- Home

- Todays Market

- Indian Stock Market News September 28, 2020

Sensex Opens Higher; Automobile and Metal Stocks Lead Mon, 28 Sep 09:30 am

Asian stock markets are higher today as data over the weekend showed profits at China's industrial firms grew for the fourth straight month in August buoyed by a rebound in commodities prices and equipment manufacturing.

The Hang Seng is trading up by 0.5% while the Shanghai Composite is trading down by 0.2%. The Nikkei is trading up by 0.7%.

US stocks ended higher on Friday as technology stocks again rode to Wall Street's rescue, lifting the main indexes more than 1%.

Back home, Indian share markets have opened the day on a positive note.

The BSE Sensex is trading up by 249 points.

The NSE Nifty is trading higher by 82 points.

Ambuja Cement and TCS are among the top losers today. Meanwhile, Bajaj Finance and Tata Steel are among the top gainers today.

The BSE Mid Cap index has opened up by 1%.

The BSE Small Cap index is trading higher by 1.2%.

Sectoral indices are trading on a positive note with stocks in the automobile sector and metal sector witnessing maximum buying interest.

The rupee is trading at 73.68 against the US$.

Gold prices are trading down by 0.2% at Rs 49,576 per 10 grams.

Speaking of stock markets, in our latest episode of Investor Hour Podcast, India's #1 trader Vijay Bhambwani joins Rahul Goel to talk about his views on stock market, currencies, his trading strategy, and more...

In the podcast, Vijay talks about the volatility in the benchmark indices. Instead of trading for short-term profits of 5-10%, he thinks it's a far better idea to wait for the big profit trades. These are longer-term trades which can pay out anywhere between 50-80%.

Tune in here:

In news from the banking sector, Lakshmi Vilas Bank is among the top buzzing stocks today.

Shareholders of Lakshmi Vilas Bank created history last Friday by voting out seven directors including both its promoters in what is being seen as a dramatic strike against persistent bad governance and mismanagement.

The lender's newly appointed CEO S Sundar was also voted out with the shareholders rejecting his appointment.

At the bank's annual general meeting held Friday, shareholders voted against the appointment of chief executive officer S Sundar and reappointment of other six directors including N Saiprasad and KR Pradeep who are also promoters.

Nearly 100% institutional investors voted against these directors. Even 19% of promoters' votes went against them. Shareholders also rejected the reappointment of statutory auditors.

Capri Global Capital, which holds 5% in the bank, was among the institutional investors to vote against the directors. Rajesh Sharma, managing director of Capri Global said his company took the call based on the current state of the bank.

Indiabulls Housing Finance owns 5% in the bank. JM Financial Services holds 3.9% while SREI Infrastructure Finance and DHFL Pramerica Life Insurance hold 3.34% and 2.73% respectively.

This is the first time that shareholders have voted out as many as seven board members including its promoters and CEO who was appointed by the RBI.

The above move has left Lakshmi Vilas Bank completely leaderless and investors, depositors and employees are likely to face a few anxious days as the banking regulator Reserve Bank of India (RBI) and the markets regulator grapple with this uncertainty.

Note that this move comes at a time when the works on bank's proposed merger with the Clix group entered a critical stage.

In other news, as per an article in The Economic Times, the RBI is likely to keep interest rates unchanged in the forthcoming bilateral monetary policy review in view of the rising retail inflation driven mainly by supply side issues.

The six-member Monetary Policy Committee (MPC) headed by RBI governor is scheduled to meet for three days starting September 29. The resolution of the MPC would be announced on October 1.

In its last MPC meeting in August, RBI kept policy rates unchanged to help tame inflation that in recent times had surged past 6% mark, and said the economy is in an extremely weak condition following the pandemic.

The RBI has cut policy rates by 115 basis points since February.

Retail inflation softened slightly to 6.69% in August from 6.73% in July.

We will keep you updated on the latest developments from this space. Stay tuned.

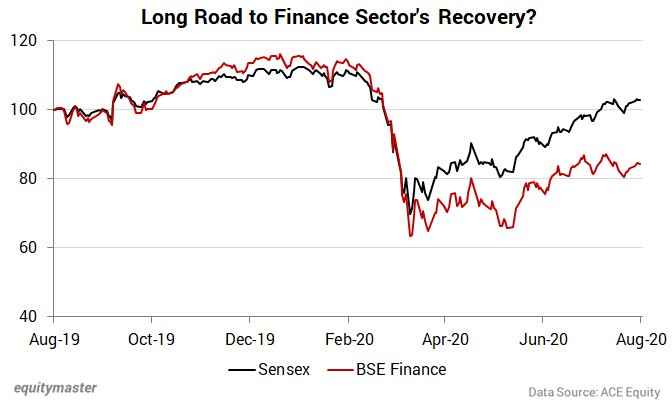

Speaking of the banking and finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Higher; Automobile and Metal Stocks Lead". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!