- Home

- Todays Market

- Indian Stock Market News October 7, 2020

Sensex Trades 342 Points Higher; Titan Company Share Rallies 4.6% Wed, 7 Oct 12:30 pm

Share markets in India are presently trading on a strong note.

The BSE Sensex is trading up by 342 points, up 0.9%, at 39,917 levels.

Meanwhile, the NSE Nifty is trading up by 84 points.

Titan and Reliance are among the top gainers today. Bajaj Finance and Tata Motors are among the top losers today.

The BSE Mid Cap index is trading down by 0.4%.

The BSE Small Cap index is trading down by 0.2%.

On the sectoral front, stocks in the metal sector and realty sector are witnessing selling pressure.

Energy and Consumer Durable stocks, on the other hand, are trading in green.

US stock futures are trading higher today, indicating a positive opening for Wall Street indices.

Nasdaq Futures are trading down by 50 points (up 0.4%), while Dow Futures are trading up 136 points (up 4.9%).

Gold prices are trading down by 0.7% at Rs 50,160 per 10 grams.

The rupee is trading at 73.34 against the US$.

Speaking of the dollar, India's #1 trader Vijay Bhambwani talks about the Dollar Milkshake Theory in his latest video for Fast Profits Daily.

In the video Vijay talks about his view on the theory which pertains to how the US government is attempting to weaponize the dollar in its currency war. This effort has very serious implications for global financial markets and by extension, for your portfolio.

So, what is the dollar milkshake theory all about, and how will it play out in the markets?

Tune in here:

In news from the global front, the Trump administration announced new restrictions on H-1B non-immigrant visa programme on Tuesday which it said is aimed at protecting American workers.

The H1B visa is a non-immigrant visa that allows US companies to employ foreign workers in specialty occupations that require theoretical or technical expertise.

The US can issue up to 85,000 H-1B visas per year for such jobs.

Note that people from India and China make up the majority of the estimated 500,000 H-1B visa holders in the US.

Under the new rules, about one third of applicants would be denied the visa that limits the number of specialty occupations open to H-1B holders and requirements that employers pay higher wages under the program.

This is likely to have an adverse impact on thousands of Indian IT professionals as a large number of Indians on the H-1B visas have lost their jobs and are headed back home during the coronavirus pandemic.

In June, the Trump administration suspended the H-1B visas along with other types of foreign work visas until the end of 2020 to protect American workers.

How this pans out remains to be seen. Meanwhile, stay tuned to get all the updates from this space.

Among the buzzing stocks today is Sunteck Realty Ltd.

In a regulatory filing, the company said that it has continued its strong sales momentum following the resumption of operations post the lockdown in Mumbai.

The company has reported a 96 per cent increase in its sales bookings at Rs 2 billion for the quarter ended September due to better demand for its properties despite the COVID-19 pandemic. Its sales bookings stood at Rs 1.02 billion for the same period last year.

Sales bookings of its properties increased 5 per cent during the first half of this fiscal at Rs 3.01 billion, from Rs 2.87 billion in the corresponding period of the previous year.

The Mumbai-based realty company focuses on a city-centric development portfolio of about 35 million square feet spread across 26 projects.

Sunteck Realty share price is currently trading up by 2.7%

In news from the financial sector, Dinesh Khara has been appointed as the new Chairman of State Bank of India, the country's largest bank, for the next three years. He will replace incumbent Rajnish Kumar, whose term comes to an end on October 7.

Prior to being appointed as Chairman of the bank, Dinesh Khara was the Managing Director (Global Banking & Subsidiaries) of the bank and has successfully accomplished the merger of five Associate Banks and Bharatiya Mahila Bank with State Bank of India.

Khara is known as a general banking specialist within SBI circles. Apart from this, during his stint in overseas expansion wing, Khara was posted at the bank's Chicago office and was associated with the overseas acquisition of Indian Ocean International Bank Mauritius.

Khara's appointment to the top post comes at a time when the banking industry is facing an unprecedented challenge due to the COVID-19 pandemic.

It will be interesting to see what developments the above change in leadership brings for SBI. We will keep you updated on all the news from this space.

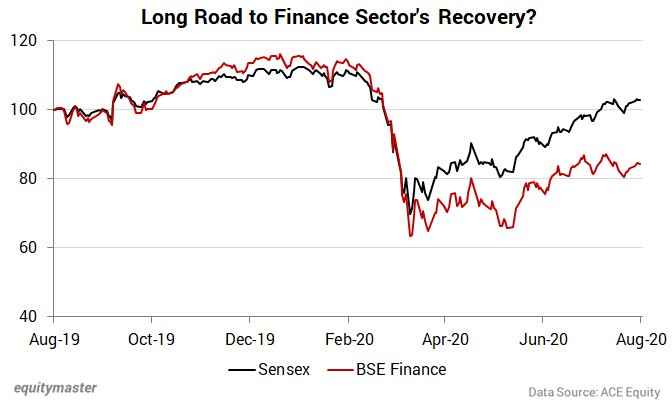

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- "Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains."

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades 342 Points Higher; Titan Company Share Rallies 4.6%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!