- Home

- Outlook Arena

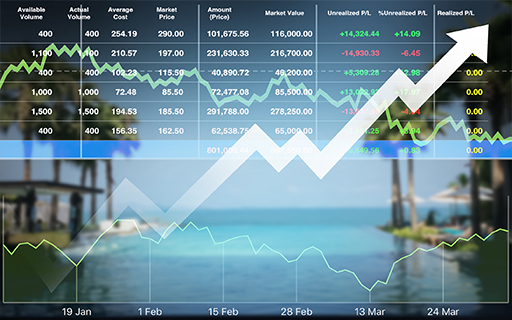

- What is the Difference Between Investing and Trading?

What is the Difference Between Investing and Trading?

Meet Jack and Jill. They are two friends who are interested in the stock market. Jack is a trader, while Jill is an investor. One day, they both decide to invest in a company called ABC Corp.

Jack decides to buy and sell the stock of ABC Corp frequently, based on short-term market movements, news events and technical analysis. He also uses margin trading, which allows him to borrow money to invest, in the hopes of magnifying his returns.

On the other hand, Jill takes a different approach. She does her research on ABC Corp and its long-term prospects, financial statements, and industry trends. She decides to hold the stock for a long time, potentially for years, as she believes in the company's growth potential.

Over time, they both observe different outcomes from their strategies. Jack's trading strategy can generate quick profits in a short amount of time if he is successful, but it can also lead to significant losses if he makes poor decisions, or the market turns against him.

Additionally, he incurs transaction costs such as brokerage fees, taxes, and interest payments on margin loans, which can eat into his profits.

On the other hand, Jill's investment strategy can generate returns over a longer period of time, as she benefits from the company's growth and profitability.

We think this is as easy an explainer we can give you of the difference between trading and investing. Let’s understand each in detail...

Investing

To put it simply, Investing is owning a piece of the business. When you're purchasing a stock as an investor, you're not buying a piece of paper. You are buying a stake in the business.

Imagine you are running your own business. What factors would you look at to see if your business is doing well?

- Is the business giving me enough return based on the money that I have invested in the business?

- Is the business growing steadily every year?

- Am I able to collect cash from my customers in time to pay back my suppliers and purchase more goods to sell?

These are the same questions an investor should ask when investing in any stock.

An investor always thinks like a business owner.

Will a businessman think of closing down his business if profits are down for 3 to 6 months or a year? He most likely won't. The same way an investor thinks long-term about the stocks he owns. Few quarters of bad results won't force him to sell his stock.

Investing is all about looking at the fundamental aspects of a stock and then deciding if that stock is worth buying or not.

The video below will help you understand more about investing...

Trading

Trading is simply buying a stock based on price. Here, the fundamental aspects of the business are not considered. Traders simply think in price terms. The judgment is simply based on human behavior related to stock price movements. A trader tries to predict how the stock price will move based on the collective action of multiple other players in the market.90520

Traders try to look at patterns from history to predict future movements in the stock price.

The video below will help you understand the mindset needed to be a successful trader...

What is Better Suited for a Retail Investor?

Trading involves a lot of activity and constant tracking of price movements. A trader normally has to be fully involved with the happenings of a stock market on a daily basis.

For majority of retail investors though, investing is about using savings to get a reasonable rate of return for investment in stock markets. Also, a retail investor might have a day job leaving limited time for him to dedicate to the markets on a daily basis.

Also, long-term investing is less likely to be volatile than trading and might suit the average retail investor.

Considering all these factors, it makes sense for a retail investor to follow the investing approach.

Overall, an individual should follow that he/she is comfortable with and also one that helps them get the best results from the stock market.

Watch this below video to know more:

![]() Top Railway Shares in India 2024: Railway Companies to Add to Your Watchlist

Top Railway Shares in India 2024: Railway Companies to Add to Your Watchlist

May 5, 2024

These lesser-known companies are prime candidates to benefit from this decade's railway investment boom.

![]() Are Good Days Ahead for Telecom Stocks?

Are Good Days Ahead for Telecom Stocks?

Apr 29, 2024

Interested in investing in telecom stocks? Read on...

![]() Is this Tata Stock a Ticking Time Bomb?

