- Home

- Todays Market

- Indian Stock Market News April 7, 2017

Sensex Remains Range bound; Sun Pharma Tanks on USFDA Inspection Fri, 7 Apr 01:30 pm

After opening the day on a negative note, share markets in India have remained range bound and are trading marginally below the dotted line. Sectoral indices are trading on a mixed note with stocks in the capital goods sector and stocks in the oil and gas sector trading in green, while stocks in the pharma sector are leading the losses.

The BSE Sensex is trading down by 73 points (down 0.3%), and the NSE Nifty is trading down by 23 points (down 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.5%, while the BSE Small Cap index is trading up by 0.5% The rupee is trading at 64.41 to the US$.

Stocks in the telecom sector are in the limelight in today's trade. Bucking the market trend, both Bharti Airtel share price and Idea cellular share price are among the top gainers on the BSE Sensex.

The advances come after the Telecom Regulatory Authority of India (TRAI) ordered Reliance Jio to withdraw its free offer.

Reliance Jio Infocomm's (RJio) attempts to widen its subscriber base through free services have been thwarted, with the telecom regulator asking the operator to withdraw the offer.

The Summer Surprise offer announced last week, promised to provide complimentary services to every Jio Prime member for three months starting April 1.

While the operator has complied with the Telecom Regulatory Authority of India's (TRAI) order, all those who have already signed up will continue to get free services under the offer till July.

The company said it was in the process of fully complying with the regulator's order and would withdraw the complimentary benefits as soon as feasibly possible.

Jio was expected to start charging for its services from April 1. However, it extended the deadline to buy the Rs 303 plan and other plans until April 15.

Under the Jio Summer Surprise offer, those who bought the Rs 99 Prime membership by April 15, with a Rs 303 plan or higher, would be eligible for three months' complementary services.

Close to 72 million subscribers had signed up for the Prime Membership offer. However, the company had nearly 100 million users when services were free. By extending free services till July, Jio was hoping to bring on board the other 30 million who did not continue with their Jio connection after it went paid.

The entry of Reliance Jio and the fierce tariff war it has triggered has set off brisk activity in the industry for fundraising and consolidation, as the incumbents look for ways and means to fend off the competition.

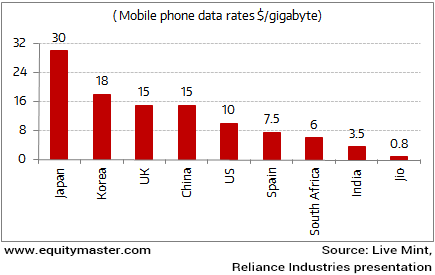

Jio's Data Pricing Disrupts the Telecom Apple Cart

The move to end the free services has spur rival telecom stocks, with Bharti Airtel share price and Idea cellular share price trading up by 1.8% and 1.4% respectively.

In news from stocks in the pharma sector. Sun Pharma share price is among the top losers on the BSE Sensex today, after the US Food and Drug Administration (USFDA) began a surprise inspection of its facility today.

Shares of the country's largest drug maker fell by as much as 3%, the lowest since late February.

The USFDA began inspections on the company's Dadra plant, which is its Second largest USFDA-approved plant after Halol and the estimated revenue generated from the formulations plant stands around US$ 250 million.

Dadra has been Sun Pharma's only formulation plant which had no USFDA concerns.

USFDA conducted a surprise inspection at the plant and found alleged storage and logistics lapses.

Sun Pharma is the fifth largest specialty generic pharma company in US market and US revenues contribute nearly 48% to its total revenue. With a drop in the US Dollar and inspection at Dadra plant, earnings of Sun Pharma in Q1FY18 may get affected.

We had recently written about the current predicament of Indian pharma companies in one of the premium editions of the 5 Minute WrapUp:

- Over the past few years, risk in the US markets has increased. The US Food and Drug Administration has become stricter on products entering US borders. Surprise inspections have increased and companies are being issued warning letters. This has impacted the business and earnings of Indian pharma players, causing major volatility for the sector.

Give it a read to form a better understanding of the current scenario in the Indian pharma sector.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Range bound; Sun Pharma Tanks on USFDA Inspection". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!