- Home

- Todays Market

- Indian Stock Market News October 23, 2020

Sensex Ends 127 Points Higher; Auto Stocks Witness Huge Buying Fri, 23 Oct Closing

Share markets in India continued to trade on a positive note during closing hours today and ended their session marginally higher.

Benchmark indices edged higher after a one-day pause seen yesterday. Most of the gains were supported by finance and auto stocks.

At the closing bell, the BSE Sensex stood higher by 127 points (up 0.3%).

The NSE Nifty closed higher by 33 points (up 0.3%).

Maruti Suzuki and Mahindra & Mahindra were among the top gainers today.

The SGX Nifty was trading at 11,935, up by 43 points, at the time of writing.

The BSE Mid Cap index ended up by 0.6%. The BSE Small Cap index ended up by 0.7%.

On the sectoral front, gains were largely seen in the auto sector and consumer durables sector.

IT stocks, on the other hand, witnessed selling pressure.

Asian stock markets ended on a mixed note. As of the most recent closing prices, the Hang Seng ended up by 0.6% and the Shanghai Composite ended down by 1%. The Nikkei gained 0.2%.

The rupee was trading at 73.65 against the US$.

Gold prices are trading up by 0.2% at Rs 50,888 per 10 grams.

Gains were seen as expectations that a US stimulus package would eventually be passed offset pressure from a stronger dollar.

Note that gold and silver plunged yesterday as the dollar recovered from its seven-week low and talks between the White House and rival Democrat lawmakers continued for a COVID-19 financial relief plan before the US election.

Even with the recent volatility in prices, gold remains among the best performing commodities this year to combat the fallout from the coronavirus pandemic.

So, is the rally over? Will gold and silver prices fall?

India's #1 trader Vijay Bhambwani doesn't think so. Vijay believes the bull market still has a long way to go.

In one of his videos, he tells you why. Tune in to the video to find out more.

Moving on to stock specific news...

Biocon was among the top buzzing stocks today.

The biotechnology major today reported a 23% fall in its consolidated net profit to Rs 1.9 billion for the second quarter ended September 30, mainly on account of higher expenses.

Its consolidated total income stood at Rs 17.6 billion for the quarter under consideration, as against Rs 16.1 billion for the same period a year ago.

The R&D expense of the company for the quarter ended September 30, 2020, was at Rs 1.5 billion as against Rs 1 billion in the same period of the previous fiscal.

The company's management said profitability was impacted on account of higher R&D expenses, staff costs, other expenses and forex losses. However, the company's core EBITDA margins stood at a healthy 32%, indicating sound operational performance.

It added that as a part of the company's commitment to address the novel coronavirus pandemic in India, the Biocon Group is working on a comprehensive portfolio of products for treating mild to severely ill COVID-19 patients.

Biocon share price ended the day down by 2.7% on the BSE.

In other news, State Bank of India's credit card arm SBI Cards and Payment Services said its gross non-performing assets (NPAs) rose to 4.3% as on September 30 compared to 2.3% a year ago.

The company added that this figure would have been 7.5% had there not been a Supreme Court order that restrained declaring some Covid-related defaults as bad loans.

One reason for the NPA spike in this quarter is that default numbers for the first quarter were suppressed due to the standstill on repayments allowed by the Reserve Bank of India (RBI). Defaults rose in the second quarter as the moratorium ended and customers began experiencing stress on repayments.

The bad loan numbers could go higher as currently there is a Supreme Court order stating that any account, which was not classified as NPA as of August 31, cannot be declared as an NPA until the next hearing or judgment as the case may be.

The above data is indicative of the distress in the self-employed segment of retail borrowers, where most defaults are seen.

As per a leading financial daily, around 84% of SBI Card's customers are salaried. Of this, 38% work in the public sector and 24% in large corporates. Yet, 9% of the company's receivables of Rs 240 billion are under the RBI's resolution plan, indicating that these borrowers are facing financial stress.

SBI Card shares witnessed selling pressure after the Q2FY21 results, which showed that the company's credit costs, i.e. the amount set aside for defaults, rose to 14.2% from 5.6% in the previous year.

The company posted a net profit of Rs 2 billion for the July-September quarter. This was down 46% year-on-year (YoY) from Rs 3.8 billion in the year-ago period.

The company has made additional provisions of Rs 7.6 billion since the pandemic. Card spends were expectedly down 10% at Rs 295.9 billion because of the lockdown, closure of malls and air-travel curbs.

How these numbers pan out in the coming months remains to be seen. Meanwhile, we will keep you updated on all the developments from this space.

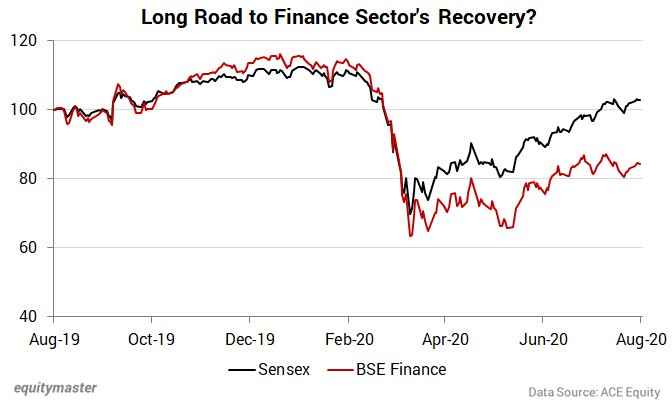

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 127 Points Higher; Auto Stocks Witness Huge Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!