- Home

- Views On News

- Oct 11, 2022 - Should You Subscribe to Suzlon's Rights Issue as the Company Charts a Recovery Path?

Should You Subscribe to Suzlon's Rights Issue as the Company Charts a Recovery Path?

Suzlon Energy is the market leader in wind energy and manufacturing wind turbine generators. But it has had its fair share of challenges over the past few years.

The company has a footprint across 17 countries. It claims to have the largest wind installed base as a wind energy OEM with approximately 13.45 GW of installed capacity as of June 2022.

Back in 2008, Suzlon Energy share price was at its peak at Rs 459. But today, it's a penny stock with a price as low as Rs 8.

Suzlon is one of the popular stocks that turned into penny stocks.

From having a marketcap of Rs 680.7 bn in January 2008, Suzlon's marketcap stood at Rs 55.3 bn in December 2008. That's a wealth destruction of over 90% in a span of 11 months.

At present, the company commands a market cap of Rs 76 bn.

As we write this, the fundamentals of the renewable energy sector in general and this company in particular, has begun to look up.

India is now the third largest market for renewable energy after China and the US. Exciting time waits companies in this space as growth prospects propel their stock prices.

So far, India has installed 66% of its targeted renewable energy installation for 2023. So far till the end of August this year, 116 GW of renewable capacity was installed.

For a long time, Suzlon was looking to raise funds to the tune of Rs 30 bn to refinance its term-loans. The company last month announced its plan to mop up Rs 12 bn via rights issue to reduce debt.

Suzlon is on a deleveraging spree with the recent rights issue and also a Rs 28 bn refinancing from REC.

The rights issue opened for subscription today.

The Rights Issue

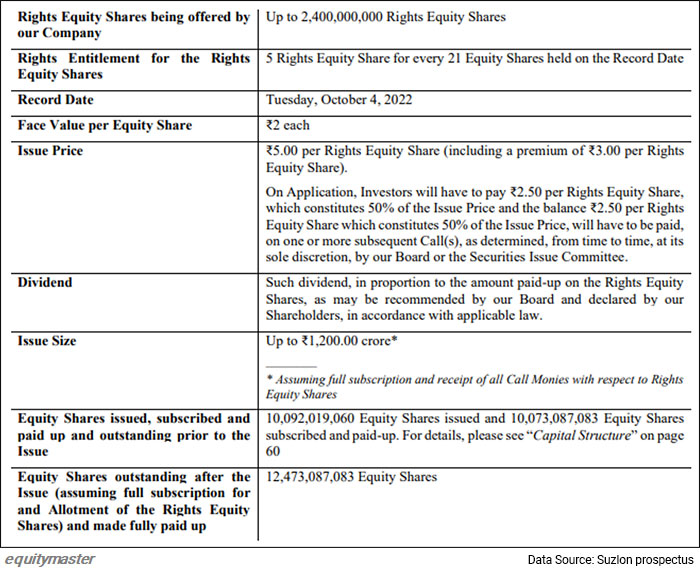

The company has fixed 4 October 2022 as the record date for the rights issue and the issue will be open until 20 October 2022.

Suzlon is offering the right shares in the ratio of 5 shares for every 21 shares held as of the record date.

Following are the details of the fully and partly paid offers.

Suzlon will repay Rs 10 bn to REC from the rights issue proceeds.

Promoters of the company have confirmed their participation and they will be fully subscribing to the extent of their rights entitlement.

Sun Pharma's promoter Dilip Sanghvi will also participate in Suzlon's rights issue. Shanghvi had bought a 23% stake in Suzlon for Rs 18 bn back in 2015. Currently, he holds a 4.2% stake in Suzlon.

The company was recently dealt with a big blow as Tulsi Tanti, who founded Suzlon in 1995, suffered from a cardiac arrest and passed away last week.

The Challenges

Suzlon Energy is certainly on stronger footing now compared to previous years. In the past couple of years, Suzlon's wind turbine generator business was hit hard as the entire industry went into a slowdown.

However, this year, the company lowered its fixed costs and increased execution capabilities. This resulted in reducing losses.

