- Home

- Todays Market

- Indian Stock Market News January 4, 2017

Sensex Stays Flat; IT Stocks Witness Selling Pressure Wed, 4 Jan 01:30 pm

After opening the day on a flat note, the Indian share markets have continued to trade flat and are trading marginally above the dotted line. Sectoral indices are trading on a mixed note with stocks in the realty sector and capital goods sector witnessing maximum buying interest. Banking stocks are trading in the red.

The BSE Sensex is trading up 26 points (up 0.1%) and the NSE Nifty is trading up 10 points (up 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.7%. The rupee is trading at 68.10 to the US$.

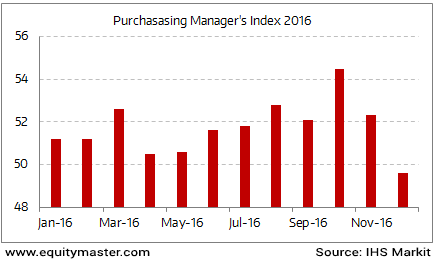

According to the Nikkei Purchasing Managers' Index (PMI) survey by Markit, India's manufacturing sector growth contracted, for the first time this year in December, as demonetisation curbed new orders as well as output of companies.

The manufacturing PMI touched 49.6 in December, compared to 52.3 in the previous month. Any reading above 50 indicates expansion, while the one below that suggests contraction.

Four of the five sub-components of the index - new orders, output, employment, suppliers' delivery time and stock of items purchased - contracted in December. Input costs accelerated at a faster pace than charges for output. This suggests companies couldn't entirely pass on the rise in input costs (driven by an increase in global commodity prices), as the cash crunch dented consumer demand.

This is the first time since the beginning of 2016 that the manufacturing PMI has come below 50, the point that separates growth from contraction. This also marked the biggest month-on- month decline in the index in over eight years or since November 2008 when the global economy had slipped into a severe downturn post Lehman collapse.

Survey participants widely blamed the withdrawal of high-value rupee notes for the downturn as cash shortage in the economy reportedly resulted in fewer levels of new orders.

Though December saw a mild decline in manufacturing output, the average reading for October-December remained in the "growth terrain", suggesting a positive contribution from the sector to overall GDP in the third quarter of 2016-17, the survey said.

PMI Contracts Amid Demonetisation

With the window for exchanging old notes getting closed in December, the January PMI data will be crucial to gauge how quickly the manufacturing sector recovers from the demonetisation impact.

Moving on to news from the energy sector. Shares of Oil and Natural Gas Corp (ONGC) are in focus today. The company's overseas arm ONGC Videsh Ltd (OVL) has won rights to bid for oil and gas development projects in Iran.

OVL is among the 29 international oil companies from more than a dozen countries that Iran has pre-qualified to bid in the upcoming tender for oil and gas projects, according to the list put out by National Iranian Oil Co (NIOC).

It is the only Indian company to have qualified to bid for projects in Iran, which holds the world's fourth-largest oil reserves and is OPEC's third-largest oil producer.

OVL is already present in Iran. In 2008, it had discovered the Farzad-B gas field in the Farsi block in Persian Gulf. The discovery has an in-place gas reserve of 21.7 trillion cubic feet (tcf), of which 12.5 tcf are recoverable. OVL is reportedly in talks with the Iranian government over the development of this field.

ONGC officials said that OVL will definitely look at participating in the bid round that Iran will hold using a new, less restrictive Iran Petroleum Contract (IPC) model.

The IPC model ends a buy-back system dating back more than 20 years under which Iran did not allow foreign firms to book reserves or take equity stakes in Iranian companies.

The new IPC is said to be more flexible terms that take into account oil price fluctuations and investment risks.

Share of ONGC were trading up by 1.8% at the time of writing.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays Flat; IT Stocks Witness Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!