- Home

- Todays Market

- Indian Stock Market News May 11, 2020

SGX Nifty Trades Volatile, Equity MF Inflows Plunge, Rs 56.6 Trillion Loans from PSBs, and Top Cues in Focus Today Mon, 11 May Pre-Open

Indian share markets ended their trading session on a positive note on Friday.

Gains were seen after talks of an economic stimulus for small businesses battered by the coronavirus outbreak improved sentiment.

Reportedly, the government may unveil fiscal stimulus amounting to 0.3% of the country's gross domestic product (GDP), focusing on small and medium sized businesses, real estate firms and banks.

At the closing bell on Friday, the BSE Sensex stood higher by 199 points (up 0.6%) and the NSE Nifty closed higher by 52 points (up 0.6%).

The BSE Mid Cap index ended up by 0.1%, while the BSE Small Cap index ended down by 0.5%.

On the sectoral front, gains were seen in the energy sector and FMCG sector, while power stocks witnessed selling pressure.

SGX Nifty was trading at 9,256, up by 60 points, at the time of Indian market closing hours on Friday.

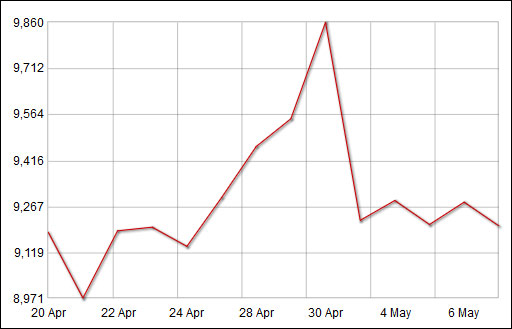

The SGX Nifty traded on a volatile note last week. It ended in the red on three of the five trading days.

Here's how it has performed over the last few weeks...

SGX Nifty: Over the fortnight

SGX NIFTY is a derivative of NIFTY index traded officially in Singapore stock exchange.

How it performs this week and affects trades in Indian markets remains to be seen.

We will keep you updated about its movement in upcoming market commentaries. Stay tuned.

Meanwhile, here's an update from Vijay Bhambwani, editor of Fast Income Alerts...

- Alert - India 10Y Bond Yields Breach 6%

Hi,

I've been warning you through my videos about falling yields (across asset classes) in 2020 before the year even started.

The bond yield collapse will impact you more than you've ever imagined. Even if you don't invest in fixed income securities.

You see markets are inter-connected.

You can watch Vijay's latest video here: A Trade to Profit from the Negative News Around Us

And to get such updates and track futures and options (F&O) data on a daily basis you can join our Telegram channel here.

Moving on, market participants will be tracking Shree Cement, TCI Express, and SBI Cards and Payment Services as these companies announced their March quarter results (Q4FY20) on Friday.

You can read our recently released Q4FY20 results of other companies here: Ambuja Cement, IndusInd Bank, Axis Bank, Tech Mahindra, Reliance Industries, Marico, Kansai Nerolac, NIIT Technologies, Persistent Systems, SKF India.

PSBs Sanction Loans Worth Rs 56.6 Trillion

In news from the banking sector, public sector banks (PSBs) sanctioned loans worth Rs 56.6 trillion for the March-April period to 41.81 lakh accounts, according to the finance ministry.

The borrowers represented the micro small and medium sized enterprises (MSMEs), retail, agriculture and corporate sectors.

Reportedly, PSB loans amounting to Rs 265 billion have been sanctioned in 2.37 lakh cases for MSMEs.

This is part of the PSB initiative to prioritise pre-approved emergency credit lines and enhanced working capital requirements to the sector.

Meanwhile, PSBs sanctioned loans worth Rs 773.8 billion to non-banking financial companies (NBFCs) and housing finance companies (HFCs) between March 1 and May 4.

Including the Reserve Bank of India's (RBI) targeted long term repo operations (TLTRO) window, PSBs extended Rs 1.08 lakh crore of financing to ensure business stability and continuity.

The finance ministry said that the three-month loan moratorium facility announced by the RBI has been availed by 3.2 crore PSB accounts.

On Thursday last week, Finance Minister Nirmala Sitharaman said that the Indian economy is poised to recover from the recent crisis brought upon by the coronavirus pandemic with PSB sanctioning loans worth Rs 56.6 trillion in just two months.

How these funds are utilised and how much economic recovery they bring remains to be seen. We will keep you updated on all the developments from this space.

25% Decline in Equity Mutual Fund Inflows in FY20

In news from mutual funds sector, investors pumped Rs 837.8 billion in equity-oriented mutual fund (MF) schemes in FY20, registering a decline of 25% from the Rs 1.11-trillion inflows in the preceding year.

However, this was the sixth successive year of net inflows in equity mutual funds, according to data by the Association of Mutual Funds in India.

The flows into equity funds in the last fiscal were lower than the flows in 2018-19 primarily because of the equity markets displaying volatility, which made some investors take a break from making fresh equity investments.

Net inflows in these funds were Rs 1.7 trillion in FY18, Rs 703.7 billion in FY17, Rs 740.2 billion in FY16, and Rs 710.3 billion in FY15. However, they had witnessed a net outflow of Rs 92.7 billion in FY14.

We will keep you updated on how this trend pans this financial year and in coming months. Stay tuned!

Speaking of mutual funds, a crisis Dalal Street has got to worry about is the debt mutual funds.

If defaults were to become widespread, then the Franklin Templeton fiasco will be just the tip of the iceberg.

Any bond that is not rated AAA is already under the scanner. The same goes for all the private placement of debt issues which mutual funds subscribed to.

But not all mutual funds are in trouble.

Last week, we hosted Ajit Dayal, at a web summit - Debt Funds or DEATH Funds - to dive deep into this crisis.

As always, Ajit had fascinating insights to share. I highly recommend you watch the video of the summit.

Here's the link to the summit.

Also, you really need to read Ajit's The Honest Truth editorial on how to walk around with a 56 inch chest in this crisis! This is a must read.

RBL Bank Q4FY20 Result

RBL Bank reported a 54% decline in its March quarter net profit to Rs 1,143 million on the back of higher provisions.

The bank's total provisions trebled on a year-on-year (YoY) basis and stood at Rs 6.1 billion in Q4FY20. It holds Rs 1,079.5 million of provisions in excess of what RBI has mandated for covid-19 related moratorium.

The lender logged a 37% YoY growth in its operating profit at Rs 7.7 billion compared to Rs 5.6 billion a year ago.

The bank's total revenue jumped 33% YoY to Rs 15.2 billion from Rs 11.5 billion reported in Q4FY19.

RBL Bank's net interest margin (NIM) stood at 4.93% in the March quarter. Its net interest income (NII) grew 38% YoY to Rs 10.2 billion in Q4FY20.

The bank's deposits fell 1% to Rs 578.1 billion in Q4FY20. Current and savings account (Casa) deposits grew 17% and 2% sequentially to Rs 171.1 billion in the March quarter.

The private lender's advances increased 7% to Rs 580.2 billion.

For the financial year 2019-20, the bank's total income stood at Rs 55.4 billion, up 39% YoY from Rs 39.8 billion, while its operating profit jumped 42% YoY to Rs 27.5 billion.

To know more, you can read RBL Bank's Q4FY20 result analysis on our website.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Trades Volatile, Equity MF Inflows Plunge, Rs 56.6 Trillion Loans from PSBs, and Top Cues in Focus Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!