- Home

- Todays Market

- Indian Stock Market News July 14, 2017

Sensex Opens Marginally Down; TCS Results Disappoint Fri, 14 Jul 09:30 am

Asian equity markets are mixed today. The Nikkei 225 is up 0.22%, while the Hang Seng is up 0.01%. The Shanghai Composite is trading down by 0.20%. US markets ended higher and the Dow another record high close, with financials rising ahead of profit reports due Friday from several big US banks.

Back home, share markets in India have opened the day on a flat note with a negative bias. The BSE Sensex is trading lower by 31 points while the NSE Nifty is trading lower by 8 points. The BSE Mid Cap Index and BSE Small Cap index opened the day up by 0.2% & 0.3% respectively.

Sectoral indices have opened the day on a mixed note with healthcare stocks and consumer durables stocks leading the pack of gainers. While FMCG and realty stocks have opened the day in red. The rupee is trading at 64.44 to the US$.

IT stocks opened the day on a mixed note with Moser Baer India and Mphasis Ltd leading the losses. TCS share price fell over 2.3% after the IT major posted 10% quarter-on-quarter (QoQ) drop in June quarter net profit at Rs 59.50 billion, which was substantially below the Rs 62.03 billion profit estimate projected. This is the biggest drop in quarterly profit in two years.

On a year-on-year (YoY) basis, PAT slipped 5.8% for the quarter in rupee terms. The company said the impact of the wage hike on Q1 profitability was 150 basis points.

The double whammy of wage hike and a stronger rupee shaved off the IT giant's operating margins by 2.3% points to 23.4, missing the 26-28% target.

Revenue from the digital stream grew 26% to constitute 18.9% of the total pie and the company is currently doing US$ 3.5 billion per year on the front.

On the employee front, TCS' headcount came down by over 1,400 to 0.39 million over the past three months, but as per the company, there have not been any layoffs unlike at some of its peers such as Wipro, Tech Mahindra and others.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

However, as per an article in the Livemint, TCS is in a rut, with growth slowing almost every passing quarter. With market conditions being really unfavourable, the company desperately needs some imaginative leadership to get out of this rut.

Moving on to the news from the pharma sector. As per an article in The Economic Times, Cipla and Novartis are in early-stage discussions to jointly market asthma drug Xolair, just months after they ended a legal battle over another respiratory drug.

Xolair (omalizumab) is an injectable prescription medicine used to treat moderate to severe persistent asthma in patients whose symptoms are not controlled by inhaled corticosteroids.

One must note that Cipla lost its battle with Novartis in March, when the Delhi High Court stayed the company's request to sell copies of Novartis respiratory brand Onbrez (indacaterol).

Cipla had been battling Novartis since 2014 over selling its generic version of the drug to cater to what it said was an unmet need.

Novartis has been looking at licensing out its respiratory portfolio, which has lost the sheen globally in the past few years.

Meanwhile, Indian generic drug makers such as Lupin, Cipla, Zydus Cadila and Sun Pharmaceutical Industries are also eyeing the respiratory drug portfolio that the Swiss giant is seeking to divest.

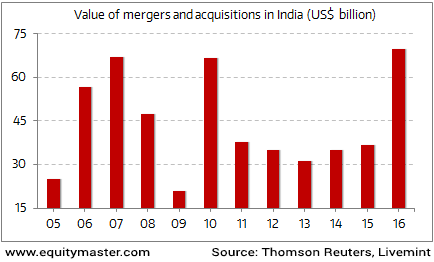

Merger and acquisition activity in India is on a high. The value of M&As that have taken place this year - at US$ 69.75 billion - is the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity at an All Time High in 2016

Especially, the M&A activity in the Indian pharma space has been on the rise in recent times. At the end of the day, whether the company is able to derive value from the acquisitions and augment the overall performance will be the key thing to watch out for.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis and Cipla stock analysis on our website.

Cipla share price opened the day up by 0.1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Down; TCS Results Disappoint". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!