- Home

- Todays Market

- Indian Stock Market News November 7, 2015

Global Markets on an Uptrend Sat, 7 Nov RoundUp

Global markets closed the week on a positive note with a majority of the indices ending in the positive territory. The Chinese market was the biggest gainer, up by 6%, buoyed by expectations of a trading connect scheme between the Hong Kong and Shenzen markets that would promote mutual market access and boost volumes.

Even the Chinese government's commitment to bring out radical reforms in state-owned enterprises over the next five years led to the strong gains in the week gone by. All the other Asian markets, barring India, posted gains for the week.

The US markets ended the week in gains even as markets fell on the last trading day as a stronger jobs report saw the increased possibility of the US Fed hiking interest rates in December. Even the unemployment rate hit a 7.5 year low of 5% adding strength to the economic recovery. Most of the European markets, except the UK, ended the week in gains.

The Indian markets fell by 1.5% during the week after exit polls predicted a close fight for the Modi government in a race to win the Bihar elections. Even the earnings season continued to remain lack lustre which has added to the poor performance of stocks.

Key world markets during the week

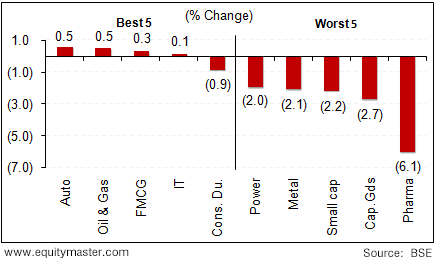

Barring a few, all sectors ended the week on a negative note. Stocks from the pharma and capital goods sectors were the biggest losers for the week.

BSE indices during the week

Now let us discuss some key economic and industry developments in the week gone by.

Slowdown in the manufacturing sector showed no respite with growth contracting to a 22-month low in October on sluggish order intake as per a Nikkei survey. The Nikkei Manufacturing Purchasing Managers Index (PMI) fell to 50.7 in October from 51.2 in September. If the index falls below 50, it is indication of contraction in the manufacturing activities. Despite the slowdown in new orders, manufacturers recruited additional workers in October. Employment rose for the first time since January, although only marginally. The report expects production growth to revive in the coming months on a further drop in inventories of finished goods.

The Reserve Bank of India (RBI) has fixed the public issue price for the sovereign gold bonds at Rs 2,684 per gram. The bonds will act as a substitute for holding physical gold as they will be linked to the gold price and provide the same returns. It will offer investors an interest rate of 2.75%. Investors can make a minimum investment of two grams in the bonds whereas the maximum limit is capped at 500 grams.

The applications for the same are being accepted from 5th November to 20th November 2015.The bonds will be sold through banks and designated post offices and will be issued on 26th November 2015. The tenure of the bond will be for a period of eight years with an exit option from the fifth year to be exercised on the interest payment dates. Interest earned on gold bonds will be taxable and capital gains tax will also be levied as in the case of physical gold.

Movers and shakers during the week

| Company | 30-Oct-15 | 6-Nov-15 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top gainers during the week (BSE-A Group) | ||||

| United Spirits | 3,152 | 3,449 | 9.4% | 4080/2501 |

| Motherson Sumi | 246 | 266 | 7.8% | 396/217 |

| Hexaware Technologies | 240 | 258 | 7.8% | 335/191 |

| Oriental Bank | 135 | 145 | 7.7% | 344/121 |

| Piramal Enterprises | 938 | 1,005 | 7.1% | 1043/751 |

| Top losers during the week (BSE-A Group) | ||||

| Opto Circuits | 15 | 12 | -17.7% | 27/12 |

| Central bank | 84 | 69 | -17.0% | 121/60 |

| Dr. Reddy's Lab | 4,270 | 3,630 | -15.0% | 4383/3010 |

| Adani Enterprises | 92 | 79 | -14.3% | 804/66 |

| Indian Overseas Bank | 35 | 31 | -12.7% | 65/30 |

Source: Equitymaster

Now let us move on to some of the key corporate developments of the week gone by.

