- Home

- Todays Market

- Indian Stock Market News March 15, 2017

Sensex & Nifty Open Flat Ahead of Fed Outcome Wed, 15 Mar 09:30 am

Asian equity markets are lower today following losses in US stocks as traders awaited a decision on interest rates from the US Federal Reserve. The Nikkei 225 is off 0.29%, while the Hang Seng is down 0.07%. The Shanghai Composite is trading up by 0.09%. Stock markets in the US & Europe finished their previous session on a weak note.

Meanwhile, Indian share markets have opened the day on a sluggish note ahead of outcome of the Federal Reserve policy meeting tonight. The BSE Sensex is trading higher by 1 point while the NSE Nifty is trading flat. The BSE Mid Cap index opened flat while BSE Small Cap index both have opened the day up by 0.2%.

Sectoral indices have opened the day on a mixed note with consumer durables stocks and healthcare sector leading the pack of gainers. While information technology and capital goods stocks are witnessing selling pressure. The rupee is trading at 66.18 to the US$.

Automobile stocks are trading mixed with Maharashtra Scooters and Tata Motors being the most active stocks in this space. As per an article in a leading financial daily, in the first major move under N Chandrasekaran's chairmanship, Tata Motors is reducing staff by offering a voluntary retirement scheme (VRS) to significantly prune its middle management.

The company is in the process of bringing down the management layers down to five from the existing 14 to cut costs. The VRS package has been approved by the board and the company says that it's part of a larger endeavour to cut costs and make overall operations more streamlined.

Reportedly, this is part of a human resource restructuring drive that is expected to transform the automaker into a much leaner company with a flat hierarchical structure.

This also comes at a time when Tata Motors has been changing gears to keep up with the ongoing trend in the industry to offer a variety of products while enhancing production synergies. Further, it intends to use modular platforms and cut costs on that front in the future. It is also expanding its horizon by introducing the sub-brand Tamo, and also announcing a likely partnership with the Volkswagen Group.

Tata Motors share price opened the day up by 0.3%.

Moving on to the news from stocks in mining sector. According to a leading financial daily, boards of three subsidiaries of Coal India Limited have slashed valuations of the shares of these companies by at least 75% over the values declared earlier this month.

As per an article in The Economic Times, the earlier valuations did not reflect the true valuation of either the subsidiaries or the parent. Although, the amount of money that Coal India will receive post reduced valuation through proposed share buybacks remains the same at Rs 50.63 billion.

The number of shares to be bought back by the company has been increased to keep the total sum the same. The earlier valuations included factors that are considered for valuing international companies, resulting in higher valuations.

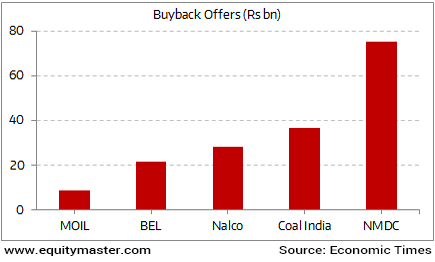

Big Buybacks of the Public-Sector Units

Historically, various plans of government's stake sales had hit a stone wall. In 2015-16, the government had set a record target of raising Rs 695 bn through disinvestment, but only managed Rs 321 bn. To avoid a repeat of last year, it is exploring a new strategy. It is expecting the cash PSUs to use the cash in buybacks.

Meanwhile, the finances of three of the seven coal-producing subsidiaries of Coal India may nosedive this fiscal due to poor production and sales. As per the reports, between April and February this fiscal, Western Coal Fields, which seems to be the worst off, saw its output drop by 5.3% and its offtake decrease by 8.7%.

Bharat Coking Coal Ltd's output rose 2.6%, but coal sales dropped by 3.2%. ECL's output rose 2.3% and despatch, 12.6%. All the three companies were lagging behind their targets by a margin of between 3% and 14% in output and 6% and 19% in offtake.

Poor coal demand has been the primary reason for this. Moreover, the fortunes of CIL and its arms were affected by the close to 50% drop in the e-auction price in the last quarter.

The Poor performance of its subsidiaries and provisioning for higher wages (due to ongoing wage negotiations) dented CIL's third quarter performance. CIL reported a 20% drop in net profit to Rs 28.84 billion in the October-December 2016 quarter.

Coal India share price began the trading day down by 0.2%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex & Nifty Open Flat Ahead of Fed Outcome". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!