- Home

- Todays Market

- Indian Stock Market News February 9, 2017

Sensex Finishes Flat; Cipla Slips 2.6% on Q3 Results Thu, 9 Feb Closing

Share markets in India pared all its early gains to finish the day on a flattish note. At the closing bell, the BSE Sensex closed higher by 40 points, whereas the

Asian markets finished mixed as of the most recent closing prices. The Shanghai Composite gained 0.51% and the Hang Seng rose 0.17%. The Nikkei 225 lost 0.53%. European markets are higher today with shares in France leading the region. The CAC 40 is up 0.39% while Germany's DAX is up 0.25% and London's FTSE 100 is up 0.08%.

The rupee was trading at Rs 67.01 against the US$ in the afternoon session. Oil prices were trading at US$ 52.82 at the time of writing.

Banking stocks ended the day on a mixed note with City Union Bank and J&K bank leading the declines. According to an article in Livemint, Axis Bank Ltd has signed an agreement to sell 14 million equity shares in Mumbai-based Experian Credit Information Co. of India Ltd for a total cash consideration of Rs 640 million.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The deal for the 10% stake was closed at a price of Rs 45.7 per share. Experian Credit Information is a joint venture between GUS Holdings BV (Netherlands), Axis Bank Ltd, Union Bank of India, Indian Bank, Federal Bank Ltd, Punjab National Bank, Sundaram Finance Ltd, Magna Fincorp Ltd, and VIC Enterprises Private Ltd.

Axis Bank is reportedly also looking to divest its 8% stake in mobile payments firm Mswipe for around $20 million in a deal that is likely to value the firm at US$200-$250 million.

Meanwhile, Axis Bank disappointed with its December quarter earnings, with profit dropping by 73.3% on a YoY basis to Rs 5.8 billion. The bank's net interest income grew 4% YoY to Rs 43.34 billion during the quarter from Rs 41.62 billion in the same quarter last year. Gross non-performing assets rose almost 25% to Rs 204.67 billion from Rs 163.79 billion at the end of the September quarter.

In another development, according to an article in The Times of India, shares of Kotak Mahindra Bank were abuzz amid rumours and denial about a possible merger with Axis Bank.

Reportedly, both the private lenders have denied the rumours of the possible consolidation move. The merger could be worth around Rs 2.5 trillion (US$37 billion) making it the second most valuable Indian bank after HDFC Bank.

Currently, the government holds 12% in Axis Bank through SUUTI, which is worth about Rs 140 billion. It holds an additional 18% stake in the bank through LIC and other state-owned insurance companies.

For Kotak Bank, its promoters need to need to pare their stake in the bank to 15% by 2020 from 33.6% in accordance with a Reserve Bank of India directive.

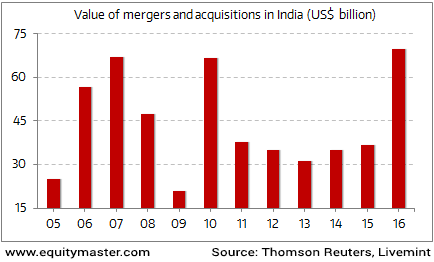

Merger and acquisition activity in India is on a high. The value of M&As that have taken place this year - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A activity at an All Time High in 2016

However, this big bump up in buyer interest during 2016 led to many big deals taking place. Thereby indicating increased confidence in the Indian economy.

Moving on to the news from stocks in pharma sector. Cipla share price fell by 2.6% as the company announced its financial results for the quarter ended 31 December 2016. The company reported 43.9% jump in consolidated net profit at Rs 3.7 billion for the third quarter. The company had posted a consolidated net profit of Rs 2.6 billion in the same period last fiscal.

Revenue during the quarter increased 15.7% to Rs 36.5 billion compared with Rs 31.5 billion in same quarter last year, with strong performance in key markets of India, US and South Africa. Moreover, India business (which contributed 39% to revenue) was strong, growing 19% year-on-year to Rs 14.1 billion, despite demonetisation.

Better profitability also came on the back of a 15.7% increase in revenue, with its India and North America business delivering good growth. India and North America together contributed to 57% of revenue. Emerging markets, with a 21% share, saw sales decline both over a year ago and sequentially.

To know more about the company's financial performance, subscribers can access to Cipla's latest result analysis (subscription required) and Cipla stock analysis on our website.

Meanwhile, Lupin Ltd reported a 21% jump in its quarterly profit, helped by higher sales in the United States. Net profit for the third quarter rose to Rs 6.33 billion from Rs 5.25 billion a year ago.

Sales in North America soared 57.6%. The region accounted for 49% of the company's total sales. US sales grew 53.4%. India sales were up 11.9% at Rs 9.9 billion. Lupin's sales in Japan, Latin America and Germany also grew on a year-on-year basis.

However, along with keeping an eye on valuations, it's also important that you have a process in place. Many of you have already tasted the fruits of one of Rahul Shah's processes with his Microcap Millionaires service.

At the Equitymaster Conference 2017 Rahul asked attendees to mark 10 February, 2017 on their calendars. Why? Because he announced that he will send out his first Profit Velocity report to subscribers.

Profit Velocity is a system-based strategy.

With Profit Velocity, Rahul has created a system to help subscribers potentially fetch gains several times those of the benchmark index. Our Founder Member opportunity, which closes at midnight of 10th February, offers a whopping 60% discount on the usual membership fees for Profit Velocity.

So, don't miss out. Act now to get your own system in place.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Flat; Cipla Slips 2.6% on Q3 Results". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!