Is this Tata Stock a Ticking Time Bomb?

Apr 25, 2024

A critical look at a big Tata group stock

![]() Why Tata Teleservices Share Price is Rising

Why Tata Teleservices Share Price is Rising

Apr 24, 2024

Telecom stocks have shot up in recent trading sessions following VI's successful FPO and Bharti Hexacom's listing.

![]() Top 5 Specialty Chemical Stocks Poised for A Rebound

Top 5 Specialty Chemical Stocks Poised for A Rebound

Apr 13, 2024

Despite near term headwinds, these five chemical stocks are primed for growth.

![]() Top 5 Real Estate Stocks to Watch Out for As Nifty Realty Index Reaches Record Levels

Top 5 Real Estate Stocks to Watch Out for As Nifty Realty Index Reaches Record Levels

Apr 4, 2024

India's real estate market is having its day in the sun. Here are five stocks that hold potential for the future.

![]() Why Campus Activewear Share Price is Falling

Why Campus Activewear Share Price is Falling

Apr 2, 2024

Campus Activewear shares fall below IPO price as company posts yet another weak earnings report.

![]() REITs: Flavour of the Month?

REITs: Flavour of the Month?

Apr 1, 2024

Fund managers have started investing in REITs, hoping to earn a regular income, enjoy long-term cash flow visibility and better risk-adjusted returns.

![]() PSU Stocks Watchlist: Top 5 Public Sector Banks to Watch Out for Big Dividends in 2024

PSU Stocks Watchlist: Top 5 Public Sector Banks to Watch Out for Big Dividends in 2024

Apr 1, 2024

Public sector banks (PSBs) in India are poised for a record-breaking dividend payout exceeding Rs 150 bn in FY24, driven by significant profit surge. Do you own any of these 5 PSBs?

![]() 6 Penny Stocks that Rallied 2,500%+ in One Year

6 Penny Stocks that Rallied 2,500%+ in One Year

Mar 30, 2024

How did penny stocks fare in FY24? And what's the outlook for investing in penny stocks in FY25? Continue reading to find out...

![]() Forget AC Stocks and Focus on These Companies Making Summer Products

Forget AC Stocks and Focus on These Companies Making Summer Products

May 4, 2024

These four non-AC stocks could be worth tracking this summer

![]() Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Apr 27, 2024

As India's solar race heats up, these companies are well-poised to capitalise on the major investment megatrend of this decade.

![]() Top Stocks in Amit Shah's Portfolio

Top Stocks in Amit Shah's Portfolio

Apr 25, 2024

One of the top politicians in the country has a widely diversified portfolio. Read more here...

![]() An Underdog Mid-Cap: The Next Big Winner?

An Underdog Mid-Cap: The Next Big Winner?

Apr 16, 2024

The mid cap turnaround story that may take you by surprise.

![]() Top 5 Energy Stocks to Watch Out for Big Dividends in 2024

Top 5 Energy Stocks to Watch Out for Big Dividends in 2024

Apr 7, 2024

Energy companies in India are poised for a record-breaking dividend payout driven by significant surge in net profit.

![]() Dividends, Dividends, and More Dividends! 3 High-Yield Stocks for You Today

Dividends, Dividends, and More Dividends! 3 High-Yield Stocks for You Today

Apr 3, 2024

Why you should change your perspective about dividend investing and 3 high dividend yield stocks in the current market.

![]() IREDA: Leading the Charge in India's Green Energy Revolution

IREDA: Leading the Charge in India's Green Energy Revolution

Apr 2, 2024

This state-owned company is capitalising on India's transition to a low-carbon economy. Take a look.

![]() Zomato: Long-Term Investment or Short-Term Gamble?

Zomato: Long-Term Investment or Short-Term Gamble?

Apr 1, 2024

Is Zomato a long-term winner?

![]() TCS & Infosys SHAKEN by Accenture Downgrade?

TCS & Infosys SHAKEN by Accenture Downgrade?

Mar 30, 2024

What TCS and Infosys investors must know after Accenture downgrade.

![]() Top 5 Stocks to Benefit from IPL 2024

Top 5 Stocks to Benefit from IPL 2024

Mar 26, 2024

IPL 2024 becomes new investing theme. Here are 5 stocks in focus.