- Home

- Views On News

- Feb 17, 2023 - Top 5 Speciality Chemical Stocks to Add to Your Watchlist

Top 5 Speciality Chemical Stocks to Add to Your Watchlist

The Covid-19 pandemic changed the way how the world looks at India.

The country was able to make the most of the opportunities after China imposed a zero Covid policy. One such opportunity was from the chemical sector, especially the speciality chemical segment.

After China closed its doors to the world to curb the virus, the world turned to India, the sixth largest chemicals producer, to fulfil the demand.

India was already at an advantage owing to the low cost of manufacturing, and a proven track record of producing world-quality products.

China commands a 20% market share in the US$ 800 bn global specialty chemical industry worth. As global supply chains undergo a strategic shift to reduce dependence on China, Indian specialty chemical stocks stands to benefit.

This is not a narrative, but a trend that is already unfolding. For instance, Japan has announced incentives to companies shifting base from China to India. And many other countries are encouraging a lower reliance on China.

With that in mind, let's have a look at five of the best specialty chemical stocks in India.

These stocks are shortlisted using Equitymaster powerful Indian stock screener.

#1 BASF India

First on the list is BASF India, a subsidiary of the largest chemical producer in the world.

The company's business consists of chemicals, industrial solutions, performance products, materials, surface technologies, and agricultural solutions.

Its products find use in agriculture, automotive, pharmaceuticals, construction, consumer durables, consumer care, paper, and paint sectors.

Being a subsidiary of a leading multinational company (MNC), BASF India gets strong technical, financial and operational support from its parent company BASF SE.

The company has a diversified revenue profile, with no segment contributing more than 30% to the total revenue.

In the last three years, the company has grown its revenue at a compound annual growth rate (CAGR) of 19.6%, driven by price realisations and volume growth. The net profit has also grown at a CAGR of 171.0% during the same period, driven by improved EBITDA (earnings before interest tax and depreciation).

As a result, the return on equity (RoE) has also improved significantly from 1.8% to 25.5% in the last three years.

In financial year 2022, the company repaid its debt completely and became debt-free. This led to an improvement in the interest coverage ratio from 18.7x to 39.5x.

BASF India has undertaken several capex projects to increase its manufacturing capacity in line with the 'Make in India' initiative. This will help the company's revenue growth in the medium term.

To know more about BASF India, checkout its factsheet and latest quarterly results.

#2 Sumitomo Chemical India

Second on the list is Sumitomo Chemical, one of the leading agrochemical companies in India.

The company has a balanced portfolio of products, including insecticides, weedicides, fungicides, fumigants and rodenticides, plant growth nutrition products, bio-rationals, and plant growth regulators.

Sumitomo Chemical India has a strong domestic presence with over 16,000 distributors, 40,000 dealers, and 700 stock-keeping units (SKU). It also exports to over 60 countries.

Currently, the company has over 200 brands which it manufactures in five plants across India. Over the next two years, the company is investing over Rs 1.2 billion (bn) to manufacture five products for its parent company and global affiliates.

The company also plans to invest 15% of the consolidated EBITDA every year to upgrade its manufacturing facilities and expand capacity to cater to the growing demand for chemicals.

Sumitomo Chemical's growth plans have helped in improving its revenue. In the last three years, revenue has grown at a CAGR of 8.3%, driven by higher demand. The net profit also grew at a CAGR of 27.4% during the same time.

Its debt-free status and a healthy interest coverage ratio of 73.2x ensures good cash flows and high leverage for its growth plans.

The company's RoE and return on capital employed (RoCE) for the financial year 2022 stood at 14.3% and 22%, respectively.

Going forward its growth plans and high demand for agrochemicals will drive its revenue.

To know more about Sumitomo Chemicals, checkout its factsheet and latest quarterly results.

#3 UPL

Third on the list is UPL, a multinational chemical company.

Formerly known as United Phosphorous, the company engages in both agro and non-agro activities.

With over 136 thousand products, it is the 5th largest agrochemical company and 4th largest seed manufacturing company in the world.

UPL also has a presence in over 138 countries with access to over 90% of the world's food basket.

To increase its renewable energy consumption from 8% to 30%, it acquired a 26% stake in Clean Max Kratos in September 2022.

In the last three years, UPL's revenue has grown at a CAGR of 8.9%, driven by volume and price. The profit has also grown at a CAGR of 25.5%, driven by efficiency in supply chain management and backward integration.

The company's debt reduced significantly from 1.8x in the financial year 2019 to 0.9x in the financial year 2022.

UPL has grown through acquisitions in the last 25 years, and it plans to continue this in the future as well.

To add to this, a surge in demand aided by China plus one strategy and the government's Atmanirbhar Abhiyan to reduce dependence on imported chemicals will further act as tailwinds for UPL.

To know more about UPL, checkout its factsheet and latest quarterly results.

#4 Galaxy Surfactants

Next on the list is Galaxy Surfactants.

