- Home

- Outlook Arena

- A Small Guide on Cigar Butt Investing

A Small Guide on Cigar Butt Investing

Imagine you find a bag full of cash in a house that you moved into recently.

You count the money in the bag, you do the math, and you almost faint with joy.

Turns out, the bag has Rs 30 m in hard cash in a house that you bought for Rs 20 m.

You are thanking your lucky stars because only recently you had borrowed Rs 15 m from bank and put down your own Rs 5 m to buy the house.

Now, even if you pay off the Rs 15 m loan that you took to buy the house, you still have a whopping Rs 15 m left that belong entirely to you.

That’s like making 3x on your investment of Rs 5 m that you have invested out of your own pocket.

Besides, you are getting the house worth Rs 20 m absolutely free of cost. Now, that’s what we call a once-in-a-lifetime deal.

Of course, this is a made up story that’s as far from real life as it can be.

However, you’d be surprised to know that businesses with these kinds of odds are often found in the stock market.

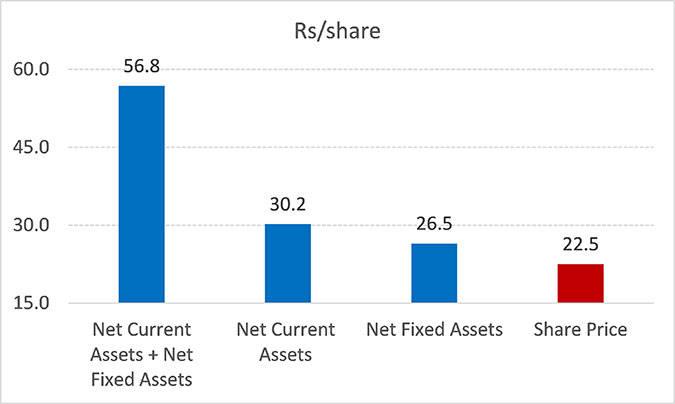

Take Titagarh Wagons for example.

Titagarh Wagons: The Net-Net that Turned into a 3-Bagger

Back in December 2013, the stock was trading at a market cap of Rs 2.3 bn (Rs 22.5 per share) whereas its current assets less all liabilities and loans was itself a little over Rs 3 bn (Rs 30 per share).

This means its entire fixed assets base of Rs 2.7 bn (Rs 26 per share) was being given zero valuation by Mr Market.

Think of it as the house and the bag of cash example I gave above.

You bought a house by borrowing some money from a bank and investing Rs 2.3 bn of your own money (current market cap of the company).

You find a big bag of cash (current assets of the company) with which you pay off all your loans but still have Rs 3 bn left after it.

Thus, you are not only earning Rs 3 bn on your Rs 2.3 bn investment but you also got the house that’s worth Rs 2.7 bn (fixed assets of the company) absolutely free of cost.

Well, in investing parlance, such investments are called cigar-butt investments and the type of investing as cigar-butt investing.

It was Warren Buffett who gave the strategy its name. He had in turn learned it from his mentor Ben Graham, the pioneer of this strategy.

Buffett likened the strategy to cigar butts that you find strewn on the street and where they have those one or two puffs left in them.

Therefore, if one invests in such businesses, you take those last couple of puffs i.e. make those quick 50%-60% returns and then sell the stock. These are not your buy and hold forever kind of stocks.

Titagarh Wagon was a classic cigar-butt stock and investors investing in the stock in December 2013 would have been rewarded with an almost 3x gain over the next 12 months. In other words, 180% returns in one year.

I believe that people are justified in being scared of such businesses. Most of the times, such they are dud businesses.

However, there are times when some decent quality businesses like Titagarh Wagons are also beaten down to such low valuations.

Who are able to identify and get into them at these impossibly attractive valuations, end up making a killing.

Back in 2013, I came across 35 such stocks. These were so beaten down, their market cap had gone below the current assets less all liabilities and you were getting the fixed and other assets absolutely free of cost.

Cumulatively, these stocks went up 105% over the next one year, more than 3x better than the returns given by the benchmark index.

Of course, there were stocks in the group that were down as much as 80% and also stocks that went up almost 9x in one year.

Which is why you should always invest in such stocks taking a group-based approach i.e. invest in at least 8-10 such stocks at a time.

This way, even if 3-4 of them end up disappointing, the winners will more than compensate for the losers.

Cigar butt investments are a rarity these days. Thanks to the advances in computing and the awareness levels amongst investors, these investments only surface in large numbers whenever there is a big crash in the stock market.

As I mentioned earlier, 2013 was one such period. Also, 2020 right after the Coronavirus crash.

