- Home

- Outlook Arena

- Top Energy Stocks in India

Top Energy Stocks in India

India's economic growth is linked directly to its energy demand. So, over the long term, the need for energy (oil and gas) will increase at the same level the economy develops.

India is the third-largest consumer of oil in the world, after the US and China as of 2022. At present, the country imports 82.8% of its oil and half of its gas needs.

According to the India Energy Outlook 2021, energy demand in India should nearly double to 1,123 million (m) tonnes of oil equivalent as the gross domestic product (GDP) goes up to US$8.6 trillion (tn) by 2040.

The Indian energy industry constitutes three different segments. There is exploration and production, storage and transportation, refining, processing and marketing.

The global automotive industry is shifting towards cleaner modes of transport such as electric vehicles (EVs). The imminent transition to EVs signals a bumpy road ahead for the energy sector, specifically crude oil. According to the International Monetary Fund, more than 90% of all passenger vehicles in the US, Canada, Europe, and other rich countries could switch to EVs by 2040.

The gradual shift towards electric vehicles and other environmental conscious source of energy poses a big question to the demand for oil and its by-products over the long-term.

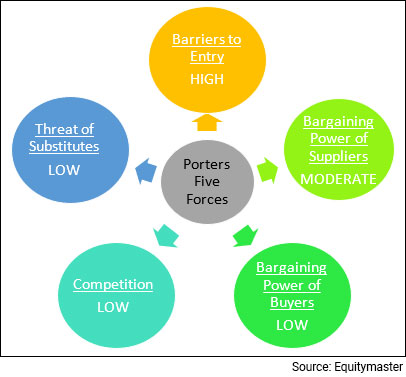

Porter's Five Forces Analysis of the Energy Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining energy of suppliers, bargaining energy of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the energy sector:

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the energy sector, barriers to entry are high. The primary reasons are capital intensive nature of the industry and economies of scale. Apart from this, players in the exploration and production segment need government permission to operate.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Crude oil prices are a function of global events. They are highly susceptible to economic growth, geopolitical events and global policies. Apart from that, they are susceptible to bets.

A large amount of crude oil in the world is produced by OPEC. Their leadership gives them a significant influence over the demand-supply scenario. Therefore, the bargaining power of suppliers is moderate in the crude oil segment of energy.

However, for petroleum products, the surplus capacity in the country drastically reduces their bargaining power.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the energy sector, the customers are price-takers with little to no bargaining power.

#4 Competition

For most industries, understanding the competition is vital to successfully marketing or selling a product.

The competition in the energy industry is low in all the segments. This is because only a few players operate in the Upstream, Midstream and Downstream segment.

However, with new reforms announced in energy sector, more private players are likely to enter the sector thus increasing the competition.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

At present, the threat of substitutes is low in the energy industry. Although, with India's ambitious plans for alternative sources of energy such as solar, wind energy,coal and hydroelectric, the scenario may change in the future.

Porters Five Forces Analysis of the Energy Sector in India

When to Invest in Energy Stocks

The demand for energy is closely linked to the economic growth which makes it a highly cyclical industry. This means that for some reason the economy and by extension the stock market flounders, so will the energy stocks.

Since economic cycles affect the earnings prospects, the best time to buy energy stocks is at the start of an economic expansion. And the best time to sell is just before the economy begins to slow down.

So, if you invest in an energy stock at the peak of an economic cycle there is good chance you will lose a huge chunk of the investment. Nevertheless, identifying the bottom of the cycle is not an easy task.

The Indian economy has been growing consistently, led by robust domestic demand. With the world's largest youth population and increasing urbanization in tow, this is likely to continue going forward. Therefore, it is safe to assume that India's demand for energy will also remain strong over the long term.

The crude oil consumption is expected to grow at a CAGR of 5.1% to 500 m tonnes by the financial year 2040 from 202.7 m tonnes in the financial year 2022.

Key Points to Keep in Mind While Investing in Energy Stocks

Here are some key points to take note of before you invest in energy stocks:

#1 Cyclicality of the sector

This is the most important factor one must keep in mind while investing in energy stocks.

The energy sector, being consumer cyclical, is dependent on business cycles and economic conditions. As the demand for energy is closely linked to the economy, energy stocks are usually riskier - their fortunes are prone to economic booms and busts.

