- Home

- Todays Market

- Indian Stock Market News December 26, 2016

Indian Share Markets Open Weak; Pharma & Metal Stocks Drag Mon, 26 Dec 09:30 am

Asian stock markets are mixed in quiet holiday trading, with several of the markets remaining closed for the Christmas holiday. The Japanese market is modestly lower and down 0.1% despite the positive cues from Wall Street on Friday. Stock markets in the US and Europe closed their previous session on a positive note.

Meanwhile, Indian share markets have opened the day marginally lower. The BSE Sensex is trading lower by 167 points while the NSE Nifty is trading lower by 43 points. The BSE Mid Cap index and BSE Small Cap index have opened the day down by 1% & 0.6% respectively. The rupee is trading at 67.91 to the US$.

All sectoral indices have opened the day on a negative note with metal, healthcare and realty stocks witnessing maximum selling pressure.

Pharma stocks opened the day on a mixed note with Divis Laboratories and IPCA Labs leading the losses. As per an article in a leading financial daily, the national drug pricing regulator National Pharmaceutical Pricing Authority (NPPA) has capped prices of over 50 essential drugs.

It has led to a price cut in the range of 5 to 44% with the average being about 25%. These 50 drugs include those used for treatment of HIV infection, diabetes, anxiety disorders, bacterial infections, angina and acid reflux. Besides, NPPA has also fixed the retail prices of 29 formulations.

In order to make essential drugs more affordable for the public, NPPA has revised ceiling prices of 55 scheduled formulations of Schedule-I under Drugs (Price Control) Amendment Order, 2016.

Reportedly, the calculation for essential drugs is based on the simple average of all medicines in a particular therapeutic segment with sales of more than 1%. NPPA is an organization of the Government of India which was established to fix/revise the prices of controlled bulk drugs and formulations and to enforce prices and availability of the medicines in the country, under the Drugs (Prices Control) Order, 1995.

According to an article in The Economic Times, Mahindra & Mahindra (M&M) is planning to increase prices of its vehicles by up to Rs 26,500 from January 2017.

Reportedly, M&M will increase prices of passenger and commercial vehicles in the range of 0.5% to 1.1% from next month. Prices of passenger vehicles would go up in the range of Rs 3000 to Rs 26500 depending upon the model.

This move comes on the back of rising input costs due to the escalation of prices of various materials including precious metals. Besides these, the cost of fuel has also gone up leading to an increase in freight costs. Also, there has been an impact of changing regulatory requirements.

One must note that other auto companies such as Hyundai Motor India, Nissan, Renault, Toyota, Tata Motors, Mercedes Benz and Isuzu have already announced a hike in prices from January to offset higher input costs and the adverse impact of foreign exchange fluctuations.

Speaking of demonetisation, impact on the auto sector, Kunal Thanvi, our auto sector analyst is of the opinion that even if sales take a big blow this year, the auto growth story won't break down. Here's what he has to say:

"Typically, in the month after the festive season, automakers suspend production for a few days to carry out factory maintenance. But this time around, the shutdowns will be longer, a few weeks perhaps. So is all this enough to abandon auto stocks? No.

Individuals and businesses will buy cars, two-wheelers, and trucks irrespective of demonetisation. A one-year hit to profitability won't change the long-term earnings power of fundamentally strong auto firms."

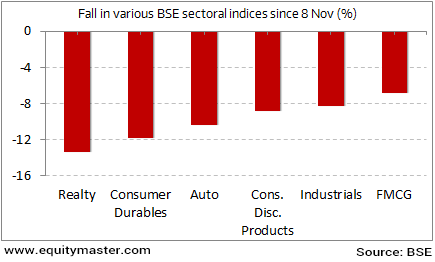

One Month On, The Biggest Losers of Demonetisation

The chart above shows the sectors that were hardest hit by the demonetisation announcement. The worst affected were realty, consumer durables and auto sector.

M&M's share price opened the day down by 0.6%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Share Markets Open Weak; Pharma & Metal Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!