Nestle India would reportedly resume production and sales of Maggi this month after NABL, an accredited laboratory, cleared the samples of the newly manufactured noodles. The Bombay High Court had mandated the lab to conduct a sample test on the noodles. Furthermore, Nestle India conducted over 3,500 tests representing over 200 million packs in both national as well as international accredited laboratories and all reports are clear. Nestle is also working on starting to manufacture Maggi Noodles at its two other plants, Tahliwal and Pantnagar.

Blue Star Ltd has acquired 51% stake in Oman Electro Mechanical Contracting Company LLC (OEMC). The joint venture, Blue Star Oman Electro-Mechanical Company LLC (Blue Star Oman), will offer Mechanical, Electrical, and Plumbing (MEP) contracting services in Oman. At present, the MEP market in Oman is around US$ 350 million, and the company is aiming to gain over 10% market share in the next couple of years. To achieve the same, the company will focus on residential, commercial, industrial, and infrastructure projects. Furthermore, the company is also planning to expand into the after-sales service business in Oman.

Dr Reddy's Laboratories' fundamentals received a jolt after the US Food and Drug Administration issued a warning against the company's three manufacturing facilities over quality control issues. It is to be noted that the company is already making amends as per nine observations made under Form 483 by the FDA inspectors in relation to these facilities. Warning letters are more stringent and can result in import alerts if not complied with promptly and adequately. Reportedly, two of the plants that have come under review, account for 12% sales of the company sales and can have a material impact if faced with enforcement action in the future.

Now let us move on to quarterly performance reported by companies.

Nestle India continued to be adversely impacted by the Maggi controversy. The company reported a revenue decline of 20% YoY as domestic business fell by a third, while exports were down by 6% YoY during the quarter. The net profits were down by 60% including a write-off of Rs 245 million.

Larsen and Toubro Ltd reported its results for the September 2015 quarter. The revenue of the company grew by 10.6% YoY driven by infrastructure, power and financial services business segments. The company's operating margins stood at 11.1% for the quarter. The Net profits grew by a faster 15.6% YoY, boosted by an exceptional income of Rs 3 billion booked during the quarter. Reportedly, the company has revised downwards its guidance for order intake from 15% to 5-7%. Reportedly, the company has been trying to sell infrastructure assets and dilute the stakes in non-core assets to reduce its debt, which at the end of the quarter stood at Rs 982.6 billion.

GAIL has posted a 66% YoY fall in its net profit during the September 2015 quarter due to lower realisations of LPG, other liquid hydrocarbons and petrochemical products. The increased interest and depreciation charges - after commissioning of a petrochemical plant pulled down profitability for the quarter.

Public sector lender IDBI Bank reported lacklustre results for the September 2015 quarter. The bank's net profit increased marginally by 0.8% YoY to Rs 1 billion. Profits remained flat as rising bad loans led to a steep rise in provisions during the quarter. The provision towards bad loans was up 49% YoY at Rs 10 billion. Net interest income for the bank rose by 14.6% YoY to Rs 16 billion during the quarter. In absolute terms, gross non-performing assets (NPAs) were up 27.7% YoY while net NPAs were up by 19% YoY during the quarter.

Tech Mahindra reported its results for the quarter ended September 2015. The revenues of the company grew by 5.1% on a QoQ basis as the company's business from large clients remained subdued. Reportedly, the top twenty clients of the company, who accounted for 63% of its revenues last year, have now come down to 56%. As per the management, the communication segment, which contributes around 53%, is expected to remain under pressure. The company expects growth to pick up in the manufacturing and Banking, Financial Services and Insurance (BFSI) segment. Presently, manufacturing and BFSI accounts for 16% and 9% of the total revenues of the company. The net profit of the company grew by 16.2% QoQ.

The global markets are expected to remain volatile, as speculations over a rate hike by the US Fed are likely to keep markets on the edge. In the home markets, a negative outcome for the ruling government is being perceived as a lost opportunity to boost its bargaining power in the upper house to push the reforms agenda. This is likely to pull down markets in the short term. However, investors should ignore such small developments, as the long-term macroeconomic picture for the country remains bright. Investors should rather focus on a company's fundamentals before making the decision to invest.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets on an Uptrend". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!