- Home

- Todays Market

- Indian Stock Market News November 5, 2020

6 Reasons Why Sensex Rallied 724 Points Today Thu, 5 Nov Closing

After staging a gap-up opening, Indian share markets continued their momentum throughout the day today and ended on a strong note.

At the closing bell, the BSE Sensex stood higher by 724 points (up 1.8%). With today's gain, the BSE Sensex wiped off all the losses of this calendar and its year-to-date return turned positive.

The NSE Nifty closed higher by 212 points (up 1.8%).

SBI and Tata Steel were among the top gainers today.

The SGX Nifty was trading at 12,154, up by 232 points, at the time of writing.

Both, the BSE Mid Cap index and the BSE Small Cap index ended up by 1.7%.

On the sectoral front, gains were largely seen in the metal sector, oil & gas sector and banking sector.

Asian stock markets ended on a strong note today. As of the most recent closing prices, the Hang Seng ended up by 3.3% and the Shanghai Composite gained 1.3%. The Nikkei rose 1.7%.

US stock futures are trading deep in the green indicating a strong opening for Wall Street indices. Nasdaq Futures are trading up by 290 points (up 2.5%), while Dow Futures are trading up by 320 points (up 1.2%).

The rupee is trading at 74.36 against the US$.

Gold prices are trading up by 1.2% at Rs 51,425 per 10 grams.

Here are Top 6 Factors Why Indian Stock Markets Rallied Today

Improving Service Sector Activity: Activity in India's dominant services industry expanded for the first time in eight months in October as demand surged. The Nikkei/IHS Markit Services PMI climbed to 54.1 in October from September's 49.8.

Firm Global Cues: Indian share markets edged higher tracking gains in global peers. Japan's Nikkei rose 1.7% to a nine-month high. US stock markets surged overnight with technology and healthcare stocks leading the charge.

US Fed Meet: The Federal Open Market Committee's (FOMC) is scheduled to come out with its policy decisions, most likely reaffirming their commitment to support the pandemic-struck economy and keep interest rates unchanged.

Foreign Inflows: Foreign portfolio investors (FPIs) have been net buyers so far since October. After pumping in Rs 218.3 billion in October, FPIs have invested Rs 31.9 billion in November so far, NSDL data showed.

Banking and IT Stocks Rally: IT and banking heavyweights including Infosys, TCS, SBI, HDFC Bank and HCL Tech were among the top contributors.

IT stocks rose today as the dollar strengthened against its global peers. Meanwhile, banking stocks witnessed buying interest after strong Q2 results by SBI.

In-line Q2 Results: So far, September quarter earnings have been along expected lines and have even beaten market expectations in some cases.

We will keep you updated on how these factors develop in the coming days and what effect they have on Indian stock markets. Stay tuned!

Speaking of the stock markets, India's #1 trader Vijay Bhambwani talks about what will happen if Joe Biden wins the US Presidential election, in his latest video for Fast Profits Daily.

In the video below, Vijay dissects Joe Biden's policies and how India will be affected by them.

So, how will the markets react? Will President Biden's policies have a negative impact on your portfolio?

Tune in here to find out more:

In news from the banking sector, the RBI today urged the Supreme Court to lift its interim order, which held that accounts not declared as non-performing assets (NPAs) till August 31 this year are not to be declared NPAs till further orders, saying it is facing difficulty due to the directive.

The apex court had passed the interim order on September 3 in a relief to stressed borrowers who are facing hardships due to the impact of Covid-19 pandemic.

The RBI and the Finance Ministry have already filed separate additional affidavits in the top court saying that the banks, financial and non-banking financial institutions will credit into the accounts of eligible borrowers by November 5 the difference between compound and simple interest collected on loans of up to Rs 20 million during the moratorium scheme period.

The bench said that it would take up the matter for hearing on November 18.

The Supreme Court also deferred to November 18 the hearing on a batch of pleas relating to charging of interest on interest by banks on EMIs which were not paid by the borrowers who availed of the RBI loan moratorium scheme in view of the Covid-19 pandemic.

We will keep you updated on the latest developments from this space. Stay tuned.

Moving on to stock specific news...

PVR and Inox Leisure were among the top buzzing stocks today.

Shares of multiplex operators PVR and Inox Leisure gained up to 10% after the Maharashtra government permitted cinema halls to operate from today.

The state government on Wednesday permitted theatres including single-screen, multiplex and drama halls to re-open from Thursday, adding that they could function outside containment zones only.

Reports state that this will benefit multiplex companies as box office revenue from Maharashtra state constitutes around 30% of total revenue for Hindi films.

PVR share price rallied 10% to Rs 1,226, while Inox Leisure share price gained 6% to Rs 279 on the BSE.

Apart from the above, market participants were also tracking Lupin share price.

Shares of Lupin dipped 2% in an otherwise strong market after the drug maker reported 50% year-on-year (YoY) decline in profit after tax at Rs 2.1 billion in the September quarter (Q2FY21), due to lower operational performance, lower other income and higher tax rate.

Lupin's revenues declined 12% YoY to Rs 38.4 billion mainly due to Kyowa divestment.

US revenues grew 5.6% YoY to Rs 14 billion whereas domestic formulations remained subdued de-growing 0.7% YoY to Rs 13.3 billion.

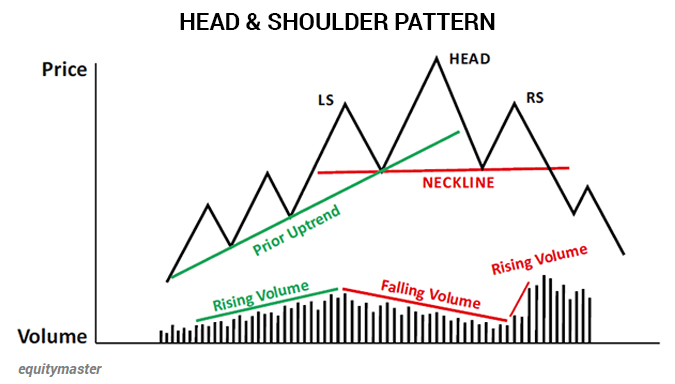

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again, fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while.

According to Apurva Sheth, senior Research Analyst at Equitymaster, spotting this pattern correctly can help you save money.

If you're interested in trading and want to know how you can use this pattern, you can read about it in one of the editions of Profit Hunter here: It's When You Sell that Counts.

To know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "6 Reasons Why Sensex Rallied 724 Points Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!