- Home

- Views On News

- Oct 16, 2021 - Taper Tantrum Around the Corner? Watch this Closely...

Taper Tantrum Around the Corner? Watch this Closely...

The Federal Reserve Bank, in its latest FOMC (Federal Open Market Committee) meeting, said that it could begin reducing the financial help it has been providing the US economy by as soon as mid-November.

It plans to do that by reducing the pace of its monthly asset purchases, a process known as tapering.

It would start by cutting US$ 10 bn a month in Treasury bills and US$ 5 bn a month in mortgage-backed securities (MBS).

It is currently buying US$ 80 bn in Treasury bills and US$ 40 bn in MBS.

Why is the Fed buying bonds and securities?

Since the coronavirus pandemic hit, the Fed has taken massive monetary easing measures to boost its flailing economy.

Buying bonds and securities increases the supply of money in the economy which effectively lowers interest rates. When interest rates are lower, banks can lend with easier terms.

The Fed does not actually print money, but the majority of the money supply is digitally credited or debited to the major banks.

Once the banks loan this money to the broader economy then real money is created.

The Fed also uses Fractional Reserve Banking and the Money Multiplier effect to inject money into the system.

So effectively US$ 1 bn of reserves with banks will create US$ 10 bn in new money in the economy.

This process is called quantitative easing (QE).

Lower interest rates are a boon to many.

Including for individuals and institutions who can incrementally borrow and invest those funds.

On the flip side, those with limited capital and fixed income needs, are compelled to look for higher yields elsewhere, particularly in riskier assets. One of those riskier assets is the stock markets of emerging economies such as India's.

This partly explains the heavy foreign money flow, and the resulting bull rally, that we have seen in the Indian stock markets in the last eighteen months.

What are the implications of tapering?

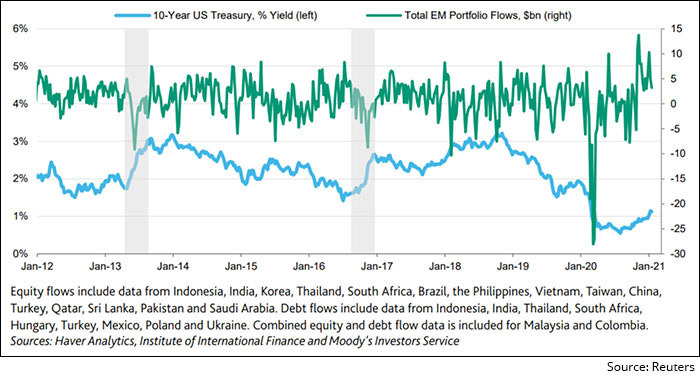

You see, the last time the Fed tapered its bond-buying program, it triggered capital outflows and currency depreciation in many emerging market economies, including India.

This episode earned the nickname taper tantrum.

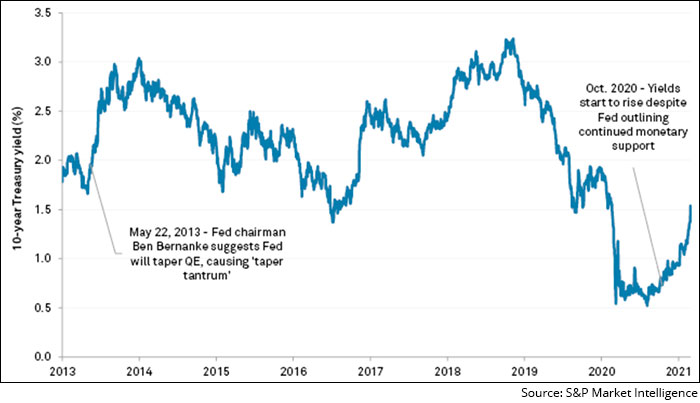

In May 2013, the US Fed Chair Ben Bernanke announced that it would taper its massive bond-buying programme that it had carried out after the 2008 global financial crisis.

This set off an increase in market interest rates, pushing up bond yields. Bernanke then elaborated on the plan of tapering and yields rose more substantially.

It had a big impact on the financial market, especially in emerging markets such as Brazil, India, Indonesia, South Africa and Turkey.

In India, foreign institutional investors (FII) pulled out money from both equities and bonds. The rupee depreciated over 15% between 22 May and 30 August 2013.

This forced the RBI as well to raise interest rates to stem the outflows.

In December 2013, the Fed began reducing the pace of asset purchases from US$ 85 bn per month to US$ 75 bn per month.