Usually, cyclical stocks can be used to generate high returns when the economy is doing well.

#2 The shift towards cleaner sources of energy

The substitute product in the energy segment is the alternative source of fuel used to run a vehicle.

The Indian automobile industry is gradually shifting its focus to electric vehicles (EV). With an aim to reduce emissions, the industry is charging forward in this direction with increased localised production. And now, with the cost and affordability of EVs dropping in the coming years, we are not far from when most vehicles will be electric.

This can pose a serious threat to the demand for energy in the coming years. However, it is still a few years away.

So, look for companies which are investing in the renewable energy space to keep up with competition.

#3 Competitive landscape

The competitive landscape in all segments of the energy sector is weak. However, with the advent of new reforms in the sector, private players are likely to crowd the market thereby, increasing the competition.

Apart from the new entrants in the existing market, alternative sources of energy can also give stiff competition to the sector. While the market is still nascent, the government's ambitious plans can change the landscape.

#4 Profitability of the company

With moderate bargaining power, the sector operates on thin margins. But what they lack in margins, they make up for in high volume.

Here's a list of top energy companies in India based on their consolidated operating profit.

| Company | Net Sales(Rs m) | Operating Profit (Rs m) | Consolidated Net Profit (Rs m) |

|---|---|---|---|

| Indian Oil Corporation Ltd. | 59,81,638 | 4,75,956 | 2,41,841 |

| Reliance Industries Ltd. | 42,37,030 | 6,61,850 | 3,90,840 |

| Bharat Petroleum Corporation Ltd. | 36,22,768 | 1,86,053 | 87,887 |

| Hindustan Petroleum Corporation Ltd. | 34,96,829 | 1,31,455 | 63,826 |

| Oil & Natural Gas Corporation Ltd. | 11,03,189 | 6,09,455 | 4,03,057 |

| GAIL (India) Ltd. | 9,16,265 | 1,58,869 | 1,03,640 |

| Mangalore Refinery And Petrochemicals Ltd. | 6,97,271 | 50,381 | 29,553 |

| Chennai Petroleum Corporation Ltd. | 4,33,754 | 27,487 | 13,424 |

| Petronet LNG Ltd. | 4,31,686 | 55,596 | 33,524 |

| Gujarat Gas Ltd. | 1,64,562 | 21,919 | 12,856 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

Therefore, one must look for a debt-to-equity ratio of one or less than one.

Here's a list of top energy companies in India with low debt to equity ratio.

| Company | Debt to Equity (x) |

|---|---|

| Indian Oil Corporation Ltd. | 0.84 |

| Reliance Industries Ltd. | 0.41 |

| Bharat Petroleum Corporation Ltd. | 0.5 |

| Hindustan Petroleum Corporation Ltd. | 1.12 |

| Oil & Natural Gas Corporation Ltd. | 0.03 |

| GAIL (India) Ltd. | 0.11 |

| Mangalore Refinery And Petrochemicals Ltd. | 2.93 |

| Chennai Petroleum Corporation Ltd. | 3.35 |

| Petronet LNG Ltd. | 0.00 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

A ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here's a list of top energy companies in India with more than 15% in ROCE.

| Company | ROCE (%) |

|---|---|

| Indian Oil Corporation Ltd. | 38.08 |

| Reliance Industries Ltd. | 31.42 |

| Bharat Petroleum Corporation Ltd. | 24.05 |

| Hindustan Petroleum Corporation Ltd. | 19.94 |

| Oil & Natural Gas Corporation Ltd. | 18.74 |

| GAIL (India) Ltd. | 17.72 |

| Mangalore Refinery And Petrochemicals Ltd. | 16.37 |

Data as of March 2022

#7 Valuations

A commonly used financial ratio used in the valuation of energy stocks is-

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out list of stocks according to their P/BV Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

Here's a list of top energy companies in India that score well on dividend yield and dividend pay-out.

