- Home

- Todays Market

- Indian Stock Market News December 19, 2016

Markets Remain Weak; Laurus Labs Makes its Debut Mon, 19 Dec 01:30 pm

After opening the day on a weak note, the Indian share markets have continued to trade in the red. Sectoral indices are trading on a mixed note with stocks in the Consumer Durables sector and Realty sector witnessing maximum selling pressure. Oil & Gas stocks are trading in the green.

The BSE Sensex is trading down 63 points (down 0.2%) and the NSE Nifty is trading down 21 points (down 0.3%). Meanwhile, the BSE Mid Cap index is trading down by 0.2%, while the BSE Small Cap index is trading down 0.1%. The rupee is trading at 67.74 to the US$.

Hyderabad-based healthcare company Laurus Labs, which raised about Rs 13.3 billion through its initial public offer (IPO) made its debut on the stock exchanges today. The stock listed at Rs 490 per share with a premium of 14.5% against its issue price of Rs 428 per share.

The IPO, which opened to public subscription on 6-8 December, was oversubscribed 4.5 times at a price band of Rs 426-428 per share.

The oversubscription can be attributed to the huge support from Qualified Institutional Buyers (QIBs). The reserved portion of QIBs was subscribed over 10.5 times, while high net worth individuals and retail investors' quota received 3.6 times and 1.7 times subscription, respectively.

The IPO comprised of over 241 million shares under the offer for sale route and a fresh issue worth Rs 3 billion.

The drugmaker derives 92% of its revenues from active pharmaceutical ingredients (APIs), which are the core chemical unit of a medication. While APIs are normally less profitable to make than the final product, the company has good revenue and profit growth given its niche focus on the high growth anti-retroviral drugs (ARVs).

The key areas of future growth for the company are product filings for ARV, hepatitis C and oncology APIs in the US and Europe, which remain its focus markets.

At the time of writing, shares of Laurus Labs were trading at Rs 483.9 per share (up 13%).

IPOs are often tricky to understand, but there is no denying the fact that they are exciting. As my colleague Rohan Pinto puts it in an edition of The 5 Minute WrapUp:

- IPOs are exciting. There's no denying it. A private business owner brings their company to the market. And the owner wants you on board!

You get to supply capital to the economy. If the company has issued fresh shares, then your money will be used to grow the business. In return, you get a share of the profits. Either dividends or capital gains or both. It is a win-win for both sides.

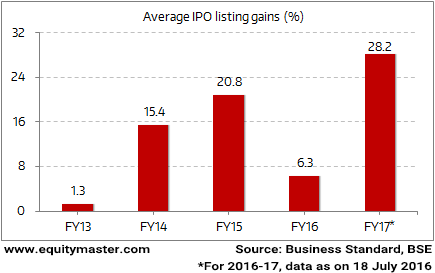

IPOs can help garner gains over a short period of time, as seen in the chart below:

Average Gains from IPOs

In theory, IPOs entail mutual benefit for both the company and the investor. However, it is not always the case.

To better understand and profit from IPOs grab your free copy of Handbook of IPO Investing today!

In other developments, according to the Rubber Board, Indian exports of rubber are gaining momentum. The Board expects the natural rubber (NR) exports from India to touch 5000 tonnes this fiscal owing to the price advantage.

The price of NR in India which had been ruling high over international market prices since December 2013 has come down in the third quarter of 2016. During the last three years the price gap in the Indian and international prices was a marked Rs 35 per kg.

From the second week of November 2016, the International prices of NR shot up and are currently hovering at higher levels as compared to the Indian market. The rise in the international market was due to increased demand for rubber in China, upward trend in crude oil prices appreciation of the US Dollar, among other factors.

In India, natural rubber is traditionally not an export commodity and the major share of the rubber produced in the country is consumed domestically. So, the response to speculative price movements will be relatively less in India compared to other NR producing countries.

The Rubber Board however, is keen on capitalizing on the jump in the international natural rubber prices by promoting the export of NR from India hoping that it would raise domestic prices to the world market levels.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Markets Remain Weak; Laurus Labs Makes its Debut". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!