- Home

- Views On News

- Sep 21, 2022 - ITC or Coal India - Which is the Better Dividend Stock?

ITC or Coal India - Which is the Better Dividend Stock?

Dividends are important for investors in a volatile market. They provide investors with an income and a return on their investment.

They also provide an incentive for companies to increase their earnings.

Dividend paying stocks have been shown to have higher returns than non-dividend paying stocks over long periods of time.

Even the father of value investing Benjamin Graham agrees when he says,

- The true investor will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation results of his companies.

Over the past couple of months, we wrote to you about how prudent investors could consider high dividend paying stocks.

If you missed the editorials, you can read them here and here.

We went a step further recently and decided to compare high dividend paying stocks on various metrics.

In a previous editorial, we compared Vedanta and NALCO to arrive at a conclusion on which is the better dividend stock.

Today, we compare ITC and Coal India and how they fare on various dividend metrics.

Let's get started...

Business Overview

ITC is a diversified conglomerate with businesses spanning fast moving consumer goods, hotels, paperboards and packaging, agri-business, and IT.

The company is the country's leading FMCG firm and the market leader in the Indian paperboard and packaging industry.

In the agri sector, it's acknowledged globally as a pioneer in farmer empowerment through its wide-reaching agri business. In the hotels segment, it's a pre-eminent hotel chain in India.

For years, ITC was planning to gradually shift towards an asset-light model in the hospitality sector for further expansion. It's only now that the words have been put to action.

ITC's wholly owned subsidiary, ITC Infotech, is a specialised global digital solutions provider.

Over the last decade, ITC has successfully created an array of strong brands which are either #1 or #2. They are market leaders in their respective categories.

Coal India, the state-owned coal mining corporate, is the single largest coal producer in the world. The company operates through 83 mining areas and is spread over 8 states of India.

The company is an apex body with 7 wholly owned coal producing subsidiaries and 1 mine planning and consultancy company.

It produces around 83% of the overall coal production in India and accounts for 76% of total thermal power generating capacity.

It's a Maharatna company, a privileged status conferred by Government of India to select state owned enterprises to empower them to expand their operations and emerge as global giants.

Despite India's renewable energy push, we believe Coal is here to stay. It forms a critical part of India's economy as the largest coal supplier to India's power sector.

Dividend payout per share

ITC

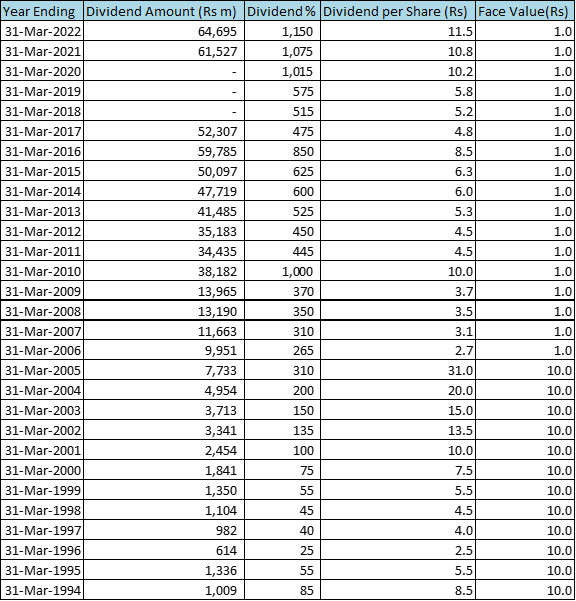

ITC has always been considered as an attractive dividend play. Right from humble beginnings in 1994, the company has rewarded investors with a higher payout compared to its peers.

This is the one thing that makes ITC stand out. Over the years, the company's management has laid out a flexible capital allocation policy. It has said that dividend payouts will be stepped up to about 80-85% of its post-tax profits.

In 1994, ITC began its track record of paying consistent dividends. It paid out a dividend of Rs 8.5 per share and the total payout was around Rs 1,009 m.

In the latest financial year 2021-22, ITC paid out Rs 11.5 per share as dividends and distributed around Rs 64,695 m in dividends.

To put things into context, ITC is paying dividends since 1994 with not a single year of gap in between.

Take a look at the table below to get a gist of ITC's rich history of paying dividends.

