- Home

- Todays Market

- Indian Stock Market News February 7, 2017

Share Markets Open Flat; Banking Stocks Lead the Losses Tue, 7 Feb 09:30 am

Asian markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.45%, while the Hang Seng is down 0.19%. The Shanghai Composite is trading down by 0.31%. Stock markets in the US and Europe ended their previous session on a weak note.

Meanwhile, share markets in India have opened the trading day on a flattish note ahead of the monetary policy review. The BSE Sensex is trading higher by 13 points while the NSE Nifty is trading flat. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.1% & 0.4% respectively.

The rupee is trading at 67.20 to the US$. Sectoral indices have opened the day on a mixed note with auto and banking stocks witnessing selling pressure. While, healthcare and FMCG stocks are among the top gainers on the BSE.

Banking stocks have opened the day on a mixed note. Dhanlaxmi bank and J&K bank are the most active stocks in this space. According to an article in Livemint, IDFC Bank has picked up a 5% stake IIFL Holdings for over Rs 5 billion through an open market transaction. The shares were purchased on an average price of Rs 317.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

According to bulk deal data available with the BSE, IDFC Bank purchased 15,853,000 shares, amounting to 4.99% stake, of IIFL Holdings. Reportedly, JP Morgan held a 5.13% stake in IIFL through an investment vehicle, Copthall Mauritius Investment Ltd.

Notably, IDFC Bank has been aggressively picking up stakes in financial services companies after securing a banking licence. It has so far bought into Grama Vidiyal Microfinance, Suryoday Small Finance Bank Ltd and ASA International India Microfinance Pvt Ltd.

On the other hand, IIFL has attracted several marquee investors in recent years. In July last year, CDC Group Plc, the UK government-owned development finance institution, invested Rs 10 billion (US$150 million) in IIFL Holdings.

In another development,

The Bank joins a growing number of banks across the globe that can, through a single connection send payments seamlessly to almost any bank account in the world on behalf of their clients. Thereby delivering a faster, more efficient and cost-effective service.

In the premium edition of The 5 Minute WrapUp, Rahul Shah wrote about the reasons why India is a cash based economy. Trust in online payments, security risks, identity and privacy issues, as well as old habits of paying in cash, are just some of the things that he mentioned.

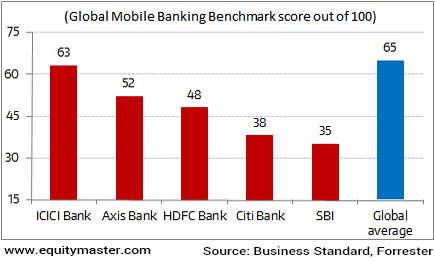

While private banks such as ICICI Bank, Axis Bank, and HDFC Bank have been at the forefront in embracing technological innovations, large public sector banks like SBI have been catching up of late.

Indian Banks lag on the Technology Front

However, Indian banks are still not at par with their global counterparts. As per a study conducted by research firm Forrester in 2016, none of the large Indian banks managed to score above the average Global Mobile Banking Benchmark of 65 out of 100. ICICI Bank was the highest rated Indian bank with a score of 63 out of 100, while SBI stood at the lowest rung with a score of mere 35 points.

Moving on to the news from stocks in cement sector. As per an article in a leading financial daily, ACC and Ambuja Cements shares surged up to 6% on Monday amid the reports suggesting LafargeHolcim is mulling a merger of the two cement companies.

LafargeHolcim owns controlling stakes in two of its Indian subsidiary ACC and Ambuja. The strategy to merge both the operations into a single unit is aimed at unlocking synergies and at the same time, help in rationalizing cost. Reports about the merger have been doing rounds since 2013 when LafargeHolcim opted for a major rejig. LafargeHolcim holds close to 63% in Ambuja Cement and 50% in ACC.

In June last year, LafargeHolcim struck a deal to divest assets previously under Lafarge India. LafargeHolcim had agreed to sell Lafarge India Pvt Ltd to Nirma Ltd for Rs 94 billion, including debt, as part of a deal to complete the India leg of the global merger of Lafarge and Holcim.

Moreover, ACC would be the biggest beneficiary if the merger goes through and would also make ACC-Ambuja a force to reckon with, the reports noted. Speaking of LafargeHolcim's restructuring exercise (Subscription Required), Tanushree Banerjee, Co-head of Research has written everything you need to know about the amalgamation. Here's a snippet:

- "This transaction is expected to improve the capital and financial structure and will be EPS accretive from the day one. Further it will unlock cost synergies of approx. Rs 9 bn through supply chain and fixed cost optimization. It is imperative to note the consolidated capacity of the combined entity stands at 58 mio tpa".

As per her, the move comes after, LafargeHolcim mentioned that India is one of its key markets with very solid long-term fundamentals and a clear potential for further improvement in business performance. To know more about the company's financial performance, subscribers can access to Ambuja Cement stock analysis and ACC stock analysis on our website.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Share Markets Open Flat; Banking Stocks Lead the Losses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!