- Home

- Todays Market

- Indian Stock Market News November 20, 2017

Dull Start to the Week; Cement Stocks Tank Mon, 20 Nov Closing

Indian share markets continued to trade on a dull note in the afternoon session amid weak international markets. At the closing bell, the BSE Sensex closed higher by 17 points and the NSE Nifty finished higher by 15 points. The S&P BSE Mid Cap finished up by 0.6% while S&P BSE Small Cap finished up by 0.8%. Sectoral indices ended the day on a mixed note with information technology stocks and bank stocks leading the losses. While, gains were largely seen in realty sector and metal sector.

Asian stock markets finished mixed as of the most recent closing prices. The Shanghai Composite gained 0.28% and the Hang Seng rose 0.21%. The Nikkei 225 lost 0.60%.

European markets are lower today with shares in London off the most as Euro fell after German Chancellor Angela Merkel said she failed to form a government coalition, sparking concerns that a new election may be in order. The FTSE 100 is down 0.28% while France's CAC 40 is off 0.10% and Germany's DAX is lower by 0.06%.

Rupee was trading at Rs 65.07 against the US$ in the afternoon session. Oil prices were trading at US$ 56.59 at the time of writing.

Biocon share price surged 7% after the company received Establishment Inspection Report (EIR) from US Food and Drug Administration (USFDA) in relation to the cGMP (current Good Manufacturing Practice) inspection of its aseptic drug product facility.

The USFDA has classified the outcome of this inspection as VAI (voluntary action indicated) and the EIR states that the inspection is closed. Of late, the firm registered a 53.1% fall in its consolidated net profit at Rs 688 million for the quarter ended September, mainly on account of plant modifications, Malaysia facility costs and pricing pressures in APIs business.

L&T share price finished on an encouraging note (up 0.6%) after the company said that it's construction arm bagged orders worth Rs 86.5 billion. The engineering conglomerate said that the Heavy Civil Infrastructure business vertical of L&T Construction bagged an order worth Rs 86.5 billion from the MMRDA for construction of Mumbai Trans Harbour Link.

In news from mining sector, Coal India share price surged 2% in today's trade after the company reported 18% jump in coal dispatches to power sector to 39.9 million tonnes (MT) in October as against 33.8 MT of dry fuel supplied to power producers in October 2016.

The dispatches by the company rose by 9.6% to 248.9 MT in the April-October period of this financial year over 227 MT in the year-ago period.

The supply of coal by Singareni Collieries Company (SCCL), a state-owned coal mining company, also registered an increase of 5% to 4.2 MT, over 4 MT in the same month of the previous financial year.

Cement stocks fell after Supreme Court sought a nationwide ban on use of pet coke and furnace oil. Pet coke is a cheap but a widely-polluting fuel used by cement, paper, brick kiln, chemicals and textile industries - to cut industrial pollution that's contributing to hazy skies.

The Supreme Court has already forbidden the use of this fuel in the National Capital Region (NCR) as intense smog over Delhi earlier this month prompted a series of measures, including advancing of BS-VI fuel introduction in Delhi

Reportedly, if the companies resort to the international coal which is 15% more expensive than pet coke, as a replacement to the pet coke, they would require taking a price hike of Rs 10/bag in order to pass on the burden.

Companies have already announced price hikes in the tune of Rs 20-25/bag, however, the key thing to watch is the sustainability of the price increase.

Shree cement share price and ambuja cement share price slumped 4.2% and 3.4% respectively, while ACC share price and JK Lakshmi cement share price finished down by 3.2% and 4.7% respectively.

In news from the economy, raising optimism over the government's commitments to improve economic efficiency, the SBI Research in its latest report has said that India would need not wait for 13 long years for the next sovereign upgrade by a rating agency, with government's resolve on fiscal consolidation target along with recent reform measures like Goods and Services Tax (GST) and Bankruptcy and Insolvency code.

The report pointed that the government's Rs 2.11 trillion recapitalisation plan will help banks to tackle the bad loan problem and will also give a push to improve their health. The report further highlighting implementation new tax regime and RERA, said that these moves will improve overall economic and investment sentiment in the country.

The report also noted stability in the country's inflation and sustainability in current account deficit. However, it raised concern that the markets would factor in a higher fiscal deficit in 2017-18 and it blamed GST for this, as it impacted the centre's short-term revenue.

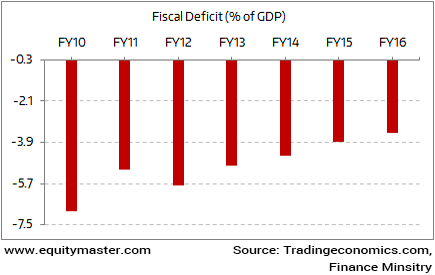

Fiscal Deficit target of 3% of GDP

One of the important yardstick to measure the financial health of an economy is Fiscal deficit. It is the difference between the government revenues and expenditure. The difference is generally bridged by debt. The present government is committed to reduce the gap. The long term fiscal deficit target is 3% of the Gross domestic product (GDP). This simply means relatively less expenditure. Hence, less government spending.

In last one decade India is making serious efforts to reduce the fiscal deficit level. Ever since, the new government came in it has been in favor of fiscal consolidation and meet the long term fiscal deficit target of 3% by FY17-18.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Dull Start to the Week; Cement Stocks Tank". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!