- Home

- Todays Market

- Indian Stock Market News June 16, 2017

Sensex Trades on a Volatile Note; Pharma Stocks Drag Fri, 16 Jun 01:30 pm

After opening the day marginally higher, Indian share markets witnessed volatile activity and are currently trading flat with a positive bias. Sectoral indices are trading on a mixed note, with stocks in the FMCG sector and the stocks in the realty sector witnessing maximum buying interest. Stocks in the IT sector and stocks in the pharma sector are leading the losses.

The BSE Sensex is trading up by 28 points (up 0.1%) and the NSE Nifty is trading up by 10 points (up 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.2%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 64.54 to the US$.

In news from the banking sector. According to an article in The Economic Times, banks have begun the long overdue process of recovery of loans worth over Rs 1.5 trillion.

Banks have had multiple meetings to finalize the resolution of the bad loans, with SBI taking the lead. The bank's action follows the Reserve Bank of India's (RBI) order to initiate insolvency and bankruptcy proceedings against the top 12 defaulters that account for a quarter of total bad loans in the banking system.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Bad loan recovery has gathered momentum after years of hesitation since the government empowered RBI to direct banks to take big defaulters through the process prescribed under the Insolvency and Bankruptcy Code (IBC) that specifies timebound resolution. Banks that have been hesitant to follow this route fearing huge writedowns of asset values have been forced get cracking following the Reserve Bank's directive.

Neither the banks nor the regulator have disclosed the names of defaulters that will be taken through the IBC process.

While these are steps in the right direction for better accountability in the sector, the RBI has a lot to do if it plans to strengthen India's banking sector, which is reeling under large non-performing assets (NPAs).

India is going through a severe bad loan problem. Major banks have reported poor numbers in the recent earnings season.

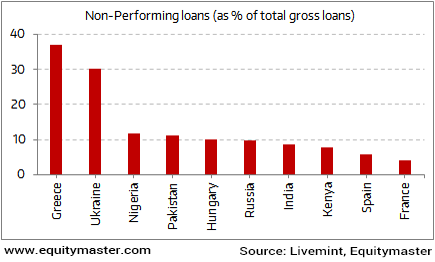

India is Near the Bottom of the Global NPA List

The problem of bad loans is indeed quite severe and when we compare it with other global peers it looks daunting.

Out of the ten major economies facing NPA problems, India is ranked seventh.

The overhang of bad debts has not only hit the bank's profitability, but has also restricted their loan book growth.

Moving on to news from stocks in the pharma sector. IPCA Labs share price plunged over 15% in today's trade after the US Food and Drug Administration (USFDA) refused admission in the US to all drugs made at the company's Pithampur and Silvassa facility.

The USFDA cited the violation of current good manufacturing practices and norms for taking the steps against the company.

The ban on drugs will continue until the company can demonstrate that the drugs manufactured sites and intended for the US market are in compliance with Current Good Manufacturing Practice.

All the company's drugs except API Chloroquine Phosphate made at Ratlam (Madhya Pradesh) unit have also been denied entry in the US.

In February 2016, USFDA had issued a warning letter to all three manufacturing units situated at Ratlam, SEZ Indore and Piparia.

At the time of writing, IPCA Labs share price was trading near its 52-week low, down 11.2%

The Indian pharmaceutical industry has come under a lot of regulatory pressure in the past few years.

The list of pharma sector woes is long. So, is there light at the end of the tunnel? Girish Shetty, our research analyst thinks there is.

As per him, it doesn't make sense to paint all pharma stocks with the same brush. The leaders of the industry will certainly survive this phase. There are interesting, niche pharma stocks that are worth your attention.

Facing pricing pressures in the domestic and export markets, currency fluctuations, as well as manufacturing issues related to their plant, there is a transformation happening in the overall sector as to how business is done and will be done in the future.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Volatile Note; Pharma Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!