Purchases were reduced by US$ 10 bn at each subsequent meeting. The asset purchase programme ended in October 2014 and the Fed began shrinking its balance sheet in October 2017.

Can we expect another taper tantrum?

The 10-year US Treasury yield has witnessed a sharp rise this year, from 0.9% to 1.6% so far in 2021. Bond yields globally, including in India, have been trending up.

Last week, such fears triggered a sell-off in the bond markets while pushing up US Treasury yields (bond prices and yields are inversely related).

This has given rise to the possibility of a new 'tantrum'.

Fears of a Taper Tantrum as Treasury Yields Spike

When yields on the ultra-safe US treasuries rise, investors have reduced incentive to invest in riskier assets such as equity.

A similar selloff now, with another US$ 70 trillion (tn) added to the global debt, could prove to be far more vicious.

The risks are greater this time around than in 2013 because of the high leverage in the system.

Global debt today stands at US$ 281 tn, according to the Institute of International Finance, versus US$ 210 tn in 2013. Companies and households too owe significantly more.

Economic growth and inflation can help reduce debt. Yet the very policies put in place to aid recovery can encourage more borrowing.

Debt is keeping central banks in a loop of never-ending provision of liquidity and of very low-interest rates.

The only way to keep the plate spinning is to keep interest rates low.

Will the Fed raise interest rates?

When the yield on the 10-year US Treasury momentarily surged past 1.6% on 8 October 2021, the highest in a year, it gave many investors a sense of deja vu as yields on shorter-term Treasuries typically move in tandem with interest rate expectations.

However, FOMC officials have stressed that a tapering decision should not be seen as implying pending interest rate hikes.

At the September policymaking session, the committee voted unanimously to hold the central bank's benchmark short-term borrowing rate at zero to 0.25%.

But as expectations of a stronger economic recovery have gained ground, inflation has been rearing its head.

In August 2020, the Federal Reserve committed itself to achieve an average inflation rate of 2% over time, as part of its monetary strategy.

Officials argued that continued higher prices may be what is needed to shift the whole economy to a higher plateau and deliver a jobs boom that helps a broader set of people.

Consumer prices are now up 5.4% over the past year, the fastest pace in decades.

However, officials feel that inflation is likely to be "mostly transitory," and is expected to moderate down to pre-pandemic levels in 2022.

How will a taper tantrum impact the Indian economy this time around?

In the 2013 taper tantrum, the impact on the stock market was short-lived.

This time, markets are overvalued (at least in some pockets, if not more) and investors fear that the spike in bond yields could become the trigger for an extended market correction.

Due to the announcement, we could see some outflows from emerging markets like India.

Increase in Long Term US Yields Lead to EM Capital Outflows

To shield the country from capital outflows, the RBI may increase domestic interest rates, in an attempt to lure foreign investors.

But this could in turn increase borrowing costs for Indian companies and individuals, thus negating the growth benefits achieved in previous years of low interest rates.

Even the government may see its borrowing costs spike. Note that India is already going to spend roughly half of its tax revenues on interest payments this year, as per the latest Union Budget.

A higher interest rate implies an even greater portion of revenues being spent servicing interest payments and less left to spend on more productive expenditures.

This could have implications for broader economic growth.

Should investors be worried?

With equity valuations running sky high, the surge in yields could provide just another nudge to equity investors to book profits.

Hardening US Treasury yields reduce the yield differential with other countries' bonds, making them less attractive.

G-sec (government bond) yields in India too have been inching upwards lately.

With a massive government borrowing plan lined up for 2021-22, an oversupply of government bonds without a commensurate demand for them has pushed them up.

Inflationary concerns and the possibility of appropriate policy action (such as a rate hike) by the Reserve Bank of India (RBI) could also aggravate the situation.

However, in case of a taper tantrum, the RBI has prepared the Indian economy well enough by accumulating sufficient foreign exchange reserves to the tune of US$ 633 bn.

Greater forex reserves with the RBI means the central bank has the means to tackle any disruption with respect to the stability of the rupee.

On the bright side, a rise in bond yields may be good for investors in small savings schemes and Government of India (GOI) floating rate bonds, where rates are linked to government bond yields and are reset periodically.

New investors too can perhaps look forward to a buying opportunity.

How the taper tantrum pans out remains to be seen. Meanwhile, stay tuned for more updates from this space.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

Equitymaster requests your view! Post a comment on "Taper Tantrum Around the Corner? Watch this Closely...". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!