- Home

- Todays Market

- Indian Stock Market News October 6, 2017

Sensex Trades in Green; PSU Stocks Lead Gains Fri, 6 Oct 01:30 pm

After opening the day in green, Share markets in India continued the momentum and are presently trading above the dotted line. Sectoral indices are trading on a positive note, with stocks in the metals sector and the PSU sector witnessing maximum buying interest.

The BSE Sensex is trading up by 175 points (up 0.6%) and the NSE Nifty is trading up 70 points (up 0.7%). Meanwhile, the BSE Mid Cap index is trading up by 0.8%, while the BSE Small Cap index is trading up by 1.1%. The rupee is trading at 65.27 to the US$.

Big changes are afoot in the country's corporate governance standards after the Uday Kotak led corporate governance committee submitted its report to the market regulator and suggested sweeping changes.

The proposed changes are aimed at tightening the corporate governance standards across the boardrooms of India. The suggestions assume greater relevance in the background of high-profile boardroom battles that have rocked corporate India over the past year.

The 25-member committee, which was set up in June and comprised bureaucrats, executives, lawyers and academics, has also recommended improvements in transparency, keeping large shareholders informed about unpublished information and stricter rules on board composition among others.

The committee suggested splitting the posts of chairman and managing director besides amending rules on independent directors, disclosures, and accounting and auditing practices.

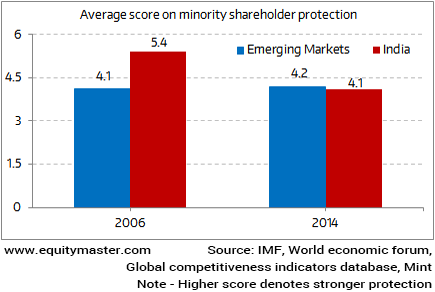

Notably, according to the IMF, India's corporate governance standards have been falling over past eight years. This is despite the fact that the regulator, has been taking various measures to control the malpractices.

India's Deteriorating Corporate Governance Standards

India has often been criticized for poor corporate governance and lack of enough regulations to protect minority shareholders' interest. In extreme cases, promoter's greed has broken all boundaries leading to a scam big enough to set an example and inspire new governance codes

The recent recommendations are a step in the right direction. They will reinforce corporate governance and also inspire new governance codes. Moreover, they will protect minority shareholders' interest by tighten the lid on unfair share practices and make managements more accountable.

In news from the retail sector. Future Retail said that it will acquire HyperCity for Rs 6.5 billion. The Kishor Biyani owned company is set to acquire HyperCity, a premium chain of 19 hypermarkets from Shoppers Stop for Rs 6.5 billion through a combination of cash and shares to further consolidate his footprint in western India.

The deal, which is likely to be completed in the next three to five months, will see HyperCity Retail India Limited become a wholly-owned subsidiary of Future Retail.

uture Retail said it will allot 9.3 million shares of Rs 2 face value to HyperCity Retail's 15 shareholders at Rs 535 per share on a preferential basis.

Of the total deal value, Rs 500 crore will come from these shares. The remaining Rs 155 crore will be paid in cash.

The deal is subject to approval of Shoppers Stop shareholders. The company will hold an extra-ordinary general meeting on October 13 in this regard.

This is Future Retail's fifth major acquisition in the past four years and will add more than a million square feet of retail space to the company.

Notably, merger and acquisition activity in India is on a high. The value of M&As that have taken place last year - at US$ 69.75 billion - are the highest on record for the country. This even beats the previous record of US$ 66.96 billion set in 2007.

At the time of writing, Future Retail share price was trading up by 2.5%, while Shopper's Stop share price was trading up by 2% after opening the day up 10%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in Green; PSU Stocks Lead Gains". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!