- Home

- Todays Market

- Indian Stock Market News July 12, 2022

Sensex Trades Lower; Tata Steel, Titan & Asian Paints Top Losers Tue, 12 Jul 10:30 am

Major Asian share markets are lower today, extending Wall Street falls on news of another Covid-19 surge in China as investors awaited US inflation data later in the week.

The Nikkei fell by 1.7% while the Hang Seng fell 0.3%. The Shanghai Composite is up 0.2%.

US stocks lost ground on Monday as a lack of catalysts left market participants warily embarking on a weak backend loaded with crucial economic data and the unofficial beginning to second-quarter earnings season.

The Dow Jones was down 0.5% while the tech heavy Nasdaq was lower by 2.3%.

Back home, Indian share markets are trading on a negative note.

Benchmark indices opened on a negative note tracking the trend on SGX Nifty and extended losses as the session progressed.

At present, the BSE Sensex is trading lower by 177 points. Meanwhile, the NSE Nifty is trading lower by 63 points.

TCS & Bharti Airtel are among the top gainers today.

Tata Steel and Titan are among the top losers today.

Bharti Airtel share price is falling as the Adani group announced its foray into the telecom sector.

Broader markets are also trading on mixed. The BSE Mid Cap index is flat while the BSE Small Cap index is trading higher by 0.2%.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

Sectoral indices are trading mixed. Stocks in the utilities and power sector witness most of the buying.

Stocks in the metal sector are witnessing heavy selling.

Shares of Siemens and Voltamp Transformers hit their 52-week highs.

Since you're interested in high flying stocks, check out our guide on how to pick the best multibagger stocks in 2022.

Also check out the 3 Indian companies which have announced big dividend payouts in 2022.

In the commodity markets, gold prices see a marginal rise. Today, prices are up by Rs 21, trading at Rs 50,665 per 10 grams.

Note that gold prices have fallen and have taken quite a knock in recent weeks.

Meanwhile, silver prices are trading lower at Rs 56,622 per kg.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Choose Your Pick

Unnecessarily Risky Small Caps vs Small Caps Brimming with Opportunity

Discover the Small Cap Strategy Thousands of Equitymaster Subscribers Use

I'm interested

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

Speaking of stock markets, in the latest episode of Investor Hour Podcast, Rahul Goel talks to Ridham Desai about long term investing and why he is bullish on India.

Tune in to the below video to find out more:

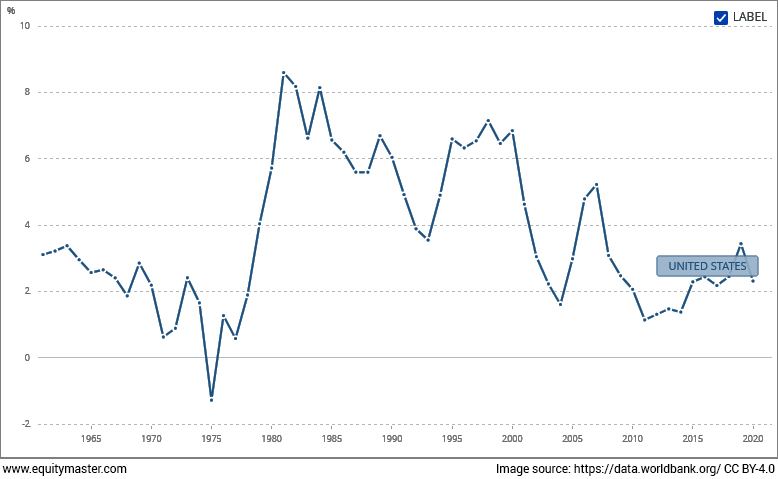

Rising interest rates have taken the share market to the cleaners. A similar rise in interest rates was also seen in 1989.

1989 and 2022 both have disappointed investors resultantly pushing them away. But ace investor Warren Buffett says,

"Be fearful when others are greedy and be greedy when others are fearful,"

Warren Buffett has taught what he preached. In 1989 when everyone was running from stock market, he invested a huge amount in Wells Fargo - an American financial company.

Over the years Fargo has gone far up and generated handsome returns for Buffett.

This begs the question: is it the right time to invest in banking stocks?

Read out editorial to know more: Bank Stocks in 2022 Mirror Warren Buffett's 1989 Wells Fargo Investment.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

India's Lithium Megatrend is an Emerging Opportunity for Investors

We all know how oil producing countries made fortunes in the last century.

But now, the world is moving away from oil... and closer to Lithium.

Lithium is the new oil. That's the reason why India is focusing heavily on expanding its lithium reserves.

If you can tap into this opportunity, then there is a potential to make huge gains over the long term.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

In news from the construction sector, Larsen and Toubro comes up with big news.

The buildings & factories vertical of L&T Construction has secured "significant" contracts. The company defines orders worth Rs 10 bn to Rs 25 bn as significant.

Among the orders is one from a data centre service provider to construct data centers of a total capacity of 10.8 MW at Mumbai and Navi Mumbai within stringent timelines.

Another order is for constructing a commercial office space of approximate built-up area of 1 m sq. ft in Hyderabad.

The Business has also secured an order for the engineering, procurement & construction of the 'Statue of Oneness' from Madhya Pradesh State Tourism Development Corporation. The project is scheduled to be completed in 15 months.

L&T share price is trading up by 0.2% today.

In news from the banking sector, Bank of Baroda has raised marginal cost of funding.

State-owned Bank of Baroda has raised the marginal cost of funds based lending rate by up to 0.15% for select tenor of loans with effect from Tuesday.

The bank has approved the revision in Marginal Cost of funds based Lending Rate (MCLR) with effect from 12 July 2022.

The one year MCLR, the benchmark for most of consumer loans such as auto, home and personal loans, has been revised upwards to 7.65% from the existing 7.50%.

The three-month and six-month tenor loans will have new MCLRs at 7.35% and 7.45%, respectively, up by 0.10% each.

Moving on to news from the IT sector, Nomura Singapore buys shares of BLS International Services.

Global financial services firm Nomura Singapore on Monday purchased 12.5 lakh shares of technology services provider BLS International Services Ltd for Rs 270 m through an open market transaction.

According to bulk deal data available with the National Stock Exchange (NSE), Nomura Singapore Ltd bought 12,50,000 shares of the company at an average price of Rs 214 per share, aggregating to Rs 267.5 m.

Since you're interested in tracking what the stock market gurus and institutions are buying, check out our recent editorials on what Dolly Khanna and Sunil Singhania have been buying these days:

Multibagger Alert: Dolly Khanna Can't Keep Her Hands Off Chennai Petroleum.

Sunil Singhania Added this Infra Stock in Q1. Here's Why...

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades Lower; Tata Steel, Titan & Asian Paints Top Losers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!