- Home

- Todays Market

- Indian Stock Market News April 11, 2017

Sensex Opens Flat; IT & Energy Stocks Lead the Gains Tue, 11 Apr 09:30 am

Asian equity markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.34%, while the Hang Seng is down 0.78%. The Nikkei 225 is trading lower by 0.48%. The US equities closed slightly higher amid geopolitical worries in their previous trading session.

Meanwhile, share markets in India have opened the day on a flat note. The BSE Sensex is trading up by 33 points while the NSE Nifty is trading down by 5 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 0.2%.

Barring metal sector and fast moving consumer goods sector, all sectoral indices have opened the day in green with oil & gas stocks and information technology stocks leading the pack of gainers. The rupee is trading at 64.44 to the US$.

Pharma stocks are trading on a mixed note with Elder Pharma and Orchid Pharma Ltd leading the gainers. Ajanta Pharma share price opened the day on an optimistic note after the US Food and Drug Administration (USFDA) cleared the company's Dahej plant in Gujarat.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The USFDA inspected its formulation facility last week and cleared it without issuing any Form 483 observations. The Dahej plant is one of the relatively newer plants of Ajanta Pharma set up in 2014 to meet its requirements for the US and emerging markets.

The approval is critical for the company as the US is its fastest-growing geography. Though, of the overall Rs 20 billion revenue estimated for FY17, the US will account for just 10% or about Rs 2 billion, it is crucial for driving future growth.

According to rating agency ICRA, domestic pharma industry's revenue from the US during for the 2011-15 period, rose at an average 33%. This plunged to 15% in 2015-16 and 12% in the first nine months of the current fiscal.

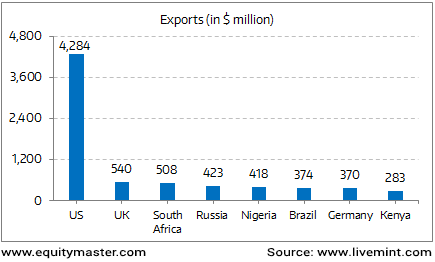

Surging Exports to the US

The revenue growth for the Indian pharma industry remains moderate with base business in US continuing to face high single digit price erosion, regulatory overhang for select companies and temporary demonetisation effects in India.

Meanwhile, Wockhardt Ltd's one of the new drug is likely to be launched in the US in 2020-21. Notwithstanding regulatory issues, the company's new drugs pipeline of five antibiotics looks promising, the company stated.

Moreover, Wockhardt recently got USFDA approval for the abridged phase-III clinical trial for one new antibiotic. With the major crisis in antibiotics currently, 11 antibiotics in clinical trials have received qualified infectious disease product (QIDP) status, of which five are Wockhardt's drugs.

For two drugs, WCK 771 and WCK 2349, the company plans to soon begin phase-III clinical trials in India and launch them in the domestic market in two years.

Wockhardt share price opened the day up by 0.6%.

Moving on to the news from stocks in engineering sector. As per an article in a leading financial daily, Larsen & Toubro's (L&T) construction arm has secured its single-biggest order worth Rs 52.5 billion from Qatar General Electricity and Water Corporation (Kahramaa) for power transmission and network expansion.

The order will involve the engineering, procurement and construction of 30 new substations of varying voltage levels of 220kV, 132kV and 66 kV and approximately 560km of 132kV and 66kV underground cables. The works of the project are spread all over the State of Qatar including both freshly developed as well as already developed areas.

Meanwhile, there was lower investment and order flows from the Middle East due to the fall in oil prices, which used to be the major region from where L&T derived its revenue.

The Qatar-based firm had roped in L&T for its earlier projects as well. This is a repeat order from KAHRAMAA after Phases VIII, X, XI, XI-A and the two cabling packages under Phase XII, the reports noted.

Diversification continues to help L&T (Subscription Required) negotiate and get better terms and margins for projects. Apparently, this is because it is less desperate to win orders as compared to a company which are present in only a couple of sectors. Its reputation, extensive technical prowess, and large skilled workforce have enabled L&T to command a certain premium from customers and vendors alike.

Whether, a further addition to these new projects provides a cushion to its profitability will be an interesting thing to watch out for going forward. Subscribers can access to L&T's latest result analysis and L&T stock analysis on our website.

L&T share price began trading up by 0.3%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; IT & Energy Stocks Lead the Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!