- Home

- Views On News

- Jun 2, 2021 - Paytm's IPO Buzz Sends Unlisted Shares Soaring

Paytm's IPO Buzz Sends Unlisted Shares Soaring

Days after it was reported that Paytm is going ahead with an initial public offering (IPO) of Rs 220 bn, unlisted shares of One97 Communications, Paytm's promoter are in huge demand.

Over the past five days, the stock price has risen to Rs 21,000 from Rs 11,500.

Paytm's board has given its in-principle approval for the Rs 220 bn IPO after taking up the matter for discussion last week on Friday.

The company is likely to file the draft red herring prospectus (DRHP) in July. The IPO is expected to come out during the October-December quarter.

What are Unlisted Shares?

There are certain criteria for a company to get listed on the stock exchange.

The company should be capable of generating high revenues.

It should be capable of paying exchange's listing fee.

The company should have specific number of shares, and so on.

Basically, it is not easy to get listed on a stock exchange and that's where unlisted shares come in.

Unlisted shares are shares that belong to the company which are not listed on the stock exchange. These shares can be traded via over-the-counter (OTC) market and also known as OTC securities.

Although no actual delivery of shares takes place here, an unofficial future/forward contract is made. These markets are beyond the control of markets regulator.

A very important point investors must note about unlisted securities is that they are less liquid then listed shares.

What's Behind the Surge in Paytm Shares?

The main reason unlisted shares of Paytm are soaring is because no one is willing to sell the stock.

There are no sellers and only buyers in the market, say reports.

Even at Rs 21,000 per shares, investors are willingly paying a hefty premium on the current prices.

In early 2020, the shares were quoting at around Rs 19,000, before crashing to Rs 8,500 in May 2020 due to Covid crisis.

Reportedly, at the current share price in the unlisted market, Paytm is valued at around US$15.5 bn.

Paytm's valuation is now more than its banking and financial peers such as IndusInd Bank, Bandhan Bank, PNB, SBI Cards, SBI Life Insurance, and ICICI Prudential Insurance.

A company which deals in unlisted securities said that they sold Paytm stocks to investors between Rs 11,000 and Rs 12,000.

The last trade they did in these shares was two days back at Rs 21,000 and since then, there are no stocks available for purchase.

Reports also suggest that traders are hoping the stock to be valued at Rs 35,000 per share in the IPO and the company will go for a bonus issue to bring down the denomination.

All you Need to Know About Paytm's Mega IPO

The Vijay Shekhar Sharma led start-up, backed by investors including Warren Buffett's Berkshire Hathaway, SoftBank Group Corp, and Ant Group Co, plans to list in India around November and its offering could coincide with the Diwali festival season.

This will be the largest ever IPO in India's capital market history, surpassing Coal India's Rs 150 bn public offering of 2010.

As per reports, Paytm will look to raise US$1 bn - US$1.5 bn as part of primary share sale.

It will take the qualified institutional placement (QIP) route to list where it will raise primary funds from a fresh issue of shares to QIBs.

Paytm had raised US$1 bn in November 2019 from US-based asset management firm T Rowe Price and existing investors, including SoftBank and Alibaba.

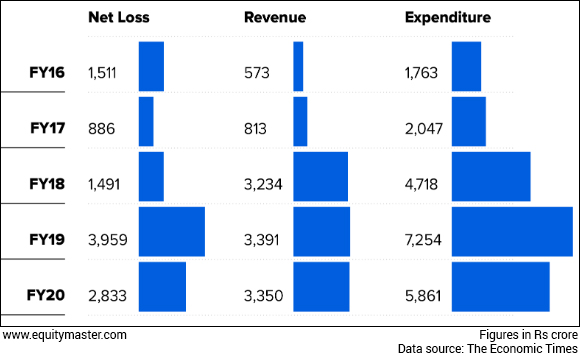

While financials for the year ended March 2021 are not available, Paytm reported a loss of Rs 28 bn on a revenue of Rs 33.5 bn in the previous year.

Prior to that in the year ended March 2019, Paytm had reported a loss of Rs 39.6 bn on a revenue of Rs 33.9 bn.

Paytm Financials

As per market regulator's regulations, only profit-making companies can list on NSE and BSE.

However, if a loss-making startup like Paytm is to go for a listing, they must float 75% of their net public offer to only qualified institutional buyers, including insurers and mutual funds, and alternative investment funds.

Only 25% of the offer can be subscribed by retail investors, including high-net worth individuals.

Potential US Listing

In April, Vijay Shekhar Sharma in his interview with Forbes India had said that while Paytm is coming out with an India IPO, it does not rule out the possibility of a potential US listing.

He said that by the time Paytm is ready, the options could be a little more on the table than just one IPO method which was always there in India.

Sharma pointed out, if one looks at Infosys, HDFC, ICICI they all were listed in India and some issued American Depository Receipts (ADRs), adding anyone listing does not stop another listing if regulations allow it.

It remains to be seen how and when Paytm plans to list in global markets.

Equitymaster's Take on IPOs

We at Equitymaster are always conservative when it comes to IPOs because they aren't always a win-win.

If you are investing in an IPO, weigh in all the positive and negative factors affecting the company.

Take a close look at the company's financials and valuations. It would give you a clear picture of what's brewing.

Or, rather than subscribing to the 'risky' IPOs, you can ride the Sensex 100,000 journey by subscribing to our blue-chip recommendation service, StockSelect.

It could be a much more profitable decision over the long term.

Happy Investing!

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Paytm's IPO Buzz Sends Unlisted Shares Soaring". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!