High Dividend Payouts with a Growth Rate

Coal India

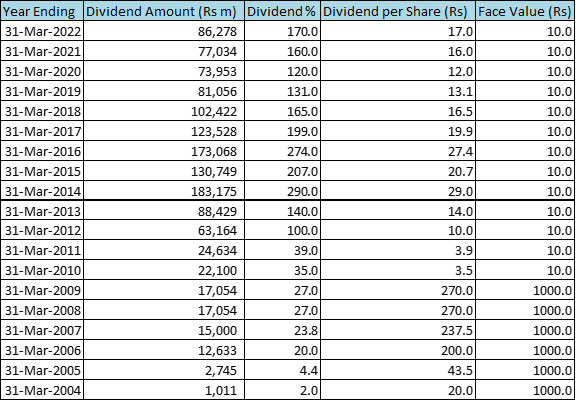

While the company's dividend history is not as long as ITC, it is surely rich.

Coal India has declared dividends since 2004.

Here's a table showing the entire history of dividends paid by Coal India.

Coal India's Rich Dividend History

If we compare both companies on dividend payout per share, ITC has kept itself ahead by declaring much higher payouts than Coal India.

In initial years, ITC saw a fall in payouts. However, in the past decade, ITC has grown its payout at a faster rate than Coal India.

For Coal India, dividend payout per share has remained constant and in a range.

In the past decade, the company has not seen a substantial growth in dividend payouts. In fact, Coal India has seen its payout fall over the past eight years.

Here's a table comparing the two companies on dividend payout per share:

ITC vs Coal India - Dividend Payout Per Share in Recent Years

| FY18 | FY19 | FY20 | FY21 | FY22 | |

| Dividend Payout per share (Rs) | |||||

| ITC | 5.2 | 5.8 | 10.2 | 10.8 | 11.5 |

| Coal India | 16.5 | 13.1 | 12.0 | 16.0 | 17.0 |

| Growth (%) | |||||

| ITC | 8% | 12% | 77% | 6% | 7% |

| Coal India | -17% | -21% | -8% | 33% | 6% |

| 5 Year Average (Rs) | |||||

| ITC | 8.7 | ||||

| Coal India | 14.9 | ||||

Dividend Yield

As interest rates rise worldwide, there is a growing concern about how it may impact various asset classes.

To ride this volatile phase, people usually invest in high dividend yield stocks.

When there's a stock market selloff, high dividend yield stocks are available at a bargain. You can invest with a huge margin of safety so when things turn around, you have the opportunity to earn high returns.

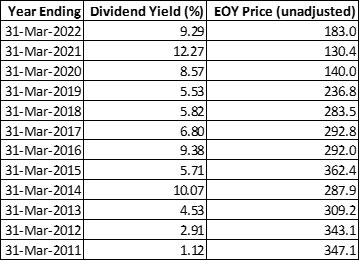

Let's take a look at how ITC and Coal India compete on dividend yields.

ITC

Starting with a modest dividend yield of 1.3% in financial year 1993- 1994, the company's dividend yield has increased to 6% over the years.

Since year 2000, ITC's dividend yield has never gone below 1.5%.

In financial year 2021-22, ITC's dividend yield was 4.6%, taking into consideration its end of year (eoy) share price.

ITC Dividend Yield Since 2000

Coal India

For Coal India, the dividend yields are much higher than ITC. The state-owned company has maintained consistency of having yields above 5% for consecutive years.

In fact, the company is now in the elite class of companies having yields around 9-10%.

In financial year 2021-22, Coal India paid dividend of Rs 17 per share which results in a dividend yield of 9.3% at its eoy share price.

Coal India Dividend Yield Over the Years

If we compare both companies on dividend yields, Coal India has an advantage. The tables above are evident that Coal India has declared hefty dividends regularly.

Here's a table comparing both companies on dividend yields.

