- Home

- Todays Market

- Indian Stock Market News December 15, 2020

Sensex Opens Lower Tracking Weak Global Cues; Burger King India Jumps 15% Tue, 15 Dec 09:30 am

Asian share markets came under pressure following a mixed Wall Street session, as concerns about increasing Covid-19 deaths, infections and lockdowns overshadowed optimism about the start of coronavirus vaccinations.

The Nikkei is trading down by 0.3% and the Hang Seng is trading down by 0.6%.

In US markets, Wall Street indices closed mixed overnight as the first US vaccination was given to an intensive care nurse on Monday, the same day the country passed the grim milestone of 300,000 lives lost.

The Nasdaq gained 0.5% and the Dow Jones Industrial Average hit a record high but fell 0.6% for the day.

Back home, Indian share markets have opened on a negative note, tracking weak global cues.

The BSE Sensex is trading down by 153 points. Meanwhile, the NSE Nifty is trading lower by 37 points.

HDFC Bank is among the top gainers today. Axis Bank, on the other hand, is among the top losers today.

The BSE Mid Cap index has opened down by 0.2%. The BSE Small Cap index is trading on a flat note.

Sectoral indices are trading on a mixed note with stocks in the energy sector and metal sector witnessing most of the selling pressure. Healthcare stocks are trading in green.

The rupee is trading at 73.62 against the US$.

Gold prices are trading up by 0.2% at Rs 49,054 per 10 grams.

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

Speaking of the precious yellow metal, in his latest video, India's #1 trader, Vijay Bhambwani shares his view on gold and silver for the coming year.

In the video, Vijay explains the reasons behind staying positive on these assets.

Tune in here to find out more:

In news from the finance sector, as per an article in The Economic Times, some of the top non-banking finance companies and housing finance companies have seen a jump in the way they provision for some of the future uncertainties due to Covid pandemic.

42 NBFCs (including HFCs) noted a Covid-19 impact comprising 19% of the expected credit loss (ECL) allowance for the year ended 31 March 2020, the report said.

The report noted an increase in ECL allowance by 33% and an overall increase in provision coverage rate by 26% as at 31 March 2020 compared to the year ended 31 March 2019.

In other news, days after the committee of creditors (CoC) sought a fresh round of bidding for crisis-ridden NBFC Dewan Housing Finance Corporation (DHFL) by all the four bidders, Oaktree Capital emerged as the highest bidder.

Multiple people involved in the discussions said that Oaktree's Rs 366.5 billion offer has the quickest repayment timelines and a higher overall recovery, but the equity infusion is only about Rs 15 billion.

Piramal Group has offered to make the highest cash payment upfront of Rs 127 billion to DHFL creditors and a higher equity contribution of Rs 25 billion.

The group has also reiterated its offer to merge its flagship finance firm Piramal Capital and Housing Finance with DHFL, thereby swelling the combined entity's net worth to more than Rs 180 billion and cushioning its ability to issue debt.

Piramal's bid comprises deferred payment of Rs 195.5 billion payable but it is payable over a longer tenure of 10 years in the form of bonds.

The NYSE-listed asset management firm Oaktree, in comparison, has offered a higher deferred payment of Rs 210 billion worth of bonds over 7 years and an upfront payout of Rs 116.5 billion.

Adani, which had emerged as the highest bidder after a late, unsolicited bid after round-3, has offered Rs 107.5 billion upfront and Rs 191.1 billion as deferred payment over a seven-year horizon.

SC Lowy, the fourth contender, also submitted a bid but only for the wholesale book.

The lenders are likely to meet in the next few days to vote for the highest bid.

Note that in November last year, the Reserve Bank of India (RBI) referred DHFL, the third-largest pure-play mortgage lender, to the National Company Law Tribunal (NCLT) for insolvency proceedings.

DHFL was the first finance company to be referred to the NCLT by the RBI using special powers under section 227.

How the above developments pan out remains to be seen. Meanwhile, we will keep you updated on the latest developments from this space.

Moving on to news from the automobile sector, Ashok Leyland is among the top buzzing stocks today.

Hinduja Group company Ashok Leyland is looking to raise US$ 200-300 million in its electric vehicle subsidiary by selling a minority stake to leverage rising investor interest in clean technology transport solutions.

Reports state that feelers have gone out to Middle East sovereign wealth funds such as Mubadala Investment company, Qatar Investment Authority and Saudi Arabia's Public Investment fund.

Technology major Alphabet Inc along with investors like SoftBank Group have also been approached.

Reports also state that Abu Dhabi Investment Authority and Microsoft have also been approached.

The unit, Optare Group, was renamed Switch Mobility last month as part of a plan by Ashok Leyland to bring its entire EV portfolio of buses, light commercial vehicles and battery infrastructure under the UK company.

Ashok Leyland currently holds 91.6% of Switch while the Hinduja Family's investment holding company owns the rest.

Ashok Leyland share price has opened the day up by 1.3%.

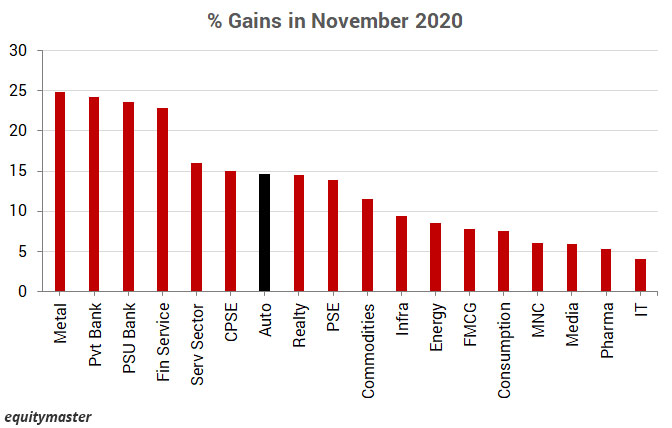

Speaking of the automobile sector, note that the sector has rebounded sharply from its March lows.

The Nifty Auto index gained as much as 15% last month.

The auto index entered the greed phase in September 2019 and will stay there until December 2021. This means there is still a lot of fuel left for auto stocks.

How automobile stocks perform in the coming months remains to be seen.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Lower Tracking Weak Global Cues; Burger King India Jumps 15%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!