- Home

- Todays Market

- Indian Stock Market News August 28, 2020

Indian Indices Extend Gains; Axis Bank & IndusInd Bank Surge Over 6% Fri, 28 Aug 12:30 pm

Share markets in India have extended early gains and are presently trading on a strong note.

Benchmark indices are trading higher for the sixth straight session today, supported by banking and finance stocks and amid persistent foreign fund inflows.

The BSE Sensex is trading up by 452 points, up 1.1%, at 39,500 levels.

Meanwhile, the NSE Nifty is trading up by 115 points. Top gainers in NSE today include Axis Bank and IndusInd Bank.

The BSE Mid Cap index is trading up by 0.9%.

The BSE Small Cap index is trading up by 0.5%.

On the sectoral front, gains are largely seen in the telecom sector and banking sector.

Gold prices are currently trading up by 0.2% at Rs 50,997.

The rupee is currently trading at 73.40 against the US$.

The domestic currency strengthened to its highest level in more than five months, helped by dollar inflows into the equity markets while gains in Asian peers also aided sentiment.

Speaking of the current stock market scenario, in his latest video, Rahul Shah discusses a unique strategy that could force you to re-think the way you invest in stocks.

Tune in to find out more:

Moving on to stock specific news...

Repco Home Finance and Edelweiss Financial are among the top buzzing stocks today.

Shares of Repco Home Finance are locked in the 5% upper circuit band at Rs 186.6 after reports suggested Aditya Birla Sun Life MF increased its stake in the company from 4.86% to 6.14%.

As per the June quarter shareholding pattern, ICICI Prudential SmallCap Fund held 2.36% stake, DSP SmallCap Fund held 4.44% stake, and HDFC SmallCap Fund held 5.97% stake.

On the other hand, in the FPI category, India Capital Fund owned 7.36% stake, Parvest Equity India owned 1.04% stake, Somerset Emerging Markets Equity held 3.28% stake, and Apax Global held 2.12% stake in the housing finance company.

So far this month, the stock has rallied 28%.

Meanwhile, shares of Edelweiss Financial rose as much as 3% intraday today before paring gains, after Hong-Kong based private equity group PAG picked up 51% stake in Edelweiss Wealth Management (EWM) for Rs 22 billion.

The Edelweiss Group runs corporate and retail credit, wealth management, asset management and life and general insurance businesses. EWM houses the capital markets and wealth management services businesses of the group.

The transaction is part of its planned demerger and subsequent listing of the business. The group also houses Edelweiss Asset Management, but it is not part of the divestment.

The deal values EWM, which manages assets worth Rs 1.27 trillion, at around Rs 43 billion and "unlocks value" for shareholders, the company said in an exchange filing yesterday.

Rashesh Shah, the founder chairman and chief executive of Edelweiss Group, said the proceeds from the partnership will go to the group holding company, which will deploy the funds into its various verticals.

Edelweiss Financial also announced its June quarter earnings for 2020-21 (Q1FY21) yesterday in which the company reported a loss of Rs 2.5 billion as compared to the profit of Rs 1.3 billion reported in Q1FY20.

Consolidated total income declined by 25.7% YoY to Rs 19.2 billion during the quarter.

Net interest income (NII) stood at Rs 533.3 million, a decline of 86.7% YoY.

The company reported operating loss of Rs 2.43 billion in Q1FY21 as against operating profit of Rs 2 billion in Q1FY20.

Edelweiss Financial share price is presently trading down by 0.7%.

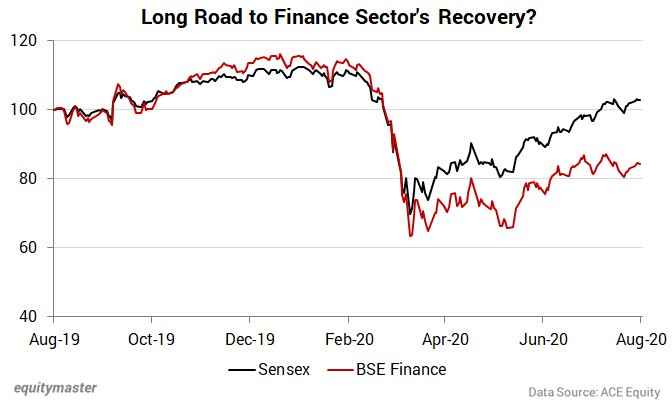

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex has made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in today's edition of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me.

However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums.

This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back.

I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here.

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Extend Gains; Axis Bank & IndusInd Bank Surge Over 6%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!