- Home

- Todays Market

- Indian Stock Market News March 2, 2017

Sensex Sheds 145 Points; Pharma Stocks Slide Further Thu, 2 Mar Closing

Indian share markets witnessed selling pressure in the final hour of trade to finish well below the dotted line. At the closing bell, the BSE Sensex closed lower by 145 points, whereas the NSE Nifty finished lower by 46 points. The S&P BSE Midcap and the S&P BSE Small Cap ended down by 1.4% & 1.2% respectively. Losses were largely seen in realty sector, power sector and healthcare sector.

Tata motors share price finished up by 2.7% after the company reported 1.93% increase in total sales in February at 47,573 units compared to 46,674 in the same month last year. Domestic sales of Tata Motors' commercial and passenger vehicles were at 42,679 units in February as against 41,532 units in the same month last year.

Meanwhile, Wockhardt share price plunged 5% after it was reported that the company's US business has suffered another jolt with the US Food and Drug Administration (USFDA) issuing a warning letter to the company's Morton Grove manufacturing plant facility in Illinois. Also,

Asian equity markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.88%, while the Shanghai Composite led the Hang Seng lower. They fell 0.52% and 0.20% respectively. European markets are mixed to lower. Shares in Germany are off as the DAX drops 0.13%. The CAC 40 is down 0.05% while the FTSE 100 in London is unchanged.

The rupee was trading at Rs 66.74 against the US$ in the afternoon session. Oil prices were trading at US$ 53.39 at the time of writing.

Telecom stocks ended the day on a weak note with Reliance Communications and Idea Cellular leading the losses. As per an article in The Financial Express, Bharti Airtel and Nokia will expand their collaborative technology partnership to work on 5G technology standard and management of connected devices.

As a part of the agreement, Nokia and Airtel will collaborate on technologies to drive 5G network growth. Note that Airtel had signed a separate deal with Nokia last year for the deployment of 4G networks. In total, Nokia deployed its 4G FDD-LTE & TD-LTE technology across 9 circles of Bharti Airtel's operations in India including Gujarat, Madhya Pradesh, Bihar, Rest of Bengal, Odisha, Mumbai, Maharashtra, Kerala and UP East.

The two companies will also work on getting the new technology on Internet of Thing-enabled devices. 5G will be built upon the existing 4G network in terms of operations and costs.

The agreement will see the use of Nokia's 5G FIRST end-to-end 5G solutions such as AirScale radio access portfolio and AirFrame data center platform to demonstrate 5G capabilities. It will also simulate user cases of 5G extreme broadband and ultra-reliability and low latency communication. Interestingly, Nokia was also to sign a similar deal with BSNL, for the development in 5G and IoT and help BSNL develop a framework for future networks.

India's telecom industry is in a state of upheaval. The new kid in town, Reliance Jio, has driven all the changes since last year. The move also comes at a time when Reliance Jio has also tied up (Subscription Required) for 5G network development with Airspan, just earlier this week.

Jio's Data Pricing Disrupt the Telecom Apple Cart

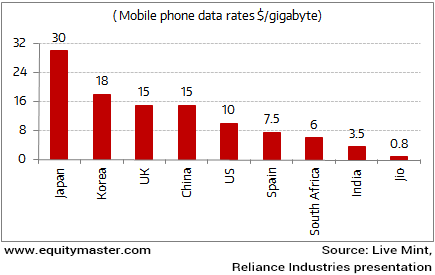

The company wanted to literally hit the ground running as reflected in the mouth-watering offer used as a bait to attract the maximum subscribers. The offer not only included low cost Lyf phones, but lifetime free voice calls as well as ultra-cheap data plans and tariffs. The mobile phone data is priced as low as Rs 50 per gigabyte (GB).

While this huge price disruption will no doubt benefit the mobile phone users, we are not quite sure whether the pricing math will be sustainable for telecom companies in the long run.

Going ahead, whether Bharti Airtel's strategy towards 5G and an entry into IoT space prove to be a turning point and improve its revenue streams will be the key thing to watch out for.

Bharti Airtel share price ended the day down by 1.8%.

Moving on to the news from stocks in banking sector. According to a report in a leading financial daily, IDBI Bank has acquired its 323 million shares from Jaiprakash Power Ventures under the strategic debt restructuring scheme by its lenders.

Reportedly, IDBI Bank's holding in the company stood at 5.39% of the company's total 5996 million equity shares. Before this acquisition, the bank held 0.13% of the equity in the company. Following the allotment, financial institutions will have 51% equity share in the Jaypee group firm.

In the meanwhile, it was reported that, the government is set to bail out IDBI Bank with a Rs 30 billion capital infusion to help it maintain a healthy capital-adequacy ratio and pursue credit growth.

The government has already said it is still open to bring down its stake in the bank to below 50%. The finance ministry is looking to rework its strategy on stake sale in IDBI Bank, which also involves valuation of its real estate assets. The government has budgeted Rs 250 billion towards bank capitalization this fiscal, of which it has allocated Rs 229.1 billion.

Reportedly, there are projections that in the last quarter of this fiscal there will be a jump in bad loans for IDBI. On the other hand, IDBI Bank's lending portfolio is mostly in corporate segment and that is one of the major reasons for surge in its bad loans.

Additionally, IDBI Bank has valued its non-core assets at Rs 60 billion, more than double the capital it received from the government last year.

However, after the bank posted a historic loss of Rs 22.5 billion in the third quarter ending December 2016, it decided to freeze big-ticket lending and open new branches and focus on recoveries of bad loans. The move is aimed towards conserving capital, the buffer banks are mandated to keep against any losses.

IDBI Bank share price ended the day down by 3%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Sheds 145 Points; Pharma Stocks Slide Further". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!