Adding to sentiment was better prospect for Indian renewable energy industry and good order book (900 megawatts as on 31 December 2021).

The company gradually reduced losses to a great extent but still remains a loss making firm.

Financial Snapshot

| Rs m, consolidated | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenue | 81,162 | 50,247 | 29,729 | 33,457 | 65,818 |

| Growth (%) | -36% | -38% | -41% | 13% | 97% |

| Total Expenditure | 71,602 | 51,017 | 38,326 | 28,114 | 57,535 |

| Operating Profit | 10,822 | 412 | (8,322) | 5,542 | 9,116 |

| OPM (%) | 13% | 1% | -28% | 17% | 14% |

| Net Profit | (3,770) | (15,272) | (26,422) | 1,042 | (1,996) |

| NPM (%) | -5% | -30% | -89% | 3% | -3% |

| Total Debt | 1,19,955 | 1,15,520 | 1,31,369 | 68,585 | 63,906 |

| Free Cash Flow | (20,249) | (5,778) | (29,682) | 1,474 | 1,739 |

The key aspects where Suzlon has fared poorly is its consistency in maintaining order book, high fixed cost structure of the wind turbine generator business, and ability to raise funds. High cost has resulted in losses in the segment due to low offtake.

With financing from REC and the rights issue, the company is looking to tackle the problem of financing.

The company's chief executive Ishwar Chand Mangal was recently quoted saying,

- "Our problem is not lack of product, technology or servicing capabilities or orders. Even in our worst times we've been servicing all the turbines we installed and now as much Rs 1,800 crore of our total income of Rs 2,000 crore comes from servicing.

Our real and only problem is financing."

As of 30 June 2022, the group's consolidated debt was around Rs 28 bn. The company plans to lower the interest cost by Rs 900 m annually after the debt reduction.

Post the rights issue, the company will have around Rs 18 bn net debt and it's aiming to clear this given the almost Rs 20 bn annual income.

Does it Make Sense to Subscribe to Rights Entitlement?

As of 11 October 2022, i.e., today, Suzlon's share price was seen quoting at Rs 7.38. The right issue shares are being given at Rs 5 per share, which means a big discount to the market price.

While this discount may look attractive, let's look at the facts here...

Since 2008, the company has not paid out any dividend. Though its offer says the company will adopt a dividend policy post listing of right shares.

Now coming to financials, the company has a track record of posting big losses over regular intervals. The company has made losses in 8 out of the last 10 years, its net worth is hugely in the negative and the balance sheet is loaded with debt.

One look at the company's financial history will paint a clear picture for sure.

And finally, while the company's promoters have said to participate fully in the rights issue, they have been on a selling spree.

The shareholding data shows that promoters have reduced stake for consecutive quarters now.

Suzlon Promoters on a Selling Spree

| Qtr. Ending | 20-Sep | 20-Dec | 21-Mar | 21-Jun | 21-Sep | 21-Dec | 22-Mar | 22-Jun |

|---|---|---|---|---|---|---|---|---|

| Indian Promoters | 17.76 | 17.46 | 17.17 | 16.52 | 16.41 | 16.04 | 15.85 | 14.92 |

| Foreign Promoters | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Total Promoters | 17.76 | 17.46 | 17.17 | 16.52 | 16.41 | 16.04 | 15.85 | 14.92 |

So fundamentally speaking, it doesn't make sense to participate in Suzlon's rights issue.

While many may believe the company is a turnaround candidate and can soon start making big profits owing to 'bright prospects', we would call such an investment speculative.

That's because the entire upside in Suzlon's case is based on future expectations. The company's past has been one big struggle after another.

Stocks like Suzlon can only be in your watchlist once they are able to show consistent revenues and profitability for at least 2-3 years.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Should You Subscribe to Suzlon's Rights Issue as the Company Charts a Recovery Path?". Click here!

1 Responses to "Should You Subscribe to Suzlon's Rights Issue as the Company Charts a Recovery Path?"

Milind S Kambli

Oct 12, 2022Thank you Yash, for guiding us for Suzlon's rights issue. We are confused before reading your article.

With regards,

Milind S kambli