- Home

- Archives

Archives... Don't Miss Anything, Ever!

Here you will find all the research and views that we post on Equitymaster. Use the tools to customize the results to suit your preference!

HDFC & Kotak Bank: DOUBLE or Trouble?

HDFC & Kotak Bank: DOUBLE or Trouble?

May 3, 2024

A critical look at Can HDFC and Kotak Bank stocks double your money?

Multibagger Pharma Stock Announces Buyback at 25% Premium

Multibagger Pharma Stock Announces Buyback at 25% Premium

May 3, 2024

This pharma stock greenlit its fourth buyback program in the last five years. Here's everything you need to know.

Bulk Deal Alert: Shankar Sharma Sells 200,000 Shares of this Drone Stock

Bulk Deal Alert: Shankar Sharma Sells 200,000 Shares of this Drone Stock

May 3, 2024

This decision by the superstar investor could prove costly as the drone company has strong growth levers in place.

Why IFCI Share Price is Rising

Why IFCI Share Price is Rising

May 3, 2024

This PSU company has turned a corner in FY24 by registering a profit after seven consecutive years of losses.

A Simple Hack to Beat the Big Investors for Multibagger Gains

A Simple Hack to Beat the Big Investors for Multibagger Gains

May 3, 2024

Forget the earnings season. Here's is a better metric that could offer interesting insights about stocks.

Impending Rally in Indian Deep Tech Stocks?

Impending Rally in Indian Deep Tech Stocks?

May 2, 2024

Whether India's top tech stocks can leverage Government's US$ 1.2 Billion AI Fund...

Aadhar Housing Finance IPO: A Promising Play on the Affordable Housing Boom

Aadhar Housing Finance IPO: A Promising Play on the Affordable Housing Boom

May 2, 2024

The Blackstone-backed company gears up for IPO. From grey market premium to price band, here's everything you need to know.

Which Companies Build Metros and Vande Bharat Trains in India?

Which Companies Build Metros and Vande Bharat Trains in India?

May 2, 2024

The biggest beneficiaries of the Indian railways' spending plan are...

Why REC Share Price is Rising

Why REC Share Price is Rising

May 2, 2024

The Navratna company has not added any new NPA in the last eight quarters, and it's aiming to be NPA free by the end of FY25.

Why Kotak Mahindra Bank Share Price is Falling

Why Kotak Mahindra Bank Share Price is Falling

May 2, 2024

Will RBI's regulatory embargo and multiple senior level exits, hurt Kotak Bank's profit growth?

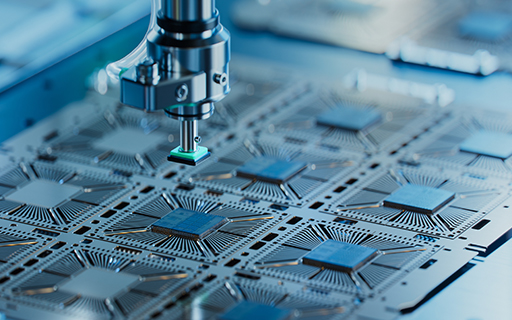

How to Invest in Indian Semiconductor Stocks

How to Invest in Indian Semiconductor Stocks

May 2, 2024

Is this the right time to invest in semiconductor stocks?

5 Upcoming Renewable Energy IPOs to Watch Out

5 Upcoming Renewable Energy IPOs to Watch Out

May 1, 2024

To capitalise on India's transition to a low carbon economy, these five PSU companies are set to launch the IPOs of their subsidiaries soon.

Can IREDA Get to Zero Net NPAs Post Navratna Status?

Can IREDA Get to Zero Net NPAs Post Navratna Status?

May 1, 2024

Getting a 'Navratna' status gives the company's board and management much more autonomy and control on quick decision making.

After Tata can This Business Group Create Wealth?

After Tata can This Business Group Create Wealth?

May 1, 2024

Aditya Birla Group announces multiple strategic decisions. How can you profit?

Recycling Stocks are Booming. Here are 10 Stocks to Track Now

Recycling Stocks are Booming. Here are 10 Stocks to Track Now

May 1, 2024

Keep an eye on these 10 top-performing recycling stocks leading the sustainability revolution.

Indegene IPO: 5 Things to Know

Indegene IPO: 5 Things to Know

Apr 30, 2024

From grey market premium to price band, here's everything you need to know about the upcoming IPO of this upcoming life science IPO.

Top 5 Debt Free Penny Stocks with Solid Growth

Top 5 Debt Free Penny Stocks with Solid Growth

Apr 30, 2024

Debt-free companies are less susceptible to economic downturns. Here are five that should be on your radar.

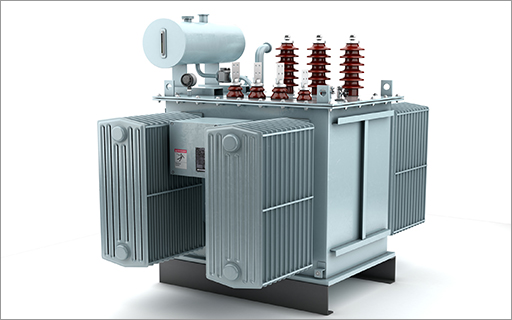

Best Transformer Stocks for Your Watchlist

Best Transformer Stocks for Your Watchlist

Apr 30, 2024

How to profit from the transformer gold rush.

Stocks Watchlist for the Rising 'Luxury' Theme

Stocks Watchlist for the Rising 'Luxury' Theme

Apr 29, 2024

Stocks that could enjoy the halo effect from the rise of luxury class in India.

Are Good Days Ahead for Telecom Stocks?

Are Good Days Ahead for Telecom Stocks?

Apr 29, 2024

Interested in investing in telecom stocks? Read on...