| Company | Dividend Yield (eoy) | Dividend Payout (%) |

|---|---|---|

| Indian Oil Corporation Ltd. | 10.59 | 47.83 |

| GAIL (India) Ltd. | 6.42 | 42.84 |

| Oil & Natural Gas Corporation Ltd. | 6.41 | 32.77 |

| Oil India Ltd. | 5.98 | 39.75 |

| Petronet LNG Ltd. | 5.94 | 51.46 |

| Hindustan Petroleum Corporation Ltd. | 5.2 | 31.12 |

| Bharat Petroleum Corporation Ltd. | 4.45 | 38.77 |

| Chennai Petroleum Corporation Ltd. | 1.57 | 2.22 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

Top Energy Stocks in India

The energy sector is in its growth phase. The top energy stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top energy stocks in India which score well on crucial parameters.

| Company | RoE (Latest, %) | D/E (Curr FY, x) | Sales CAGR (3 yrs, %) | Profit CAGR (3 yrs, %) |

|---|---|---|---|---|

| Petronet LNG Ltd. | 26.74 | 0 | 4.00% | 15.80% |

| Gujarat Gas Ltd. | 25.59 | 0.09 | 28.80% | 45.60% |

| GAIL (India) Ltd. | 20.28 | 0.11 | 6.80% | 22.20% |

| Indian Oil Corporation Ltd. | 20 | 0.84 | 0.00% | 15.50% |

| Oil & Natural Gas Corporation Ltd. | 18.25 | 0.03 | 5.00% | 16.20% |

| Bharat Petroleum Corporation Ltd. | 17.01 | 0.5 | 0.70% | 10.20% |

For more details on energy stocks, check out Equitymaster's powerful stock screener for filtering the best energy stocks in India.

List of Energy Stocks in India

The details of listed energy companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of energy stocks.

Best Sources for Information on the Energy Sector

Indian Brand Equity Foundation Energy Sector Report - https://www.ibef.org/industry/energys-and-mining

So, there you go. Equitymaster's detailed guide on the top energy stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the energy sector and top energy stocks in India. This is a great starting point for anyone who is looking to explore more about energy stocks and the energy sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Apr 15, 2024

The increasing adoption of EVs, the expanding renewable energy market, and the development of cleaner technologies is creating a big opportunity for energy players.

![]() Top Wind Energy Shares in India 2024: Wind Energy Companies to Add to Your Watchlist

Top Wind Energy Shares in India 2024: Wind Energy Companies to Add to Your Watchlist

Apr 5, 2024

India's wind energy market is experiencing explosive growth, more than doubling in just three years.

![]() Meet the Nifty Next 50 Stocks that Had a Better Year than Tata Motors

Meet the Nifty Next 50 Stocks that Had a Better Year than Tata Motors

Mar 31, 2024

Nifty Next 50 is a map to India's future. These 5 dynamic companies outperforming the market are poised for success.

![]() Top 5 Penny Stocks to Watch Out for in India's Booming Power Sector

Top 5 Penny Stocks to Watch Out for in India's Booming Power Sector

Mar 26, 2024

Power stocks have found favour after a long wait. Here's what lies ahead for them and how you can invest in the best power companies.

![]() Why BGR Energy Share Price is Falling

Why BGR Energy Share Price is Falling

Feb 29, 2024

Share price of BGR Energy tanked 44% in 1 week. Here's what's causing this dip?

![]() Invest in a Sustainable Future with Mutual Funds Focused on Solar Energy

Invest in a Sustainable Future with Mutual Funds Focused on Solar Energy

Feb 18, 2024

India is ranked 5th in the world with an excellent installed solar power capacity of 73.32 gigawatts (GW) as of December 2023. If one wants to benefit from the growth potential of this sgement, they can even think about investing in Indian solar businesses.

![]() ONGC Share Price: Risk Reward Equation in Favor of Investors?

ONGC Share Price: Risk Reward Equation in Favor of Investors?

Feb 15, 2024

ONGC is investing heavily to achieve its onshore wind energy target of 2 GW by 2030. This is one of the highly advanced tech-led projects in the renewable energy space.

![]() Best OMC Stock: BPCL vs HPCL

Best OMC Stock: BPCL vs HPCL

Feb 13, 2024

Oil demand in India is expected to double by 2045. And this OMC stock has a competitive advantage compared to its listed peers.

