- Home

- Todays Market

- Indian Stock Market News January 13, 2017

Dull End to the Week; TCS and Infosys Slump Fri, 13 Jan Closing

Share markets in India continued to trade flat in the afternoon session and finished the week on a dull note. TCS and Infosys lost 4% and 2.9% in today's trade with a poor set of numbers for the December 2016 quarter. Sentiments also remained weak in the IT sector surrounding the H1-B visas in the US as a key headwind going forward.

At the closing bell, the BSE Sensex stood lower by 9 points, while the NSE Nifty finished down by 7 points. The S&P BSE Mid Cap & the S&P BSE Small Cap finished flat. FMCG sector gained the most, followed by bank stocks.

Asian markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.80% and the Hang Seng rose 0.47%. The Shanghai Composite lost 0.21% as Chinese exports in December decreased 6.1% YoY in dollar-denominated terms, while imports rose 3.1% from the previous year. European markets are higher today with shares in Germany leading the region. The DAX is up 0.47% while France's CAC 40 is up 0.43% and London's FTSE 100 is up 0.41%.

The rupee was trading at 68.23 against the US$ in the afternoon session. Oil prices were trading at US$ 52.86 at the time of writing.

According to an article in a leading financial daily, global clean energy investment fell by 18% to US$287.5 billion in 2016, dragged down by sharp falls in equipment prices and slowdown in key Asian markets. The falling cost of clean energy technology, combined with marked slowdowns in China and Japan, underpinned a global slowdown in spending last year.

As per a new report by Bloomberg New Energy Finance (BNEF), Chinese investment totaled at US$87.8 billion, down 26% from the 2015 record high of US$119.1 billion, while Japan invested a meagre US$22.8 billion, marking a 43% decrease year on year.

The primary cause of the investment drop was a slowdown in China and Japan. After years of record-breaking investment driven by some of the world's most generous feed-in tariffs, China and Japan are cutting back on building new large-scale projects and shifting towards digesting the capacity they have already put in place.

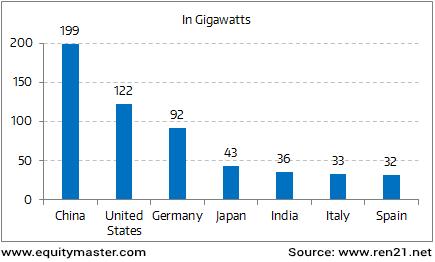

Renewable Power Capacities in the World

Importantly, while overall global clean energy investment (Subscription Required) was down last year, it's important to note that the total capacity installed was not. Even though overall investment was down, offshore wind experienced a record financing of US$29.9 billion in 2016, 40% higher than the previous year, as developers in Europe and China took advantage of bigger turbines and improved economics.

Speaking of renewable energy space in India, Bhavita Nagrani, our Research analyst has recently shared her views on how the rise of the renewables is changing the dynamics of the power industry (Subscription Required). She has also compared the costs of setting up various types of power plants in these times and how the Indian central government has been pushing hard for more renewable energy capacity.

Moving on to the news from stocks in auto sector. According to an article in a leading financial daily, Hero MotoCorp has tied up with Marwen SA to launch its latest product 'Glamour 125' motorcycle in Argentina. The company has launched five new products to locally assemble it in Argentina. Post the launch in Argentina the product, Glamour 125 will be launched across global markets.

In a move to expand its business into international markets, the company has unveiled its first-ever global launch of a new product outside of India. This global launch of the new Glamour coincides with the commencement of Hero's operations in Argentina, its 35th market in an its rapidly growing global footprint.

The company has established a manufacturing plant in Villa Rosa Province of Buenos Aires. The plant has a capacity of 5,000 units per year with plans for future expansion, the reports noted. The BS-IV compliant 125 cc new Glamour has been developed at Hero MotoCorp's R&D campus in India keeping in mind young customers across the globe.

Moreover, in the immediate future, these products will be sold through a network of 40 dealers across the regions of capital Buenos Aires. By end of 2017, the company also plans to have 95 dealerships across Argentina.

Hero Motorcorp share price finished the day down by 0.9% on the BSE.

Automobile stocks finished the trading day on a weak note with Maruti Suzuki and TVS motors leading the losses.

And here's a note from Profit Hunter:

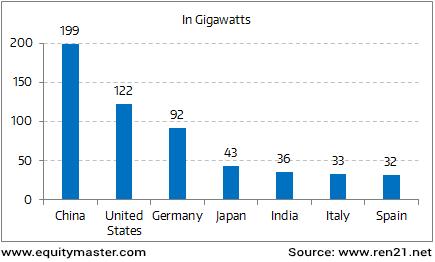

Today, let's take a look at the chart of Hero Moto Corp:

In 2016, Hero Moto Crop rallied strongly and topped out in September 2016 at Rs 3,700. It generated a 50% return in just 9 months. Since then the stock is in a correction mode. Although it has found support at 2,850 levels, the moving averages are positioned unfavorably.

The Exponential Moving Averages (EMA) is an important indicator tracked by leading technical analysts. One of its functions is that, it acts as a support and resistance. The 20 EMA usually tracked by short term traders, 50 EMA is followed by medium term traders, and the most important, the 200 EMA, is usually tracked by the longer term investors (200 EMA is also closely watched indicator by the entire financial markets).

Currently, the stock seems to be at a very important juncture. The stock is facing a strong resistance from its 20 day, 50 day and 200 day EMA. The cluster of averages near 3,100 levels is apparently preventing the stock from going beyond this level.

A sustained close above this level could help the bulls take control. If not, then the stock could be expected to remain under pressure. The coming sessions will dictate whether the bulls can fight through these cluster of averages....

Hero Motocorp Facing Resistance from Cluster of Moving Averages

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Dull End to the Week; TCS and Infosys Slump". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!