- Home

- Todays Market

- Indian Stock Market News February 2, 2017

Indian Indices Trade Near the Dotted Line; Metal Stocks Witness Selling Thu, 2 Feb 11:30 am

After opening the day on a flat note, the Indian share markets witnessed choppy trades and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the metal sector and auto sector witnessing maximum selling pressure. Stocks in the telecom sector are trading in the green.

The BSE Sensex is trading down 42 points (down 0.2%) and the NSE Nifty is trading down 15 points (down 0.2%). The BSE Mid Cap index is trading up by 0.5%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 67.43 to the US$.

Market participants in the Indian stock market are keeping tabs on how the announcements made in yesterday's budget will affect their investments. Finance Minister Arun Jaitley came out with a low-key budget yesterday. While the focus was still on farmers, underprivileged, rural development and job creation, the budget didn't leave any of the other stakeholders disappointed.

The Union Budget focused on 10 distinct themes viz. farmers, rural population, energizing youth, poor and underprivileged, infrastructure, financial sector, digital economy, public service, prudent fiscal management, and tax administration. As per Jaitley, Budget 2017-18 is set out to Transform, Energise, and Clean India.

The stock markets have clearly given a thumbs-up to the budget. But the question is: Should you rush out and grab a slice of this relief stock rally?

Rahul Shah, co-head of research, answer this question in the recent edition of the 5 Minute WrapUp. As per him, market participants should not fall for the post-budget buying frenzy. Rather, they should look out for value and follow a long term value investing approach.

It's also important to have a set process in place. Many of you have already tasted the fruits of one of Rahul's processes with his Microcap Millionaires service.

But at the Equitymaster Conference 2017, Rahul asked attendees to mark 10 February 2017 on their calendars. The reason? He will send out his first Profit Velocity report to subscribers.

As you may have guessed, Profit Velocity is a system-based investing approach.

With Profit Velocity, Rahul believes that the system could help subscribers fetch gains several times those of the benchmark index. In keeping with that, our Founder Member opportunity, which closes shortly, offers an unprecedented 60% saving on the usual membership fees for Profit Velocity.

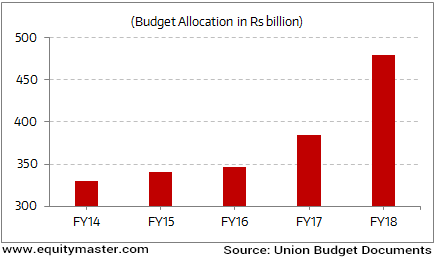

One of the major beneficiaries of the budget was the rural economy. Many measures are announced in the budget to prop-up the rural India. With an aim to double farmer's income in five years, the government made an allocation of Rs 480 billion under Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA). This is the highest ever allocation for MNREGA as is seen in the chart below:

MNREGA Scheme Back in Limelight

Apart from the above, the government stated it would be disbursing agricultural credit to the tune of Rs 10 trillion in FY18. This, along with a 60 days' interest waiver announced earlier, will benefit farmers in a long way. Apart from this, the government will undertake Mission Antyodaya to bring one crore households out of poverty and make 50,000 gram panchayats poverty free by 2019.

We commend the above developments taken by the government in order to stimulate the rural economy in India.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Near the Dotted Line; Metal Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!