- Home

- Todays Market

- Indian Stock Market News February 1, 2017

Markets Reacts Positively as FM Tables Union Budget 2017-18 Wed, 1 Feb 01:30 pm

Indian share markets are trading strong after taking cues from the budget announcements. Sectoral indices are trading on a mixed note with stocks in the information technology sector and power sector trading in the red. However, stocks in the realty sector and the banking sector are witnessing maximum buying interest.

The BSE Sensex is trading up 246 points (up 0.8%) and the NSE Nifty is trading up 81 points (up 0.9%). The BSE Mid Cap index is trading up by 0.9%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 67.63 to the US$.

The Finance Minister tabled the Union Budget 2017-18 today. The Union Budget focused on 10 distinct themes: Farmers, rural population, energizing youth, poor and underprivileged, infrastructure, financial sector, digital economy, public service, prudent fiscal management, and tax administration.

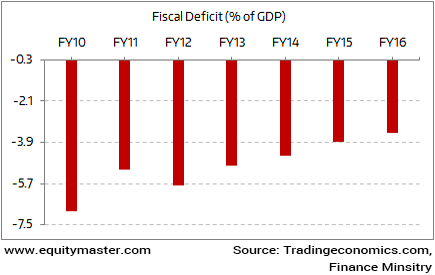

The total budget expenditure of the budget this year is pegged at Rs 21,470 Billion. Despite the high figure the government has managed to keep the budgeted expenditure at a fiscal deficit of 3.2% as against the FRMB recommendation of 3% for the current fiscal.

Fiscal Deficit target of 3% of GDP

The Finance Minister announced a slew of sops and tax benefits among other fiscal announcements. Presently the burden of taxation was mainly on salaried class. Post demonetisation there was a legitimate expectation of reduced burden. In accordance to this expectation, in news that will bring cheer to the majority of the tax paying population., the Income tax has been halved to 5% for those earning between Rs. 250,000 and Rs. 500,000. The Finance Minister said that this move is to reduce the burden on tax payers and bring in more people under the tax net, through lower rates.

All other categories of taxpayers in subsequent brackets will get benefit of Rs 12,500. Surcharge of 10% will be levied on persons earning between Rs 5 million to Rs 10 million. The surcharge of 15% on those earning above Rs 10 million will continue to remain the same.

Among other tax benefits, Foreign Portfolio Investors (FPIs) will be exempt from indirect provisions reducing tax burden.

The finance minister proposed the change in the definition of 'Long Term' for long term capital gains in case of properties to 2 years from the current three years.

In another major development, in a push for Digital India, and curbing black money, the Finance Minister proposed to ban all cash transaction above Rs 300,000 from 1 April 2017.

To ensure transparency in political funding in the country, the government has proposed that any maximum donation from any one source can only be Rs 2,000.

Earlier, the donation limit was Rs 20,000. The Finance Minister Arun Jaitley also said these donations can be made either through cheques or digital means only.

The government has also proposed an amendment to the Reserve Bank Act to enable issuance of electoral bonds. These bonds can be redeemed by the political parties in registered accounts and within a specified time only.

This is precisely what we have been talking about for a long time. Vivek Kaul, our big picture expert had started a petition to end special privileges to political parties. And over 25,000 of our dear readers signed up for the petition to get equal rights and bring about an era of transparency in the funding of political parties.

Market participants remained optimistic after the budget announcement. However, it remains to be seen how the policies and amendments mentioned in the Union Budget will be implemented over the year.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Markets Reacts Positively as FM Tables Union Budget 2017-18". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!