- Home

- Todays Market

- Indian Stock Market News June 12, 2017

Sensex Opens Lower; Capital Goods Sector Leads the Losses Mon, 12 Jun 09:30 am

Asian equity markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.36% while the Hang Seng is down 0.98%. The Shanghai Composite is trading down by 0.23%. The European markets ended Friday's session with modest gains. Investors were largely able to shrug off the inconclusive results of the UK election.

Meanwhile, share markets in India have opened the day lower. The BSE Sensex is trading lower by 114 points while the NSE Nifty is trading lower by 39 points. The BSE Mid Cap Index opened the day down by 0.3% while BSE Small Cap index opened lower by 0.2%.

Barring metal stocks, healthcare stocks and consumer durables stocks, all sectoral indices have opened the day in red with capital goods stocks and information technology stocks leading the losses. The rupee is trading at 64.26 to the US$.

In the latest development, the Goods and Services Tax Council has decided to cut the rate on household goods and other essential items, raising the threshold for the scheme that requires lesser compliance and approving another key set of rules relating to audit and accounts.

Accordingly, the Council reduced tax rates on 66 items including cashew nuts, packaged foods such as sauces and pickles, agarbatti, insulin, school bags, children's coloring books, cutlery, and some tractor components. The Council has also reduced the tax rate on cinema tickets costing Rs 100 or less.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The Council also decided to increase the limit under the composition scheme from Rs 5 million to Rs 7.5 million. The compensation scheme was introduced for small business that would struggle to comply with the various requirements of GST.

As per Arun Jaitley, reducing the tax rate meant a revenue impact for the government, but lower tax incidence could help improve tax buoyancy and keep inflation low.

The GST Council will meet again on June 18 to discuss any pending issues, including the e-way bill rules and the rates on lotteries.

The GST bill is one of the most awaited legislations that investors are hoping will get passed in the ongoing monsoon session of the parliament.

Key World Markets During the Week

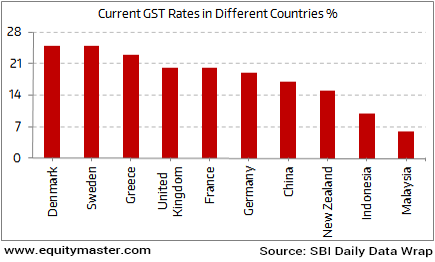

Moreover, GST has been a widely-accepted concept and around 160 countries have implemented the same. So how do the rates across the countries looks like? The above chart highlights the same.

Undoubtedly, a single tax replacing all forms of local taxes at the state and central levels has advantages. The basic idea is to create a single, cooperative and undivided Indian market to make the economy stronger and powerful. It is likely to bring in structural changes that will benefit organsied players over the long run.

Moving on to the news from stocks in oil & gas sector. As per an article in Livemint, Oil and Natural Gas Corp (ONGC) is looking to acquire Hindustan Petroleum Corporation Ltd (HPCL) in a Rs 422.54 billion deal after finding Bharat Petroleum Corp Ltd (BPCL) too expensive to buy.

One must note that, after the Finance Minister Arun Jaitley's Budget announcement of creating an integrated oil company, ONGC evaluated options of acquiring either HPCL or BPCL.

BPCL has a market cap of Rs 1017.4 billion and buying government's 54.9% alone would have entailed an outgo of Rs 558.85 billion. So, ONGC is in favour of acquiring HPCL, which has a market cap of Rs 548 billion.

Further, ONGC has cash reserves of Rs 130.14 billion and to fund the government stake acquisition in HPCL it will have to borrow at least Rs 180 billion.

Notably, HPCL will add 23.8 million tonnes of annual oil refining capacity to ONGC's portfolio, making it the third-largest refiner in the country after IOC and Reliance Industries.

ONGC share price opened up by 0.1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Lower; Capital Goods Sector Leads the Losses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!