ITC vs Coal India - Dividend Yield in Recent Years

| FY18 | FY19 | FY20 | FY21 | FY22 | |

|---|---|---|---|---|---|

| Dividend Payout per share (Rs) | |||||

| ITC | 5.2 | 5.8 | 10.2 | 10.8 | 11.5 |

| Coal India | 16.5 | 13.1 | 12.0 | 16.0 | 17.0 |

| EOY Price (Rs) | |||||

| ITC | 255.9 | 296.7 | 172.0 | 218.5 | 250.8 |

| Coal India | 283.5 | 236.8 | 140.0 | 130.4 | 183.0 |

| Dividend Yield (%) | |||||

| ITC | 2.0 | 1.9 | 5.9 | 4.9 | 4.6 |

| Coal India | 5.8 | 5.3 | 8.6 | 12.3 | 9.3 |

Dividend Payout Ratio

Dividend payout ratio is measured by the amount of dividend a company pays in a year divided by the net profit for the year.

The market likes a payout that is high and stable or a payout that is growing.

Let's see how both the companies fare on this ratio.

ITC

ITC's dividend payout ratio was 93% in financial year 2021-22.

The company has come a long way in increasing this payout ratio. Between 2003 and 2009, the company had a modest payout ratio ranging between 30-40%.

The dividend payout ratio peaked in 2021 at 101%.

The following table shows the adjusted dividend paid by ITC to its shareholders between 2018-2022.

ITC Dividend Payout Ratio

| Year | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Dividend per share (Rs) | 5.2 | 5.8 | 10.2 | 10.8 | 11.5 |

| Net profit (Rs m) | 112,712 | 125,923 | 153,062 | 131,612 | 152,427 |

| Dividend payout ratio (%) | 55.8 | 56.0 | 81.5 | 100.5 | 93.0 |

Coal India

Coal India's dividend payout ratio was 60.4% in financial year 2021-22.

Between 2014-2018, Coal India had a dividend payout ratio ranging between 95%-145%.

The following table shows the adjusted dividend paid by Coal India to its shareholders between 2018-2022.

Coal India Dividend Payout Ratio

| Year | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Dividend per share (Rs) | 16.5 | 13.1 | 12.0 | 16.0 | 17.0 |

| Net profit (Rs m) | 70,386 | 174,631 | 167,142 | 126,999 | 173,581 |

| Dividend payout ratio (%) | 145.5 | 46.2 | 44.3 | 77.6 | 60.4 |

Both the companies are faring equally if we compare them on dividend payout ratio. For both, the payout ratio has remained constant and consistent.

ITC vs Coal India - Dividend Payout Ratio (%)

| Dividend Payout Ratio (%) | ||

|---|---|---|

| Year | ITC | Coal India |

| 2012 | 56.2 | 42.7 |

| 2013 | 54.5 | 50.9 |

| 2014 | 53.7 | 121.2 |

| 2015 | 51.8 | 95.2 |

| 2016 | 73.2 | 121.3 |

| 2017 | 56.1 | 133.1 |

| 2018 | 55.8 | 145.5 |

| 2019 | 56.0 | 46.2 |

| 2020 | 81.5 | 44.2 |

| 2021 | 100.5 | 77.6 |

| 2022 | 93.0 | 60.4 |

Can ITC and Coal India continue to pay high dividends?

Dividends are only sustainable to the extent a company's earnings are sustainable. If for some reason, earnings were to decline, high dividends of today may count for nothing.

Also, dividend payments are highly dependent on the management policy.

Therefore, even a dividend paymaster can become a dividend dud.

Let's analyse whether ITC and Coal India will be able to continue their dividend paying streak in the future.

ITC

If you track ITC closely, you know that the company is a zero-promoter holding company.

With the absence of a promoter, few investors still remain skeptical about the company sustaining its dividend track record.

However, so far so good. The company has made bigger payouts even with the absence of promoters.

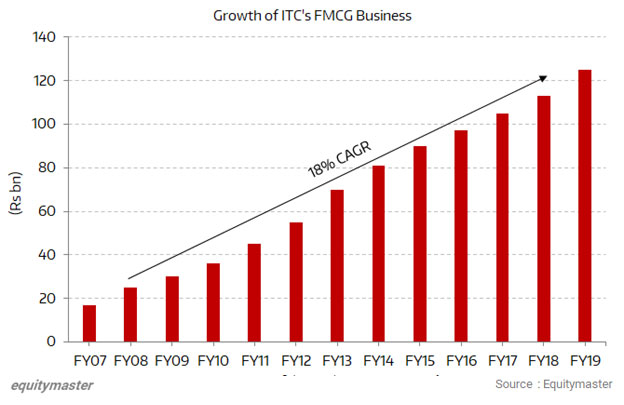

Over the last decade, investors remained concerned about ITC's diversification efforts, high cigarette taxes, ESG headwinds, diverging global trends and an underperforming FMCG business.

