10 August 2022.

- The bonus ratio is 1:1. This means one bonus share will be issued for one share held by investors.

- The bonus record date is 29 September 2022, one month from today. The share will trade ex-bonus on 28 September 2022.

Pondy Oxides and Chemicals has declared a bonus issue after a long time. The last time it declared a bonus was in 2006.

A look at the company's financials

Pondy Oxides and Chemicals has given multibagger returns on the bourses, but its financials paint an unclear picture.

The revenues dropped massively in one financial year and rose massively in the other.

The profit margins are also very low. In the financial year 2019-20, the sales have increased by 4% and yet the margins have dropped.

However, the overall picture is good. In the past 5 years, total revenues have increased by 14% and the net profit margin has increased by 8%.

Financial Snapshot

| Particulars (Rs in m) | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Total Income | 9,417 | 10,529 | 12,234 | 10,076 | 14,594 |

| Growth | 24% | 12% | 16% | -18% | 45% |

| Operating profit | 600 | 687 | 397 | 276 | 818 |

| Operating profit margin | 6% | 7% | 3% | 3% | 6% |

| Net profit | 292 | 337 | 163 | 108 | 482 |

| Net profit margin | 3% | 3% | 1% | 1% | 3% |

Also, one of the top investing gurus of India, Dolly Khanna, has this stock in her portfolio.

The June 2022 shareholding pattern of Pondy Oxide shows that Dolly Khanna holds 3.91% stake or 227,252 shares of the company.

How shares of Pondy Oxides and Chemicals have performed recently

Pondy Oxides and Chemicals rose around 107% in the past one year. On a YTD basis, the share price has gone up by 90%.

If you had invested Rs 1 m in Pondy Oxides and Chemicals a year ago, then today it would be Rs 2.1 m!

Pondy Oxides and Chemicals share price touched its 52-week high price of Rs 929.6 on 19 April 2022. Its 52-week low was Rs 403.0 touched on 21 September 2021.

Pondy Oxides and Chemicals is currently trading at a PE (price to earnings) multiple of 9.1 times.

About Pondy Oxides and Chemicals

Pondy Oxides & Chemicals Ltd. manufactures metal oxides and plastic additives. The company produces zinc oxide, lead sub oxide, litharge red lead, and liquid stabilizers of polyvinyl chloride (PVC).

Through a subsidiary, Pondy manufactures epoxy oil stabilisers and paint driers. Pondy Oxides and Chemicals is a leading secondary lead smelter in India.

These products are provided to companies like those that make batteries, chemicals, and PVC extruded and moulded products.

For more details, check out Pondy Oxide and Chemical's factsheet and quarterly results.

Stay tuned to Equitymaster to know more about corporate actions.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "This Multibagger Smallcap Stock Zooms 10% ahead of Bonus Issue". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!