- Home

- Todays Market

- Indian Stock Market News August 21, 2020

Sensex Ends 214 Points Higher; Banking and Power Stocks Witness Buying Fri, 21 Aug Closing

Indian share markets continued their momentum during closing hours today and ended their session on a positive note.

At the closing bell, the BSE Sensex stood higher by 214 points. Meanwhile, the NSE Nifty stood higher by 59 points.

NTPC and Asian Paints were among the top gainers today.

SGX Nifty was trading at 11,376, up by 77 points, at the time of writing.

The BSE Mid Cap index ended up by 0.6%. The BSE Small Cap index ended up by 1.4%.

Sectoral indices ended on a positive note with stocks in the banking sector and power sector witnessing buying interest.

Asian stock markets ended on a positive note. As of the most recent closing prices, the Hang Seng was up 1.3% and the Shanghai Composite stood higher by 0.5%. The Nikkei ended up by 0.2%.

The rupee is trading at 74.93 against the US$.

Gold prices are trading down by 0.5% at Rs 51,900 per 10 grams.

In the previous session, gold had slumped 1.8% or Rs 950 per 10 gram while silver had crashed 2% or Rs 1,400 per kg.

Gold prices have been volatile in India after hitting a new high of Rs 56,191 per 10 grams.

Speaking of gold, note that the media and experts have been taking potshots at Buffett of late for buying a gold mining stock. This seems to be an acknowledgement of his mistake in not buying gold a decade back.

But is this truly a case of 'error of omission' as Buffett would call it? Is Buffett's exposure to gold significant?

Should you too shun stocks and significantly increase your exposure to the yellow metal?

Co-head of research at Equitymaster, Tanushree Banerjee answers all these questions in her latest video.

Tune in to find out more:

Moving on to stock specific news...

Aarti Drugs was among the top buzzing stocks today.

Aarti Drugs share price witnessed huge buying interest and rose 10% today after the Board of Directors approved the issuance of fully paid-up bonus share.

The Board of Directors at its Meeting held on August 20, 2020, have approved the issuance of fully paid-up bonus shares in the ratio of 3:1 i.e. three bonus equity shares of Rs 10 each for one fully paid-up equity share of Rs 10 each.

Strides Pharma Science share price was also in focus today after the company in a regulatory filing said it has received the approval of US health regulator (USFDA) for Ursodiol Tablets used for treatment of patients with primary biliary cirrhosis (PBC).

PBC is a progressive disease of the liver caused by a buildup of bile within the liver that results in damage to the small bile ducts that drain bile from the liver. The product is a generic version of Urso 250 tablets, 250 mg, and Urso Forte Tablets, 500 mg, of Allergan Sales, LLC.

The product will be manufactured at the company's flagship facility at Bengaluru and will be marketed by Strides Pharma in the US market. The company has 126 cumulative ANDA filings with USFDA of which 88 ANDAs have been approved and 38 are pending approval.

On the results front, the company had reported over four-fold rise in its consolidated net profit at Rs 1,018.4 million for the quarter ended June 30, 2020. Total income of the company stood at Rs 7.9 billion in the quarter under consideration as compared to Rs 6.9 billion in the same period a year ago.

In news from the financial space, after pulling out massive funds in March quarter, foreign investors pumped in nearly US$ 4 billion in Indian equities in the three months ended June. The foreign fund inflows were seen on the back of attractive valuations, lifting of lockdown curbs and the government's efforts to kickstart economic activity.

Besides, foreign portfolio investors' (FPIs) assets in Indian equities too surged after a sharp fall in the previous quarter. The value of their investments in Indian stocks climbed significantly during the quarter ended June 2020.

As of the quarter ended June, the value of FPI investments in Indian equities stood at around US$ 344 billion, which was considerably higher than the US$ 281 billion registered in the preceding quarter and meant a spike of 23%.

In other similar news, June quarter of FY21 saw foreign institutional investors' (FIIs) holdings in Nifty500 companies at a near 5-year low.

As per a report by leading brokerage firm, even though the FII holdings increased marginally in Q1 by 8 bps quarter-on-quarter (QoQ), it declined 130 bps year-on-year (YoY) to 20.8%.

FIIs reduced ownership by 68% in Nifty 500 and 74% in Nifty50 companies QoQ.

Insurance, consumer, oil & gas were among the sector that saw FIIs increase stake in them while PSU banks, NBFCs, telecom, technology were among the sectors in which FIIs reduced stake.

How this trend pans out in the coming quarters remains to be seen. Meanwhile, we will keep you updated on all the developments from this space. Stay tuned.

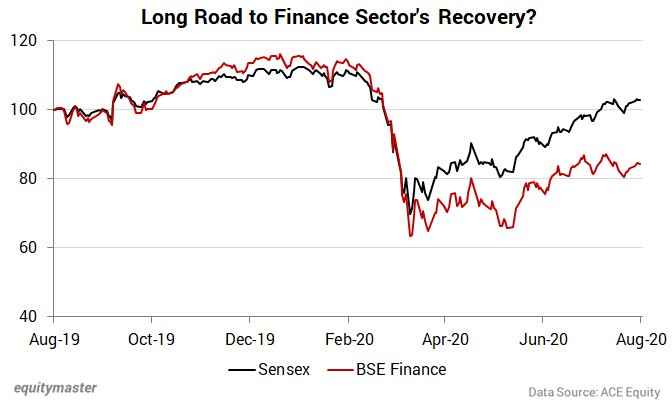

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex has made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in today's edition of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me.

However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums.

This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back.

I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Last week, Richa recommended one such stock - a high quality NBFC. Subscribers can read the report here.

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 214 Points Higher; Banking and Power Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!