The company is a leading manufacturer of performance surfactants and speciality care products with over 205 product grades.

Being the largest manufacturer of oleo chemical-based surfactants, it is a preferred supplier to leading FMCG (fast-moving consumer goods) brands such as Unilever, Himalaya, Dabur, Henkel, and CavinKare.

Galaxy Surfactants has seven manufacturing facilities in India, the US, and Egypt manufacturing over 45 performance surfactants and over 160 speciality care products.

The company has a strong focus on research and development (R&D) and has around 88 approved patents on its name, of which three were granted in the financial year 2022.

In the current fiscal year, the company became water positive and is taking steps to increase its renewable energy consumption.

At present, the company is focussing on improving its share among existing customers and increasing its presence in emerging markets.

In the last three years, revenue has grown at a CAGR of 12.4% on the back of new product launches and volume growth. The net profit has seen a marginal growth of 4.5% during the same period.

Steady cashflows have helped the company maintain its debt-to-equity ratio at 0.1x.

Going forward, its expansion plans to penetrate new markets and product launches will help the company grow its revenue and profits.

To know more about Galaxy Surfactants, checkout its factsheet and latest quarterly results.

#5 PI Industries

Last on the list is PI industries, a leading player in the agrochemicals space.

The company manufactures insecticides, fungicides, and herbicides which are widely used in farms across the globe.

It also forayed into the pharma business and successfully developed a Covid-19 drug intermediate.

The company has over five decades of experience in the agrochemicals space, which has helped the company build a healthy portfolio of products.

The company is heavily investing in capex (around Rs 7 bn) to scale up the capacities of existing products to cater to the growing demand for agrochemicals.

Despite this, PI Industries is debt free and has a healthy interest coverage ratio of 52.5x.

In the last three years, its revenue has grown at a CAGR of 16.5%, driven by healthy demand and higher volumes. The net profit also grew twofold on the back of cost optimisation measures taken by the company.

The company's RoE and RoCE for the financial year 2022 are 13.7% and 16.7%, respectively.

PI Industries plans to grow its agrochemical business through new product launches and its pharma business through acquisitions.

To know more about PI Industries, checkout its factsheet and latest quarterly results.

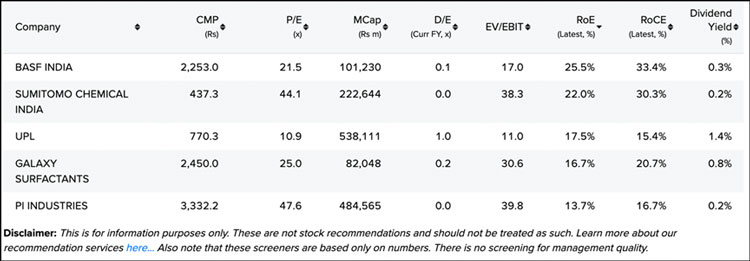

Snapshot of top speciality chemical stocks from Equitymaster's Indian Stock Screener

Here's a quick view of the above companies based on their financials.

Please note that these parameters can be changed according to your selection criteria.

This will help you identify and eliminate stocks not meeting your requirements and emphasise those stocks well inside the metrics.

Why should you invest in speciality chemicals stocks?

The chemicals sector in India is set to become a trillion-dollar sector by 2025, if all things fall in place.

In October 2022, we wrote about the chemical sector and how it plays a big role in pushing India's manufacturing sector as a whole.

Within the sector, the specialty sector stands to benefit the most as even a 5% shift from China to India will unleash a US$8 bn opportunity for specialty chemical companies in India. Within the next five years, India could double its share in global chemical industry.

Although the speciality chemicals industry is poised for growth, you need to be very choosy while picking stocks within the space. There is always a risk of companies not being able to capitalise on growth leading to a dramatic fall.

You must do your due diligence and check the factors favouring and impacting the industry before investing in this industry.

Happy investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Equitymaster requests your view! Post a comment on "Top 5 Speciality Chemical Stocks to Add to Your Watchlist". Click here!

2 Responses to "Top 5 Speciality Chemical Stocks to Add to Your Watchlist"

Janardan Mohanty

Feb 17, 2023BASF is the giant among these 5 as it is research based and many of its products are monopoly items. In agrochemicals segment it has recently launched a new product "Broflanilide" which is considered a game changer for BASF worldwide. This is a revolutionary product in the agrochemicals space and this single product may generate revenue of close to Rs1000cr in India alone. Noted companies like PI Industries, Indofil Chemicals have started comarketing this product and many more companies are lining up for this product. Clearly the full potentiality of BASF in India is not fully estimated. BASF is also a prominent player in vegetables seeds segment.

Shipra Pawar

Feb 20, 2023Good Insight about Speciality Chemicals.... Was looking forward from a long time. As the boom is about It for a long time …. This Chemical sector is not noticed… I have been observing Sumitomo chemicals when it was around 280 …. Beyond my belief it has drastically jumped…. Didn't dare to invest then …