- Home

- Todays Market

- Indian Stock Market News October 25, 2017

Sensex Closes to Record Highs; SBI Rallies 28% Wed, 25 Oct Closing

Indian share markets rose to record highs as public-sector banks soared after the cabinet unveiled a Rs 2.11 trillion recapitalization plan, while construction stocks rallied after the government approved an Rs 6.92 trillion investment plan. State Bank of India was the top percentage gainer in the NSE Nifty, surging as much as 27% to its highest since January 2015.

At the closing bell, the BSE Sensex closed higher by 435 points and the NSE Nifty finished up by 88 points. The S&P BSE Mid Cap finished up by 0.4% while S&P BSE Small Cap finished down by 0.2%. Gains were largely seen in PSU stocks, bank stocks and capital goods' stocks.

Asian stock markets finished mixed as of the most recent closing prices. The Hang Seng gained 0.53% and the Shanghai Composite rose 0.26%. The Nikkei 225 lost 0.45%. European markets are mixed today. The CAC 40 is up 0.29% while the DAX gains 0.04%. The FTSE 100 is off 0.21%.

Rupee was trading at Rs 65.14 against the US$ in the afternoon session. Oil prices were trading at US$ 52.33 at the time of writing.

In the news from IPO space, the initial public offering (IPO) of Reliance Nippon Life Asset Management got fully subscribed today.

Reliance Nippon Life Asset Management Ltd an asset management company having market share of over 11.4% in mutual funds offerings in India. The company is ranked the 2nd most profitable asset management company in India. The company is promoted by Reliance Capital Limited, which is an RBI registered non-banking finance company and is a part of Reliance Group led by Mr. Anil D. Ambani.

The company manages 55 open-ended mutual fund schemes including 16 ETFs and 174 closed ended schemes and has a network of 171 branches and over 58,000 distributors including banks, financial institutions, national distributors and independent financial advisors as of 30 June 2017.

Just Released: Multibagger Stocks Guide

(2018 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Is the company leaving enough money on the table for investors? We recently released our IPO note for the above IPO. You can access the same in our IPO section.

Moving on to news from private bank stocks. Kotak Mahindra Bank Ltd reported a 20% rise in its September quarter net profit, beating analyst estimates, due to higher net interest income and other income.

On a consolidated basis, the bank reported a profit of Rs 14.4 billion, up 20% from Rs 12.02 billion a year ago. Net interest income (NII) or the core income a bank earns by giving loans increased 16% to Rs 23.12 billion versus Rs 19.95 billion last year.

Asset quality of the bank improved. As a percentage of total loans, gross non-performing assets (NPAs) fell to 2.47% as compared to 2.58% in the previous quarter and 2.49% in the year-ago quarter. Net NPAs were at 1.26% in the September quarter compared to 1.25% in the previous quarter and 1.2% in the same quarter last year.

Kotak Mahindra Bank share price plunged 5.4% in today's trade.

Engineering stocks finished the trading day on a strong note with L&T share price and Engineers India share price leading the gains driven by the government's recent push to infrastructure sector.

The government on Tuesday approved mega infrastructure projects worth Rs 6.92 trillion as part of a broad plan to create thousands of new jobs, raise income, boost investment and quicken growth in the broader economy.

Finance minister Arun Jaitley said that the government will launch an umbrella road building programme to de-bottleneck the sector. The program will cover 83,677 km of roads and will involve a capital expenditure of Rs 6.92 trillion over the next 5 years.

Of this, 34,800 km of roads will be created under the Bharatmala Pariyojana (BMP) with an outlay of Rs 5.35 trillion will generate 142 million man-days of jobs, a finance ministry statement said.

In the news from telecom sector, Reliance Communications share price ended the day on a lower note. This comes as the telecom operator is looking to shut down major parts of its wireless business in the next 30 days. As per an article in the Economic Times, the operator has cited the competition brought in by new entrant Reliance Jio's free voice and cheap data services as one of the factors behind this development.

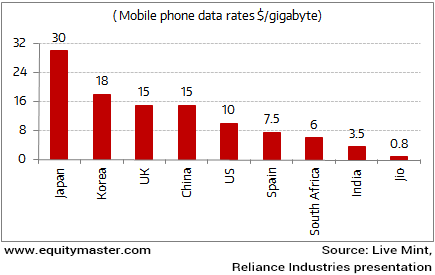

Note that Reliance Jio has left no tables unturned to make its 4G venture a success.

The company wants to hit the ground running as reflected in the mouth-watering offer used as a bait to attract the maximum subscribers. The offer not only includes low cost Lyf phones, but lifetime free voice calls as well as ultra-cheap data plans and tariffs.

Jio's Data Pricing to Disrupt the Telecom Apple Cart

While this huge price disruption will no doubt benefit the mobile phone users, we are not quite sure whether the pricing math will be sustainable for telecom companies in the long run.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Closes to Record Highs; SBI Rallies 28%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!