- Home

- Todays Market

- Indian Stock Market News August 27, 2020

Sensex Ends Marginally Higher; Realty and Automobile Stocks Witness Buying Thu, 27 Aug Closing

Indian share markets ended their trading session marginally higher today.

Benchmark indices erased gains during the last hour of trading and turned flat, dragged down by energy stocks.

The BSE Sensex ended the day up by 40 points. Meanwhile, the NSE Nifty stood higher by 10 points.

The top gainers in NSE today were Tata Motors, IndusInd Bank, and M&M.

SGX Nifty was trading at 11,599, up by 51 points, at the time of writing.

The BSE Mid Cap index ended on a flat note. The BSE Small Cap index ended up by 0.4%.

Sectoral indices ended on a mixed note with stocks in the realty sector and auto sector witnessing buying interest.

Meanwhile, energy stocks witnessed selling pressure.

Asian stock markets ended on a mixed note. As of the most recent closing prices, the Hang Seng was down 0.8% and the Shanghai Composite stood lower by 0.4%. The Nikkei ended up by 0.6%.

Gold prices are trading down by 0.7% at Rs 51,419 per 10 grams.

The rupee is trading at 73.82 against the US$.

Speaking of the current stock market scenario, in his latest video, Rahul Shah discusses a unique strategy that could force you to re-think the way you invest.

Tune in to find out more:

Moving on to stock specific news...

Realty stocks such as Sunteck Realty, Oberoi Realty and Indiabulls Real Estate were among the top buzzing stocks today.

Maharashtra government's decision to cut stamp duty from 5% to 2%, and other levies for buying and selling of properties in urban and rural areas provided major fillip to realty stocks.

The state government has cut stamp duty rates from 5% now to 2% in urban areas of the state till December 31 and 3% till March 31, 2021. Urban local body tax has been retained at 1%.

On the other hand, stamp duty rates have been cut from 4% to 1% in rural areas till December 31 and 2% till March 31, 2021.

Among individual stocks, Sunteck Realty zoomed 19% to hit an intra-day high of Rs 307.7 per share on the NSE, while Oberoi Realty surged 8%.

Indiabulls Real Estate jumped over 5%, while Godrej Properties and Sobha gained in the range of 3-4%.

Housing finance companies, too, rallied in trade. HDFC gained 3%. LIC Housing Finance rose 2%, while PNB Housing Finance gained 5%.

Moving on to news from the finance sector, speaking at the 'Unlock BFSI 2.0' event, RBI Governor Shaktikanta Das stressed that the central bank has not exhausted its ammunition, whether on rate cuts or other policy actions.

Das stressed that post containment of coronavirus pandemic, a careful trajectory needs to be followed for unwinding and added that the financial sector should return to normalcy.

He said that that the debt resolution framework is expected to give durable relief to the borrowers who are facing Covid-related distress.

He said that the banking sector in India continues to be sound and stable and clarified that it should not be assumed that RBI will unwind the measures soon.

During his address, the RBI governor said that the consolidation of public sector banks is a step in right direction and added that the size of banks is essential, but efficiency is even more important.

On the financial stress being faced by banks, the central bank head said how banks react and respond to the challenge is important.

He added that a proactive raising of capital will be crucial to improve the resilience of banks and the financial sector.

Shaktikanta Das also said that once there is clarity on the Covid-19 curve and other aspects, the RBI will start giving its estimates on the country's inflation and economic growth.

It would be interesting to track if there are any reforms carried out in the above areas in the coming time and how they help the economy.

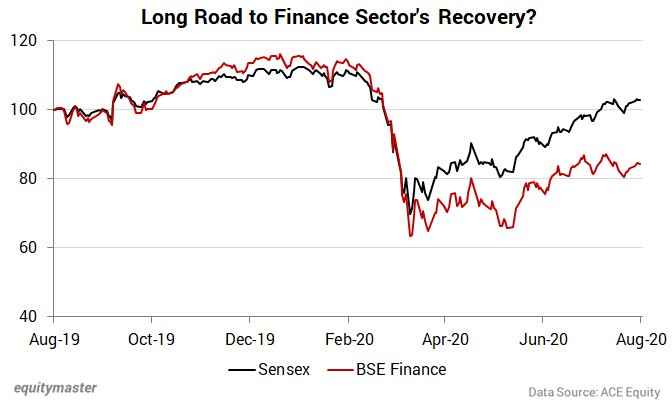

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex has made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in today's edition of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me.

However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums.

This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back.

I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here.

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Marginally Higher; Realty and Automobile Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!