But it seems the worst is behind the company.

ITC is putting all its weight behind the FMCG business through large-scale investments to build scale. The management believes there is headroom to grow in every segment given the low levels of penetration across different categories.

As the company's FMCG business grows, don't be surprised if the dividends grow alongside.

In a research note, Morgan Stanley expects ITC's FMCG profit contribution to gradually increase to 8.5% and 12% over the next 5 and 10 years, up from 3% currently. They estimate margins will improve to 11% and 17.6% by FY25 and FY35.

It also expects the FMCG business to contribute to dividends over the next 5 years.

In financial year 2021-22, ITC's FMCG business grew to Rs 159.9 bn from Rs 128.4 bn in financial year 2020-21.

The company has a strong balance sheet and excellent free cash flow.

| Rs m, consolidated | FY18 | FY19 | FY20 | FY21 | FY22 |

|---|---|---|---|---|---|

| Revenues | 434,489 | 483,527 | 494,041 | 492,728 | 606,681 |

| Operating Profit | 183,399 | 206,061 | 218,848 | 196,487 | 225,154 |

| PAT | 112,712 | 125,923 | 153,062 | 131,612 | 152,427 |

| Long Term Debt | 359 | 134 | 96 | 98 | 56 |

| Debt to Equity Ratio (%) | 0 | 0 | 0 | 0 | 0 |

| Free Cash Flow | 115,796 | 105,762 | 150,845 | 127,859 | 149,769 |

In the past, profitable and cash rich operations (in the tobacco business) have enabled ITC to build huge cash reserves. A company with cash reserves is able to pay big dividends ahead.

With the company being debt free, the strong reserves are likely to aid the company to continue its dividend paying spree.

Coal India

Globally, coal companies have not had better fortunes. Major world powers are seen moving away from coal consumption.

With the government's focus on renewable energy, the demand for coal is set to progressively decline over the years.

Going forward, the company's operating profit may come under pressure and as a result, we may see the company's cash flow getting impacted due to an increase in capex. This can have a material impact on Coal India's dividend payments.

A recent report also suggests that the company's Rs 410 bn of cash flow is at risk.

Here's an excerpt from the report:

- The world's largest coal producer will see more than Rs 410 bn of its cash flow at risk if it fails to diversify revenue sources with India continuing to ramp up climate ambitions.

The company faces significant financial risk by 2050 as national coal production falls and clean energy adoption gathers pace, said a new study by the International Institute of Sustainable Development.

By 2024, Coal India has planned a capex of around Rs 600 bn, to increase mining and coal washing capacity and improve rail infrastructure. The company also plans to set up solar power and thermal power plants and revive fertiliser plants.

Market experts are of the view that despite the proposed capex, the company will be able to continue its high dividend payout streak.

A lot of PSU companies like Coal India are cyclical stocks. They see huge fluctuations in their earnings and stock price, tracking the underlying commodity.

Any impact on coal prices owing to geopolitical issues is another concern.

Which dividend stock is better?

Both the companies have their 'A' game on when it comes to dividends.

ITC has declared higher dividend payout per share than Coal India. The FMCG major has also grown dividends at a faster rate than Coal India.

Coal India ranks better than ITC on the dividend yield criteria as it has declared hefty yields for the past eight years.

On the dividend payout ratio, both the companies are faring equally well as the payout ratio has remained constant and consistent.

However, if we consider the growth prospects, ITC is one step ahead. A lollapalooza effect is occurring for ITC at present where multiple factors are moving in the positive direction. Read this editorial to know more: ITC - Load, Aim...Fire!.

In conclusion, while both these companies will continue to pay dividends, we believe ITC will be the one making higher dividend payouts.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "ITC or Coal India - Which is the Better Dividend Stock?". Click here!

1 Responses to "ITC or Coal India - Which is the Better Dividend Stock?"

Abhishek Jain

Sep 22, 2022Your articles are insightful and help investors make correct choices. Thank you team EquityMaster!