Therefore, if you have the patience and the temperament to capitalise on these opportunities when they arise, cigar-butt investing can prove to be quite remunerative, especially if you are operating with small sums.

![]() Is this Tata Stock a Ticking Time Bomb?

Is this Tata Stock a Ticking Time Bomb?

Apr 25, 2024

A critical look at a big Tata group stock

![]() An Underdog Mid-Cap: The Next Big Winner?

An Underdog Mid-Cap: The Next Big Winner?

Apr 16, 2024

The mid cap turnaround story that may take you by surprise.

![]() Zomato: Long-Term Investment or Short-Term Gamble?

Zomato: Long-Term Investment or Short-Term Gamble?

Apr 1, 2024

Is Zomato a long-term winner?

![]() There's a Massive Bull Market Ahead. Here's Why...

There's a Massive Bull Market Ahead. Here's Why...

Mar 21, 2024

Global fund managers are turning bullish on India.

![]() Can Competition Kill Asian Paints?

Can Competition Kill Asian Paints?

Feb 28, 2024

Should the current rough patch be considered permanent damage for Asian Paints? Find out...

![]() Are Investors Being Irrational in Valuing Tata Motors Higher than Maruti?

Are Investors Being Irrational in Valuing Tata Motors Higher than Maruti?

Feb 16, 2024

Tata Motors overpowers Maruti Suzuki to become largest auto company by market cap. What next?

![]() Paytm: A Value Buy or a Value Trap?

Paytm: A Value Buy or a Value Trap?

Feb 6, 2024

Has the recent correction made the stock attractive from a long-term perspective or is there more pain to come?

![]() Tata Motors More Valuable than Maruti: Crowd Folly or the New Reality?

Tata Motors More Valuable than Maruti: Crowd Folly or the New Reality?

Feb 5, 2024

Tata Motors topples Maruti Suzuki to become largest auto company by market cap. What next?

![]() Polycab India: Value Buy or a Value Trap?

Polycab India: Value Buy or a Value Trap?

Jan 12, 2024

Does Polycab India deserve to fall further?

![]() Are Nestle Shares Finally Within Reach of Small Investors?

Are Nestle Shares Finally Within Reach of Small Investors?

Jan 8, 2024

Has the split in Nestle stock made it more attractive for retail investors?

![]() Can Asian Paints Repeat History of Multibagger Returns?

Can Asian Paints Repeat History of Multibagger Returns?

Apr 24, 2024

Whether the rough patch should be considered a permanent damage for Asian Paints.

![]() Exide Stock Price: Undervalued or Overvalued?

Exide Stock Price: Undervalued or Overvalued?

Apr 9, 2024

Is Exide still undervalued after the price surge?

![]() TCS & Infosys SHAKEN by Accenture Downgrade?

TCS & Infosys SHAKEN by Accenture Downgrade?

Mar 30, 2024

What TCS and Infosys investors must know after Accenture downgrade.

![]() Global Hedge Fund Manager Signals India Ratings Upgrade and Massive Bull Run

Global Hedge Fund Manager Signals India Ratings Upgrade and Massive Bull Run

Mar 12, 2024

Data from RBI Bulletins that can compel rating agencies to relook at their view on India.

![]() My Back of the Envelope Valuation for BPCL & HPCL

My Back of the Envelope Valuation for BPCL & HPCL

Feb 19, 2024

Is it right to value big stocks like BPCL and HPCL based on just broad numbers?

![]() Has Tata Motors Topped & Maruti Bottomed?

Has Tata Motors Topped & Maruti Bottomed?

Feb 9, 2024

Is Tata Motors' market cap leadership a sign that the stock has topped?

![]() 5 Stocks to Benefit from the Upcoming 2024 General Elections

5 Stocks to Benefit from the Upcoming 2024 General Elections

Feb 6, 2024

These stocks could benefit the most from the third possible term for Modi. Do you own?

![]() ITI Ltd: What Next After 300% Gains?

ITI Ltd: What Next After 300% Gains?

Jan 17, 2024

What explains the 4-bagger gains in ITI Ltd?

![]() The Polycab Saga: What Should Sensible Investors Do Now?

The Polycab Saga: What Should Sensible Investors Do Now?

Jan 12, 2024

Has Polycab become attractive after 30% fall from the top?

![]() Valuation Shocker: Titagarh Rail as Expensive as HUL

Valuation Shocker: Titagarh Rail as Expensive as HUL

Jan 1, 2024

Does Titagarh Rail Systems deserve to be valued as highly as HUL?