- Home

- Todays Market

- Indian Stock Market News January 9, 2017

Indian Indices Trade Near the Dotted Line; FMCG Stocks Witness Buying Mon, 9 Jan 11:30 am

After opening the day on a flat note, the Indian share markets witnessed choppy trades and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the FMCG sector and realty sector witnessing maximum buying interest. Stocks in the pharma sector are trading in the red.

The BSE Sensex is trading up 10 points (up 0.04%) and the NSE Nifty is trading up 4 points (up 0.04%). The BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by around 0.6%. The rupee is trading at 68.20 to the US$.

In a recent news from the global markets, potential candidates to head the Federal Reserve in 2018 have suggested that monetary policy would be tighter if they were in charge. As per an article in Bloomberg, the political candidates criticized the Fed for trying to do too much to help an economy struggling with problems that monetary policy cannot solve.

The current term of Janet Yellen as the chair of Governors of the Federal Reserve System expires in February 2018. Buzz around the street is that all former officials in George Bush's administration would take over from Janet Yellen if President-elect Donald Trump decides not to nominate her for another four-year term as chair. Trump has criticized Yellen in the past for keeping interest rates low to benefit the Democrats.

In its December monetary policy meet, the US Federal Reserve raised its target federal funds rate by 0.25% to between 0.50% and 0.75%. The rate hike was the first since last December and only the second since the 2008 crisis, when the Fed cut rates to near zero and deployed other tools such as massive bond purchases to stabilise the economy.

The Fed's outlook is now for three more 0.25% hikes in 2017. And then three more increases in both 2018 and 2019. This would mean nine rates hikes over the next three years before the rate levels off at a long-term 'normal' of 3%.

However, we doubt the strength and durability of the US economic recovery since it has been driven mainly by massive doses of money printing and artificial suppression of interest rates. Hence, we also doubt the Fed's capability to further raise interest rates.

A quick succession of rate hikes would create a massive storm in the global financial markets. But no rate hike would lay the ground for much bigger financial storms later. Sooner or later, there will be an end to easy money policies. And that will lead to some big trends. Here's Asad Dossani, editor at Profit Hunter:

- Regardless how many more times interest rates go up; one thing is clear. This is the beginning of the end of easy money. At least, the end of easy dollars (easy euros, pounds, and yen will stay with us for a while).

As per Asad, the Fed's promise of more interest rate increases will lead to the end of easy money and will create big trends next year that traders can profit from.

Speaking of trading, Apurva Seth, editor at Profit Hunter, is now ready to reveal what he believes will be a very lucrative trading strategy for 2017...a strategy that could help you make money without taking undue risk.

This is Apurva's Post-Demonetisation Trading Strategy... The strategy is easy to execute and has the potential to help you identify many exciting trading opportunities in 2017.

This training session is now LIVE! So don't miss it and Attend This Session Right Now!

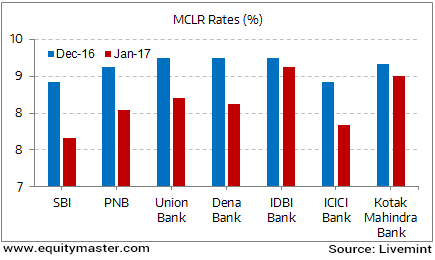

Moving on to news from the banking space... Many banks haves pared their lending rates. The State Bank of India (SBI) slashed lending rates by a whopping 0.9% across all loan products. Also, other banks including ICICI Bank, Union Bank of India, Punjab National Bank, and IDBI Bank have followed suit and cut their lending rates. This is seen on the back of deposit surge post demonetisation.

Furthermore, some banks have announced a significant cut in their MCLR rates. The MCLR rate is used as a benchmark rate for new loans.

Interest Rates Finally Headed Down South?

Essentially the banks are now aggressive on the rates cut in the hope of riding on some credit growth. The Reserve Bank of India data suggest a slowdown in India's credit growth. This is languishing at 5.8% YoY.

However, the key thing to assess amid these rate cuts would be the drop in margins of the banks while looking to expand their credit growth.

If one has to go by the present situation, there are many red flags raised on loan quality at public sector banks in India.

A few days back, Tanushree Banerjee, Co-head of Research at Equitymaster, wrote about India's largest banks peddling teaser loans once again. As per Tanushree, 'Teaser loans could be the last nail in the coffin of banks reeling under bad loan problem.' And this should worry depositors in PSBs.

The recent correction in banking stocks shows that investors are testing the safety of their stocks... and finding the banking sector lacking. As an aside, Tanushree will be speaking about safe stocks at the Equitymaster Conference 2017, and you're invited. Mark your calendar for 21 January 2017. More details here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Trade Near the Dotted Line; FMCG Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!