![]() Best Renewable Energy Stock: KP Energy vs Inox Wind

Best Renewable Energy Stock: KP Energy vs Inox Wind

Feb 10, 2024

These two companies are among the few wind EPC players in India.

![]() This Renewable Energy Stock is Up 10,000% in 5 Years

This Renewable Energy Stock is Up 10,000% in 5 Years

Feb 2, 2024

The company's board recently approved a stock split along with rewarding shareholders with bonus shares.

![]() Top 5 Energy Stocks to Watch Out for Big Dividends in 2024

Top 5 Energy Stocks to Watch Out for Big Dividends in 2024

Apr 7, 2024

Energy companies in India are poised for a record-breaking dividend payout driven by significant surge in net profit.

![]() IREDA: Leading the Charge in India's Green Energy Revolution

IREDA: Leading the Charge in India's Green Energy Revolution

Apr 2, 2024

This state-owned company is capitalising on India's transition to a low-carbon economy. Take a look.

![]() Multibagger Alert! 5 Stocks that Rallied Over 1,000% in Financial Year 2024

Multibagger Alert! 5 Stocks that Rallied Over 1,000% in Financial Year 2024

Mar 30, 2024

These 5 stocks made headlines by skyrocketing in the financial year 2023-24. More gains ahead or a possible downturn?

![]() Why Suzlon Energy Share Price is Falling

Why Suzlon Energy Share Price is Falling

Mar 6, 2024

Suzlon Energy hits lower circuit for third consecutive day. Here's What is causing the dip.

![]() Should You Invest in Solar Penny Stocks in 2024?

Should You Invest in Solar Penny Stocks in 2024?

Feb 28, 2024

Here are two high potential solar plays to watch out this year.

![]() Deep Tech Stocks to Leverage India's Economic Inflection Point

Deep Tech Stocks to Leverage India's Economic Inflection Point

Feb 16, 2024

Companies with Deep Tech edge could be the biggest wealth creators of coming decades.

![]() Why IREDA Share Price is Falling

Why IREDA Share Price is Falling

Feb 14, 2024

The government's renewable energy targets will need financing requirements of around Rs 30 trillion out of which Rs 12 trillion will be from power financing NBFCs like IREDA.

![]() Why SJVN Share Price is Falling

Why SJVN Share Price is Falling

Feb 12, 2024

SJVN is strategically important to the Indian government for improving the share of power from renewable sources, especially hydropower.

![]() Top 10 Power Stocks to Watch Out for in India in 2024

Top 10 Power Stocks to Watch Out for in India in 2024

Feb 9, 2024

Power stocks have found favour after a long wait. Here's what lies ahead for them and how you can invest in the best power companies.

![]() 5 Things to Know about NTPC Green Energy IPO

5 Things to Know about NTPC Green Energy IPO

Feb 1, 2024

India's largest power company is planning an IPO for its green energy arm. More details inside...

FAQs

Which are the Top Energy Companies In India right now?

As per Equitymaster's Indian stock screener, here is the list of the best energy stocks in India right now...

- #1 RELIANCE IND.

- #2 ONGC

- #3 IOC

- #4 GAIL

- #5 BPCL

These companies are investing in the renewable energy segment and keeping themselves ahead of the competition.

Note that, there are various other parameters you should take into account before investing in any company such as promoter holding etc. Sustained research must not be compromised despite the positive odds.

Which are the energy stocks with the best shareholder returns?

Indraprastha Gas and HPCL were the top performers over the last 5 years in terms of sales and profit growth.

Indraprastha Gas growth can be attributed to it being the pioneer in city gas distribution (CGD) and enjoying an exclusive position in the business, besides the strong parentage of GAIL and Bharat Petroleum Corporation (BPCL).

HPCL has also done well in the domestic energy sector on account of its strong parentage (Oil and Natural Gas Corporation (ONGC), its established brand name and its leading position in the domestic oil marketing business.

To know which other companies performed well over the last 5 years, check out our entire list of top performers.

What kind of dividend yields do energy stocks offer?

The energy sector has a consistent trend of dividend yields. Different companies have different dividend policies which vary depending on the owners discretion.

At present, IOC, GAIL, ONGC and Oil India offer attractive dividend yields.

For more, check out the top dividend yield stocks on Equitymaster's Indian stock screener.