- Home

- Todays Market

- Indian Stock Market News September 22, 2020

Sensex Ends 300 Points Lower; Oil & Gas and Capital Goods Stocks Witness Selling Tue, 22 Sep Closing

Indian share markets witnessed selling pressure today and ended on a negative note.

At the closing bell, the BSE Sensex stood lower by 300 points. Meanwhile, the NSE Nifty ended down by 96 points.

Zee Entertainment Enterprises (ZEEL) was the top loser in NSE. Meanwhile, the top gainers in NSE today include HCL Technologies and TCS.

SGX Nifty was trading at 11,170, down by 73 points, at the time of writing.

Midcap and smallcap stocks witnessed huge selling pressure today. The BSE Mid Cap index ended down by 1.7%. The BSE Small Cap index ended down by 1.6%.

On the sectoral front, capital goods stocks and oil & gas stocks were among the hardest hit.

Asian stock markets ended on a mixed note. As of the most recent closing prices, the Hang Seng was down 0.98% and the Shanghai Composite stood lower by 1.29%. The Nikkei ended up by 0.18%.

The rupee is trading at 73.52 against the US$.

Gold prices are trading down by 0.3% at Rs 50,342 per 10 grams.

Investors are now looking forward to clues on Fed's monetary policy as a slew of policymakers are due to make public speeches, including Chairman Jerome Powell, who will appear before Congressional committees later this week.

Speaking of gold, in our latest episode of Investor Hour Podcast, Jim Rogers joins Rahul Goel to talk about gold and more...

In the podcast, he tells that he was buying gold and silver and would buy even more. He believes you can get rich with investments in gold and silver.

In this freewheeling chat, he also talks about China, his view on the US dollar, the opportunities in agriculture, the bubble in tech stocks, bonds, bitcoin...and more.

Listen in to the podcast here.

You can also watch the podcast video here:

Moving on to news from the banking sector...

State Bank of India (SBI) share price will be in focus today as the lender has launched an online portal for retail borrowers who are seeking further relief from their loan's Equated Monthly Instalment (EMI) repayments because of novel coronavirus pandemic.

Apart from launching the portal, the bank has also released a set of FAQs to answer the borrowers' queries regarding who is eligible for seeking restructuring of loans and how the process will work.

The rules, clarify that any further moratorium can be for a maximum of two years and that the last date for applying for this loan restructuring scheme is 24th December 2020. What is more, loans taken after 1st March 2020 will not be eligible for this revamp scheme even if the borrower's finances are impacted by the pandemic.

Additionally, SBI will compare your salary slip from February 2020 with August 2020 to know the eligibility of your loan restructuring resolution among other eligibility criteria.

Earlier this month, the Supreme Court had asked the Central government to file a detailed affidavit on a batch of petitions seeking an extension of the moratorium period on repayment of loans and to waive off the interest on the repayment of the loan amount in view of the Covid-19 pandemic.

Note that the RBI, in March, had announced a moratorium on repayment of term loans in order to provide relief to borrowers impacted by the COVID-19 related disruptions. Initially, the moratorium was allowed till May 31 but was later extended till August 31.

We will keep you updated on all the developments form this space. Stay tuned.

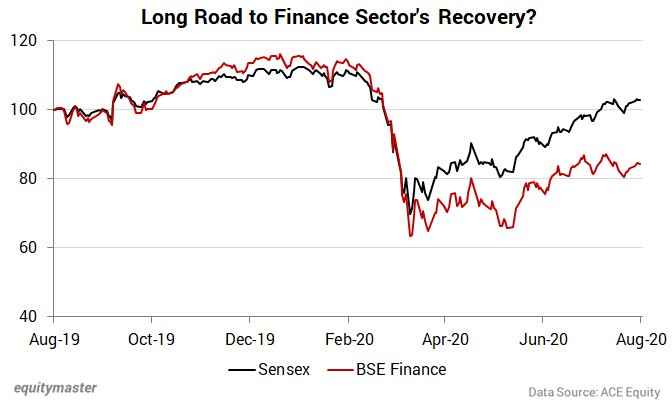

Speaking of the banking and finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

In news from the IPO space...

The initial public offering (IPO) of Angel Broking opened for subscription today.

The Rs 6 billion IPO, which includes a fresh issue of Rs 3 billion and an Offer For Sale (OFS) of Rs 3 billion from existing shareholders, enters the market when two IPOs from different sectors are already witnessing a positive response from the street.

The firm has managed to raise Rs 1.7 billion from 26 anchor investors, allocating 58,82,352 equity shares.

The price band of the IPO is Rs 305-306 per equity share of face value Rs 10 each. The OFS will include sale of equity shares worth Rs 1.2 billion from International Finance Corporation (IFC).

Angel Broking will receive Rs 3 billion from the issue of fresh shares, which the broking house said it would use for working capital management and general corporate purposes.

Meanwhile, the Rs 22.6-billion public offer of Computer Age Management Services (CAMS) was subscribed 1.35 on the second day of the issue today at the time of writing.

The IPO has received bids for 17.3 million equity shares against offer size of 12.8 million equity shares (excluding anchor book).

The portion set aside for retail investors has seen 2.3 times subscription, while the reserved portion for qualified institutional buyers is subscribed 28.55%, non-institutional investors at 63% and employee quota is subscribed 31%.

The company has fixed price band at Rs 1,229-1,230 per share for its maiden public issue which will remain opened till September 23.

The public issue consists an offer for sale of 1,82,46,600 equity shares by NSE Investments, the subsidiary of National Stock Exchange which has been asked by markets regulator to divest its entire stake in CAMS in the current IPO.

To know more about the company, you can read our note on the IPO here: CAMS IPO: Should You Apply? (requires subscription).

How the above IPOs sail through remains to be seen. Meanwhile, we will keep you updated on the latest developments from this space. Stay tuned.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 300 Points Lower; Oil & Gas and Capital Goods Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!