- Home

- Todays Market

- Indian Stock Market News March 16, 2017

Nifty Opens at Lifetime High as Fed Hikes Rates Thu, 16 Mar 09:30 am

Asian equity markets are higher today after the Federal Reserve raised rates. The Nikkei 225 is up 0.13% while the Hang Seng is up 1.05%. The Shanghai Composite is trading up by 0.63%. European & the US stocks closed higher in their previous trading session, helped by a bounce in oil prices, after the Federal Reserve took a less aggressive stance than expected.

Meanwhile, Indian share markets have opened the day higher tracking the global markets. The BSE Sensex is trading up by 176 points while the NSE Nifty is trading up by 54 points. The BSE Mid Cap index opened up by 0.7 while BSE Small Cap index opened up by 0.8%.

HCL Technologies share price opened up by 3% after it was reported that the Board of HCL Technologies will meet next week to consider stock buyback,thereby joining the growing roster of IT companies that have opted for the route to make use of huge piles of cash lying idle with them.

All sectoral indices have opened the day in green with capital good stocks and metal sector leading the pack of gainers. The rupee is trading at 66.51 to the US$.

Telecom stocks are trading higher with MTNL and Reliance Communications being the most active stocks in this space. As per an article in a leading financial daily, Bharti Airtel has called off plans to sell a controlling stake in its infrastructure division Bharti Infratel but has decided to monetise 21.6% equity in the company.

However, the company is planning to sell or transfer up to 400 million shares in Infratel to either wholly-owned subsidiary Nettle Infrastructure Investments, any other potential investors or both.

Following the transfer or sale of 400 million shares, Bharti Airtel will directly have 50.3% stake in Infratel, Nettle or the potential investor will hold 21.6% and other shareholders will together hold 28% stake.

Speaking of telecom sector, competition is likely to dent the operating profits of even the largest players Bharti Airtel and Idea Cellular for several quarters. The twin impact of, Reliance Jio's launch and notebandi has hit their financial performance.

Rahul Shah, Co-head of Research has offered a very detailed explanation to our subscribers on this in an issue of Research Digest (subscription required). Here's an excerpt:

- You see, the industry by its very nature is a difficult industry. It is an industry that Buffett calls the 'many cockroaches in the kitchen' industry. No sooner do you kill one cockroach, another one emerges and then it is back to square one.

There will always be some or the other problem on the horizon that will put a downward pressure on margins and ultimately the returns on capital.

And if one wants to stick to this view of things always remaining difficult in the industry, then there's no way the stocks can command the kind of valuations they are commanding currently.

Bharti Airtel share price opened the day flat.

Moving on to the news from stocks in pharma sector. According to a leading financial daily, the price control of stents will result in annual savings of about Rs 44.5 billion for patients.

The National Pharmaceutical Pricing Authority (NPPA) had notified the ceiling price of coronary stents at Rs 7,260 for bare metal stent and Rs 29,600 for drug-eluting ones. The corresponding average MRPs before the notification stood at Rs 45,100 and Rs 0.12 million.

Reportedly, after the inclusion of coronary stents in the Schedule I of DPCO 2013 on 21 December 2016, the prices were fixed by the NPPA on 12 February 2017. The government through the NPPA is keeping a tab and has alerted the states and state drug controllers to monitor the availability of stents

Bhavita Nagrani, our pharma sector analyst has written about the regulatory system in India and various measures taken by the government to control the domestic drug prices (Subscription Required) in one of our premium editions of The 5 Minute WrapUp. Every year, more drugs are added to the price control list. The government has also begun to control the prices of medical devices.

However, according to the US government, India's decision to control prices of cardiac stents shows it is a country that isn't business-friendly. Overseas companies, including US-based Abbott and Boston Scientific, account for almost 70% of India's stent market.

The stent price caps would prevent patients from accessing further innovation in this space, according to global stent manufacturers.

As per the reports, domestic pharmaceutical industry is likely to register moderate growth largely owing to increased regulatory scrutiny as well as consolidation of supply chain in the US market. According to rating agency ICRA, revenue from US during from 2011-15 period, rose at an average 33%. This plunged to 15% in 2015-16 and 12% in the first nine months of the current fiscal.

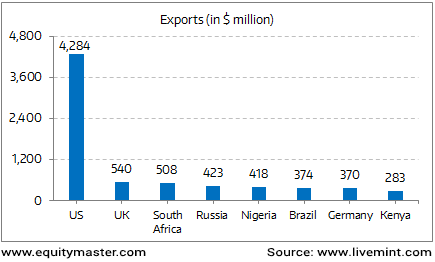

Surging Exports to the US

The revenue growth for Indian pharma industry remains moderate with base business in US continuing to face high single digit price erosion, regulatory overhang for select companies and temporary demonetisation effects in India.

Pharma stocks opened the day on a mixed note with Elder Pharma & Glenmark Pharma leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Nifty Opens at Lifetime High as Fed Hikes Rates". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!