- Home

- Todays Market

- Indian Stock Market News October 7, 2020

Sensex Opens Marginally Lower; Banking and Finance Stocks Drag Wed, 7 Oct 09:30 am

Asian stock markets are trading mixed today, weighed by a weaker Wall Street finish after US President Donald Trump dashed hopes for a fourth stimulus package with a tweet.

The Hang Seng is trading up by 0.4% and the Nikkei is trading down by 0.2%.

US stocks fell sharply on Tuesday after President Donald Trump said he was calling off negotiations with Democratic lawmakers on coronavirus relief legislation until after the election.

Stocks were trading higher before the remarks, but reversed course after Trump made the comments on Twitter.

Back home, Indian share markets have opened the day on a negative note.

The BSE Sensex is trading down by 93 points.

The NSE Nifty is trading lower by 18 points.

TCS and Reliance Industries are among the top gainers today. IndusInd Bank, on the other hand, is among the top losers today.

The BSE Mid Cap index has opened down by 0.3%.

The BSE Small Cap index is trading up by 0.1%.

Sectoral indices are trading mixed with stocks in the banking sector and finance sector witnessing selling pressure. Energy stocks, on the other hand, are trading in green.

The rupee is trading at 73.53 against the US$.

Gold prices are trading down by 0.9% at Rs 50,079 per 10 grams.

Speaking of stock markets, in our latest episode of Investor Hour Podcast, Mark Faber talks about global stock markets, gold, investing in Indian stocks and a lot more.

Dr Faber is bullish on India and owns Indian stocks via an ETF. He believes India is a top destination for global investors and that will not change.

In the podcast, he also talks about his personal investments and why he is investing his money the way he is right now.

Tune in to the video here:

Moving on to stock specific news...

Tata Consultancy Services (TCS) is among the top buzzing stocks today.

TCS will kickstart the September quarter earnings of the fiscal year 2020-21 (Q2FY21) for the IT companies as the firm is slated to announce its numbers later today.

The IT major is also scheduled to consider share buyback.

Earlier this week on Monday, TCS' market capitalisation surged past the Rs 10 trillion mark for the first time and it became the second Indian firm after Reliance Industries to achieve this milestone. The stock of the company hit a fresh record high of Rs 2,727 on the BSE in the intra-day trade.

Note that IT stocks have staged a recovery lately on expectations that the second quarter could show improvement.

Media reports state that both IT majors TCS and Infosys are likely to report decent 2.5% to 3% sequential growth in Q2 in constant currency terms, on the back of revenue accretion from recent large deals.

TCS share price has opened the day up by 1.2%.

Moving on to news from the finance sector, Bajaj Finance on Tuesday said its consolidated deposit book rose by 22.5% to Rs 216 billion as of September 2020, while customer franchise grew by 14 %.

Customer franchise as on September 30, 2020, stood at 44.1 million as compared to 38.7 million a year ago.

In a regulatory filing, the company said that it acquired 1.2 million new customers during the July-September quarter.

Deposit book stood at approximately Rs 216 billion as compared to Rs 176.3 billion a year ago.

However, new loan booked during Q2FY21 fell to 3.6 million as compared to 6.5 million in the year-ago period.

Assets under management in the quarter under review rose to Rs 1,373 billion from Rs 1,355.3 billion.

The company said it will continue to accelerate its provisioning for Covid-19 for the second quarter as well to further strengthen the balance sheet.

Bajaj Finance share price has opened the day down by 2.8%.

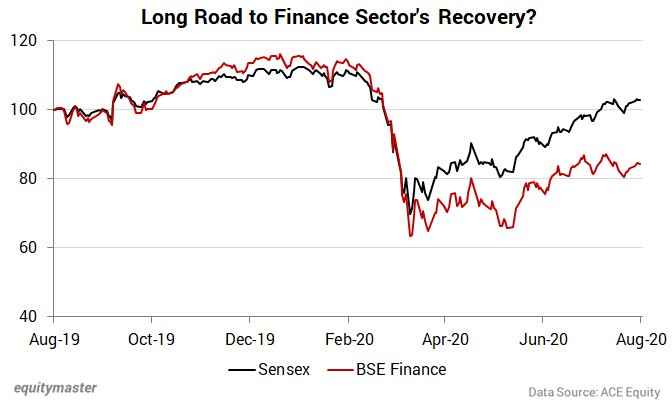

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Lower; Banking and Finance Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!