- Home

- Outlook Arena

- Asset Allocation

The Best Asset Allocation For Your Equity Portfolio

'Equities' is just an 8 letter word. At the same time, the amount of theories, concepts and scenarios associated with it are many. So, investors have a number of queries related to investing in equities. The top most being, "How and where do I allocate my money in equities so as to get the best results?" Usually, brokers are of little help, spouting some well rehearsed statements involving jargon and heavy words. Well meaning friends too, do not always end up giving a crystal clear picture.

'Equities' is just an 8 letter word. At the same time, the amount of theories, concepts and scenarios associated with it are many. So, investors have a number of queries related to investing in equities. The top most being, "How and where do I allocate my money in equities so as to get the best results?" Usually, brokers are of little help, spouting some well rehearsed statements involving jargon and heavy words. Well meaning friends too, do not always end up giving a crystal clear picture.

Equitymaster's Asset Allocation guide is an effort to highlight the various factors influencing asset allocation in equities. In this guide, we will have a look at how best to allocate your equity investments so as to achieve optimum returns from them.

We are certain that you will find this guide useful. We encourage you to share your thoughts and feedback on this guide on asset allocation in equities.

We recommend that investors should decide their exposure to equities, which is only one part of the overall investment portfolio, after they have kept aside some cash. While we are no experts in wealth management, we believe keeping aside some safe cash is absolutely necessary. Not only will this cash take care of your liquidity needs, but it will also come handy during market declines. Particularly when there will be opportunities to pick up fundamentally strong stocks at cheap valuations. For some of you this cash component could be 6 months of usual monthly expenditure, for others 36 months. You need to decide what amount works for you, and then set it aside. Maybe in a FD, or in a pure liquid fund. Or maybe just cash at home!

How To Plan Your Equity Portfolio

- Importance of Asset Allocation

Equitymaster talks about what it means by 'asset allocation' with regards to a stock portfolio and how you can draw up the ideal asset allocation plan.

- Setting the Foundation for Equity Allocation

In this article we get into the more specific aspects of building a portfolio that fits your needs, and guide you on planning your asset allocation.

- Understanding Equities

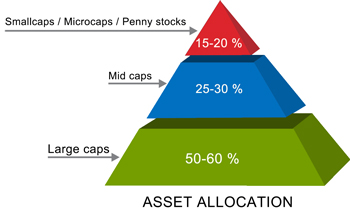

In this article we discuss basics of investing, understanding market capitalisation and allocation between large cap, mid cap and small cap stocks.

Advanced Stock Screener

Now that you have read our views on asset allocation, let's take the next step. How do you find the best Large Cap, Mid Cap and Small Cap stocks? Equitymaster's Advanced Stock Screener is your answer. Access the list of stocks now! - Large Caps, Mid Caps, Small Caps

How To Make Money From Stocks

There's one big difference between people who make money from stocks, and those who don't... And it's not the skill of picking the right stock every time. It's how you allocate your portfolio. You already know about it, but choose to ignore it every time you buy a stock... Even though it is extremely simple, and easy to implement. Now, allow us to help you finally make money from stocks... In this note we reveal it all...

Where Do You Stand Now?

As a member of Equitymaster's Portfolio Tracker (PT), you get ready-made reports on your asset allocation. Not only that, by benchmarking your allocation, the PT guides you on how to plan your stock market investments. Go ahead, try it today! (Already, a member? View the Asset Allocation Report Now!)